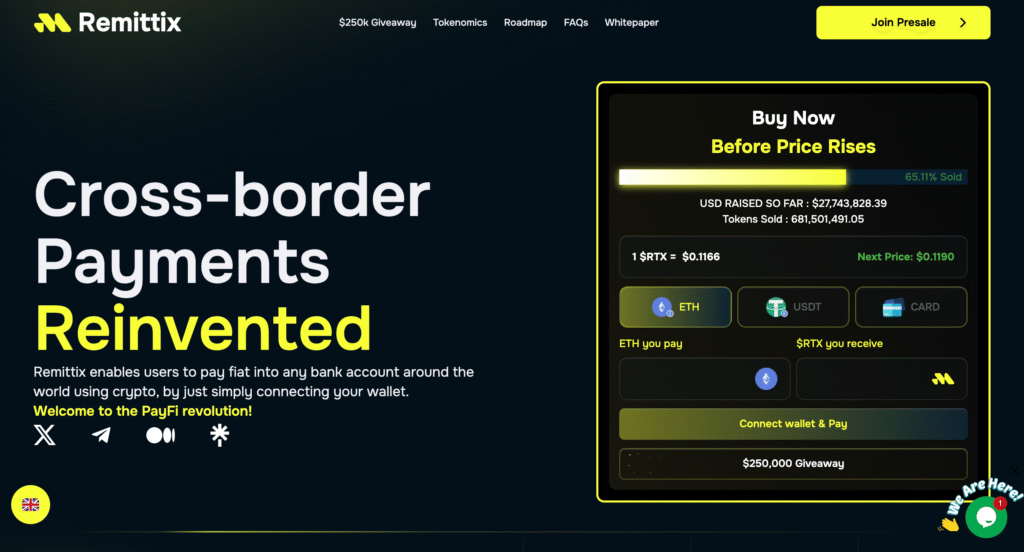

The Surge of Remittix and Its Utility‑First Pitch

Remittix advances a practical thesis: low‑cost transfers from crypto into bank accounts at scale. Early presale traction and a beta wallet hint at strong community interest. The project frames utility over hype by prioritizing reliable payout corridors and user experience. In crowded markets, a clear problem‑solution fit can be the strongest growth engine.

XRP Versus Remittix: Overlap and Differentiation

Both projects target cross‑border efficiency, yet their routes to trust differ. XRP leans on established institutional rails and years of integrations with payment firms. Remittix emphasizes transparency, security audits, and grassroots adoption to build credibility. This divergence creates room for coexistence where users choose by corridor coverage, fees, and tooling.

Security, Audits, and the Compliance Imperative

Payment tokens operate under closer scrutiny than typical DeFi experiments. Third‑party code audits, clear disclosures, and sanctions screening are no longer optional. Remittix’s public security posture supports risk‑aware users assessing counterparty exposure. Strong compliance design can open doors to banking partners that demand verifiable controls.

Recommended Article: Remittix Forecast Remains Bullish As DeepSnitch Presale Surges

Wallet Experience and On‑Ramp/Off‑Ramp Strength

Friction at the wallet or payout step can halt adoption, regardless of tokenomics. Remittix’s beta aims to streamline KYC, address validation, and settlement transparency. Robust fiat off‑ramps in high‑demand corridors will be key to daily utility. If users reliably complete end‑to‑end transfers, retention and referrals tend to follow.

Incentives, Referrals, and Sustainable Growth Loops

Giveaways and referral programs can seed networks, but durability depends on repeated usage. Aligning rewards with verified transaction milestones reduces mercenary behavior. Clear fee discounts or service tiers can nudge power users without distorting economics. Sustainable loops form when incentives amplify genuine product‑market fit rather than mask gaps.

Regulatory Outlook and Market Timing

Global policy on stablecoins, travel‑rule compliance, and exchange licensing will shape execution. Projects that internalize evolving rules can scale faster when windows open. Market cycles may inflate or compress valuations, but real payments volume compounds. Timing matters, yet readiness determines who captures demand when sentiment shifts.

The Road to Payment Evolution in 2025 and Beyond

Near‑term success hinges on corridor expansion, bank partnerships, and operational resilience. Longer‑term differentiation will emerge from analytics, fraud controls, and merchant tooling. Should Remittix convert early traction into dependable throughput, it can earn a durable niche. In PayFi’s race, consistent delivery often outperforms headline‑driven spikes.