Ondo Finance Stands Strong Amidst DeFi Volatility

The DeFi sector reached its highest point in Q2 2025, with a total value locked (TVL) of $153 billion. This shows that more people are using DeFi and investing in it. Volatility has slowed down momentum, but strong platforms like Ondo Finance are still attracting liquidity and building trust.

Changes in lending models have shown how weak they are, especially when interest rates are high and money is hard to get. These stresses showed how useful tokenized assets can be.

Staking Models Show Weakness

Ethereum borrowing rates shot up to almost 18%, which made leveraged staking not worth it and caused stress across all liquid staking tokens. Validator exit queues grew, showing how weak traditional staking is when there are liquidity shocks.

Ondo’s new liquidity products fill these gaps by offering collateralized structures that lower risks. Its tokenized redemption model might help it stay strong during times of volatility.

Macroeconomic Factors Put More Pressure

Changes in the economy, like unexpected U.S. jobs data, made both digital and traditional markets more volatile. This interdependence has an effect on Bitcoin, gold, and assets linked to DeFi.

Speculation about a Fed rate cut makes these swings bigger, which gives traders chances to make money. In these kinds of macro-driven situations, Ondo can act as a hedge.

Recommended Article: ONDO Token Builds Momentum Near Crucial Support Zones

Ondo’s Tokenized Assets Bridge TradFi and DeFi

Tokenized stocks and ETFs from Ondo Finance connect traditional finance with DeFi, allowing people to lend and borrow more than just native crypto assets. These partnerships make sure that institutions are trustworthy and that assets are backed.

By the end of the year, Ondo may have tokenized more than 1,000 assets, which would make liquidity more flexible. This structure could draw in institutional investors looking for high returns.

Regulatory Shifts Favor Compliance

Regulation in the U.S. and Europe has made things clearer, which has helped compliant platforms grow. These rules are in line with Ondo’s openness, which makes it more likely to grow.

The MiCA framework made lending rates lower, which made yields more predictable. Because Ondo’s infrastructure is compliant, it can be used more widely in financial markets.

Institutional Adoption Gains Speed

Institutional partners are still using Ondo’s model, which adds credibility and deeper liquidity. These inflows prove that its framework works and make demand channels very strong.

As institutions move money into tokenized assets, Ondo may become more popular. Its ecosystem benefits from structures that manage risk and diversity.

Ondo’s Global Markets Launch Fuels Investor Confidence

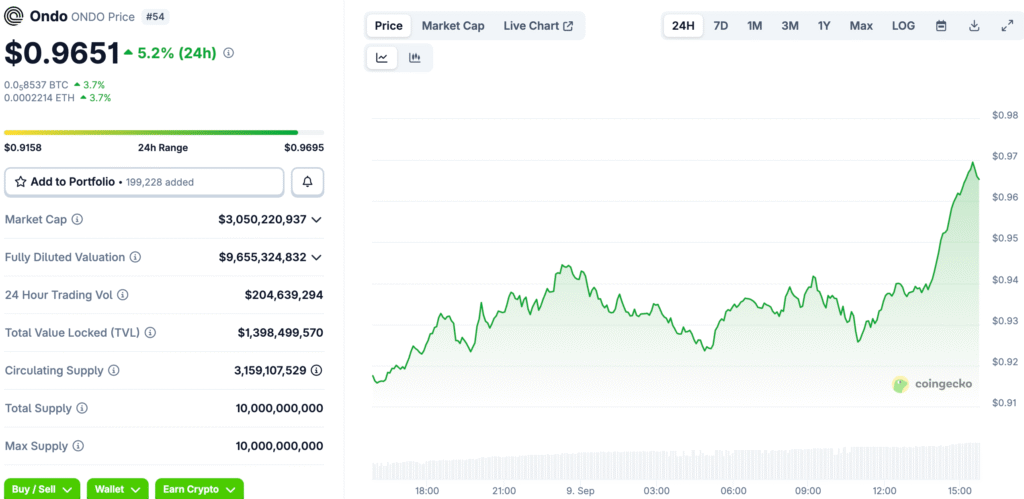

After Ondo’s Global Markets launch, the price of its token went up, which shows that investors are confident again. This fits with the general trend of DeFi resilience.

Adding more tokenized assets could create a flywheel effect that helps liquidity get stronger. Ondo looks like it will be able to recover even though things are still volatile.