Ethereum Price Hits a Key Technical Breakdown

Ethereum is showing signs of going down after breaking out of a symmetrical triangle. This could mean that it will go down in the short term. If selling pressure increases in the broader market, analysts say that Ethereum could go back to the $3,560 support level.

Michaël van de Poppe says that the $3,550–$3,750 range is an important area to watch for Ethereum price stability in the future. A clear break below these levels could make bearish sentiment stronger, which would make traders have to carefully rethink their short-term plans.

Analysts Warn About Mounting Market Pressures

Ethereum’s technical structure is sending out warning signs, and there are signs that its recent downtrend may continue. Weakening momentum suggests that traders may be cautious and wait for confirmation before confidently opening new long positions.

Volume trends have changed a lot, showing that institutional investors are less excited about speculation and more unsure about the short term. These events show how important it is to pay close attention to market signals as Ethereum gets closer to important technical support zones.

Mutuum Finance Presale Gains Strong Early Momentum

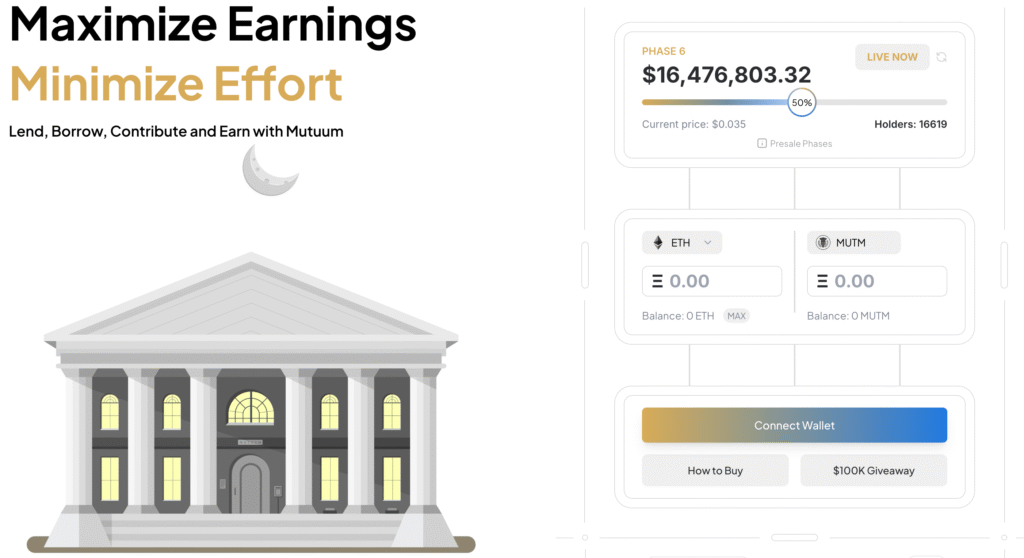

With its Stage 6 presale selling tokens for a low price of $0.035, Mutuum Finance has quickly gotten people’s attention. Over 16,570 people have already put money into the project, which has helped it raise more than $16.3 million.

These impressive numbers show that there is a growing demand for and trust in Mutuum Finance’s innovative DeFi model. The fast-paced presale shows that investors are excited about new opportunities that have a lot more potential than well-known blockchain projects like Ethereum.

Recommended Article: Warren vs Binance: Mutuum Finance Gains Investor Confidence

Innovative Ecosystem Strengthens MUTM’s Market Position

Chainlink oracles are used by Mutuum Finance to keep prices stable and operations honest in the lending, borrowing, and insurance markets. This multi-layered approach makes sure that data feeds are always accurate, even when the market is unstable. This greatly increases the overall resilience of the protocol.

Redundant systems, such as fallback parameters and composite data feeds, make things safer and more stable. These steps show that Mutuum Finance is a trustworthy and advanced DeFi protocol that can handle complicated liquidity operations quickly and easily.

Advanced Risk Models Draw In Strategic Investors

The platform uses dynamic risk management, which means it uses proportional loan-to-value ratios and reserve multipliers to make things safer. Mutuum Finance can effectively balance growth opportunities with user protection thanks to this careful structuring.

Low-risk assets get a 10% buffer, and high-risk assets can hold up to 35% reserves strategically. This risk-based distribution model strikes the right balance between stability and profitability, making it attractive to investors who want long-term exposure that lasts.

Mutuum Finance Emerges as High-Growth Alternative

Ethereum is having some technical problems right now, but Mutuum Finance is a promising high-growth DeFi competitor. It is in a strong position against more established competitors because of its presale progress, advanced ecosystem, and strong interest from investors.

Mutuum Finance has raised $16.3 million and has thousands of backers. Its innovative framework appeals to investors looking for high returns. MUTM has an advantage over Ethereum in tough market conditions because of its strategic positioning and technological depth.

Mutuum Finance Offers Growth While Ethereum Faces Market Uncertainty

Ethereum’s $4,000 level is now a key battleground for bulls and bears who are watching how support reacts. A clear recovery above resistance levels could boost confidence, but if the market stays weak, it could make people more cautious.

In the meantime, Mutuum Finance’s presale and advanced DeFi design give early participants a chance to make a lot of money. This situation gives investors two different options: established reliability or high-growth innovation in the changing crypto markets.