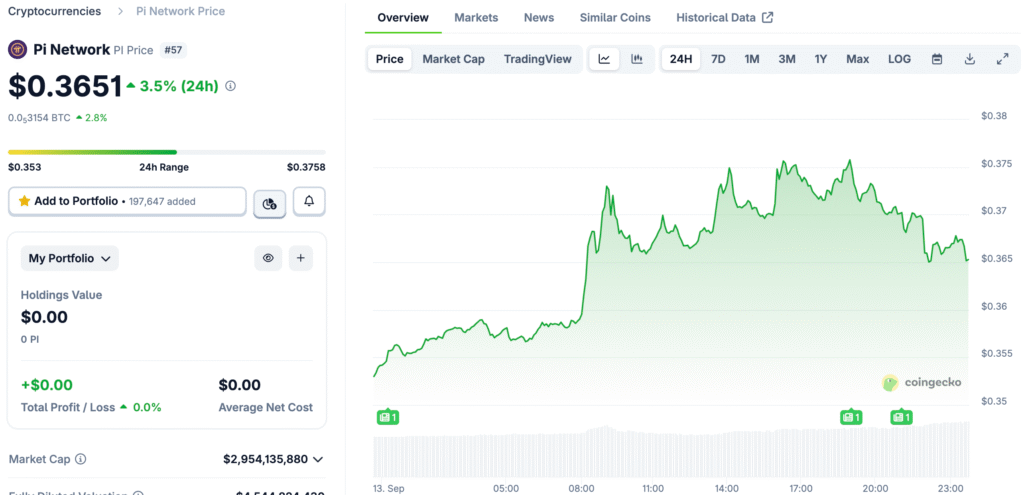

Pi Network Rebounds After Week-Long Consolidation

After a few days of consolidation, the price of Pi Network goes up 3%, showing that bullish momentum is back, even though centralized exchanges are still a problem. This bounce back suggests that the recovery could be stronger, and traders are watching to see if a breakout could confirm more gains in the near future.

After a brief period of cooling off, price action shows strength returning. Buyers are slowly regaining faith in Pi Network’s ability to hold key supports. The short-term reversal gives hope that Pi Network could soon break through higher technical barriers, which strengthens its medium-term bullish setup. This new activity shows that investors are paying attention, as Pi continues to be strong even though the broader cryptocurrency market is sending mixed signals today.

CEX Wallet Balances Show Weakness in Retail

PiScan’s data indicates a significant increase in centralized exchange wallet balances, possibly due to increased depositing and retail investor loss of interest. This indicates a falling confidence in the market, leading some traders to sell tokens instead of buying them.

The two million token rise in 24 hours demonstrates the rapid shift in investor sentiment during uncertain consolidation periods. Increased reserves also increase selling pressure, making it challenging to maintain bullish momentum without more support from confident retail investors. This raises red flags and urges traders to monitor demand levels.

Technical Setup Points to a Channel Breakout

Pi Network is testing the top of its descending channel, and bulls are getting ready to break through resistance and show how strong a breakout could be. At the moment, the price is close to thirty-six cents. If it closes above this level, it will confirm breakout structures that aim for higher technical levels.

The next big problem for bulls, if momentum keeps going, is the fifty-day exponential moving average at thirty-eight cents. If this key indicator breaks, it would mean that the trend is more likely to reverse, which would show that buyers are regaining control after a long period of consolidation pressure. Until then, Pi is stuck in a range, waiting for confirmation that the overall mood matches the bullish technical patterns that are starting to show up on charts.

Recommended Article: Pi Network Whale Buying Fuels Breakout Speculation and Hype

Indicators Reflect Gradual Bullish Momentum Return

The Moving Average Convergence Divergence indicates a strengthening momentum, supporting bullish continuation. This aligns with traders seeking confirmation of trend reversals in momentum indicators. The Relative Strength Index has bounced back to the neutral fifty level, indicating balanced pressure and potential upside growth.

If the RSI rises, buyers may feel more confident in bulls’ momentum, boosting Pi’s short-term recovery outlook. These signs indicate cautious optimism, with Pi’s next move largely dependent on breaking resistance levels.

Support Levels Remain Critical for Price Stability

If Pi Network doesn’t break decisively higher, support around thirty-two cents could be very important for keeping the price from going down any further. This area used to be the all-time low, which shows how important it is for keeping bullish confidence among cautious investors.

If this level isn’t defended, it could lead to stronger selling pressure, which would slow down momentum and push back the chances of a short-term bullish continuation. These kinds of breakdowns often make people lose faith, which makes it harder for the market to bounce back unless there is more buying and less money coming into centralized exchanges. For now, staying above support is important because it adds to the structural stability that makes the broader bullish case for Pi’s path stronger.

Retail Participation Affects the Next Phase of the Market

Retail investors play a crucial role in maintaining momentum by counteracting selling pressure from larger centralized exchange deposits. Declining participation could weaken breakout strength, highlighting the importance of community involvement. If demand from retailers returns, Pi may stabilize, enhancing rallies and improving technical signals.

However, if weakness lasts too long, it could stop upward movement, potentially leading to another consolidation or retracement phase. This dynamic demonstrates how investor confidence directly affects breakout confirmation, making sentiment analysis as important as technical chart interpretation.

Pi Network’s Path to a Breakout Hinges on Reclaiming $0.38

Pi Network is strong, with a bounce back above thirty-six cents, but there are still problems because exchange reserves show that retail confidence is falling. Technical patterns show that a breakout is possible, but momentum depends a lot on continued participation and breaking through strong resistance around thirty-eight cents.

If momentum keeps going and interest from retailers grows, Pi may confirm a breakout to higher levels that go beyond the narrow channel of consolidation. If resistance isn’t reclaimed, on the other hand, it could lead to retests of previous lows, so stability around thirty-two cents is very important. Overall, Pi is still balanced between risk and opportunity, so traders need to keep a close eye on both on-chain data and technical confirmation.