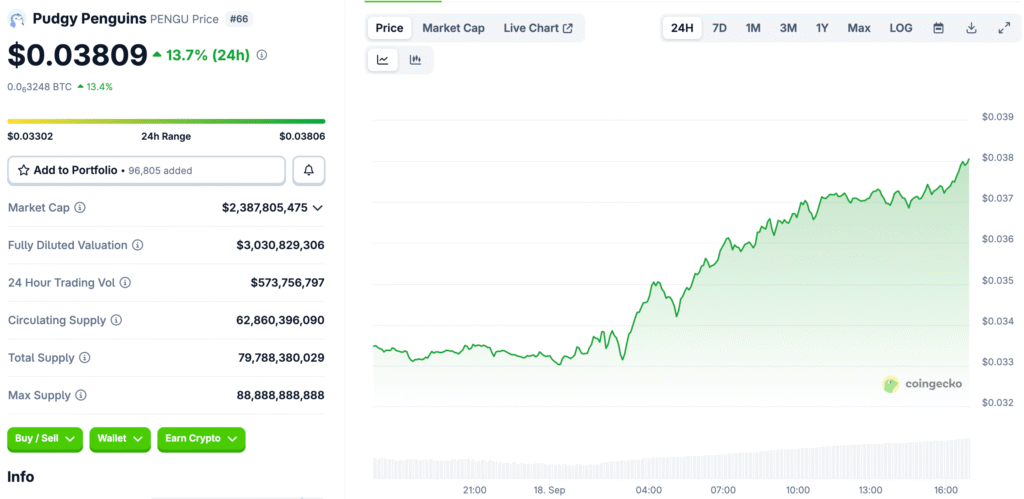

PENGU Builds Momentum Above Key Technical Level

PENGU broke through its 20-day EMA, indicating renewed strength as buyers prepare for the Federal Reserve decision. Traders now see $0.0337 as an important base, and the price could rise if volume remains high and macroeconomic policies improve. Analyst Lark Davis highlighted the importance of the first successful retest attempt, as successful EMA retests often occur before rallies.

Past patterns suggest the market may rally again and even reach defined resistance levels. As short-term structure strengthens, market participants expect more bullish momentum as long as macroeconomic conditions support continued interest in risk assets.

Technical Breakout Signals Target Near $0.05

Analysts predict $0.05 as the next significant resistance level, a 50% gain from the current market price. After weeks of pressure, momentum has picked up, and buyers are hopeful to break through the trendline that slowed growth in August.

If the price goes above resistance, technical confirmation could bring retail investors back to PENGU’s ecosystem and increase speculative demand. The 50-day EMA acts as support, strengthening bullish setups and reducing the risk of immediate breakdowns. Low trading volumes suggest investors are waiting for macroeconomic news to confirm their capital positions.

Federal Reserve Decision Shapes Market Outlook

The FOMC meeting is significant, with a 94% chance of a 25-basis-point rate cut. This could ease borrowing and increase interest in riskier assets like cryptocurrencies. Traders believe better liquidity will aid speculative rallies, but concerns remain about the Fed’s future actions.

While a 50-basis-point cut is technically possible, most believe the Fed will avoid extreme measures due to high inflation risks. The flow of assets across stocks, bonds, and cryptocurrencies will affect the central bank’s role in controlling inflation and supporting jobs.

Recommended Article: Pudgy Penguins Price Signals Bullish Breakout Toward New Highs

Labor Market Weakness Supports Policy Shift

Job growth is slowing down, putting pressure on the Federal Reserve to adopt looser monetary policies. Job openings are at their lowest level in years and weekly unemployment claims are at their highest level since late 2021. This weak job market lowers wage pressures, causing inflation but also hurts consumer demand, making the Fed’s balancing act harder.

Investors see this as a reason to lower interest rates, potentially leading to bigger rallies in growth-driven and speculative assets. This background makes bullish bets stronger by aligning technical momentum with macroeconomic conditions for more upside.

Inflation Concerns Complicate Central Bank Decisions

The labor market is cooling, but inflation remains above target, causing uncertainty for policymakers. Prices remain high at around 3%, well above the Fed’s 2% target. This raises concerns about a price rise in late 2025, making it difficult to decide whether to cut rates. Sticky inflation makes speculative assets riskier, but traders often see rate cuts as good news for risk-dependent sectors.

Cryptocurrencies like PENGU thrive when liquidity increases, making short-term investors more optimistic than worried about inflation. Uncertainty about inflation increases volatility risks and strengthens the connection between Fed decisions and crypto price movement.

PENGU Correlates With Broader Risk Asset Trends

Meme tokens like PENGU are highly linked to liquidity-driven markets, particularly during periods of easing when investors are willing to take risks and make money. Bitcoin struggles to maintain momentum, and altcoins often reflect market uncertainty while reacting strongly to economic events. A good policy environment could give PENGU the boost it needs to rise.

In the past, memecoins have often increased after strong catalysts, especially when liquidity expectations match technical setups. If momentum picks up after the FOMC meeting, retail investors could aggressively jump in, causing PENGU’s price swings to increase and bringing valuations closer to analysts’ expectations.

Traders Watch Critical Levels After FOMC Outcome

Traders are ready for volatility as the Fed’s decisions affect both the stock market and the cryptocurrency market. Everyone is still watching the $0.05 resistance level. If rate cuts happen as expected, PENGU could rise a lot, which would support bullish analyst predictions and strengthen technical breakouts. If momentum doesn’t stay strong, though, prices could fall back to support at $0.0337 or even $0.030.

Policy announcements can cause big swings in the market during the day, so active traders who are positioning around PENGU need to be very careful with their risk management. As liquidity conditions change along with macroeconomic signals, investors need to weigh the potential for gains against the risks of losses. This week will set the tone for PENGU’s path going into Q4 2025, no matter what happens.