Compound Introduced Lending Innovation in 2018

Compound was the first to offer decentralized lending by letting people borrow and lend crypto assets. In the early years of DeFi, it changed the way finance worked.

COMP governance tokens helped boost yield farming by 2020. Its effects changed the whole DeFi sector and opened up new opportunities for early adopters.

Compound Growth Potential Appears Limited Today

In 2021, COMP was worth more than $850. Its growth has slowed since then, and it is now closer to $43. There isn’t much hope in the market.

The market cap is still big, but it has a limit. Compared to newer, earlier-stage DeFi projects that are coming into the space, explosive growth opportunities seem few and far between.

Mutuum Finance Gains Traction With Presale Success

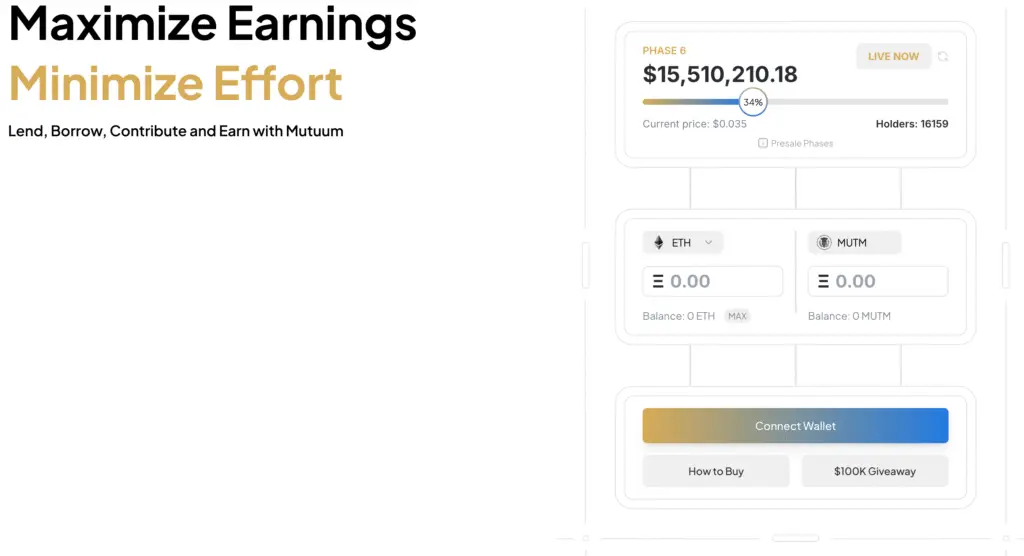

Investors are very interested in Mutuum Finance (MUTM). The price of Phase 6 tokens is $0.035, and more than $15.4 million has already been raised.

More than 16,100 people who own them have taken part. A 95/100 rating from CertiK audits increases trust in the design and security of the protocol.

Recommended Article: Mutuum Finance Gains Whale Interest While XRP Price Stalls

Lending Models Offer Flexibility to Users

Mutuum Finance has two systems: peer-to-peer lending and peer-to-contract lending. This dual model makes it easier for both borrowers and lenders to be flexible.

In P2P loans, borrowers can change the terms of the loan. P2C, on the other hand, offers protocol-driven stability by balancing the need for liquidity with competitive yields.

Risk Management Improves Protocol Stability

Mutuum, like Compound, uses overcollateralization. To protect liquidity pools, borrowers must put up assets worth more than the loan. This system does a good job of lowering risks.

Liquidation mechanisms make sure that you can pay your debts when your collateral drops. These features keep the protocol going while also making sure that lenders get a fair return.

Growth Potential Sets MUTM Apart From COMP

Investors like that MUTM is cheap and can grow. Early estimates say that returns could be as high as 30 times, which is much more than COMP can grow right now.

With strong fundamentals and momentum, MUTM is ready to be adopted quickly. Analysts think it will replace the early DeFi giants.

Mutuum Finance Challenges Compound’s DeFi Dominance

People will always remember Compound as a pioneer. But it looks like its growth story is mostly over. Investors are moving on to new chances.

MUTM offers security, new ideas, and low entry costs. This puts it in a good position to be a leader in the next chapter of DeFi.