Ethereum Faces Technical Weakness Amid Bearish Breakdown

Ethereum recently fell below a symmetrical triangle pattern, which could mean that it is weak in the short term if selling continues at this rate. Analysts say that the price could move slowly toward the $3,560 support zone, which would mean a possible 15% drop from where it is now.

The $3,550 to $3,750 area is very important to key market watchers, and the twenty-week exponential moving average is a key sign of this. Traders are keeping a close eye on these technical levels because if they stay weak, it could mean that Ethereum’s recent consolidation range is in danger of a larger downtrend.

Mutuum Finance Presale Gains Rapid Momentum

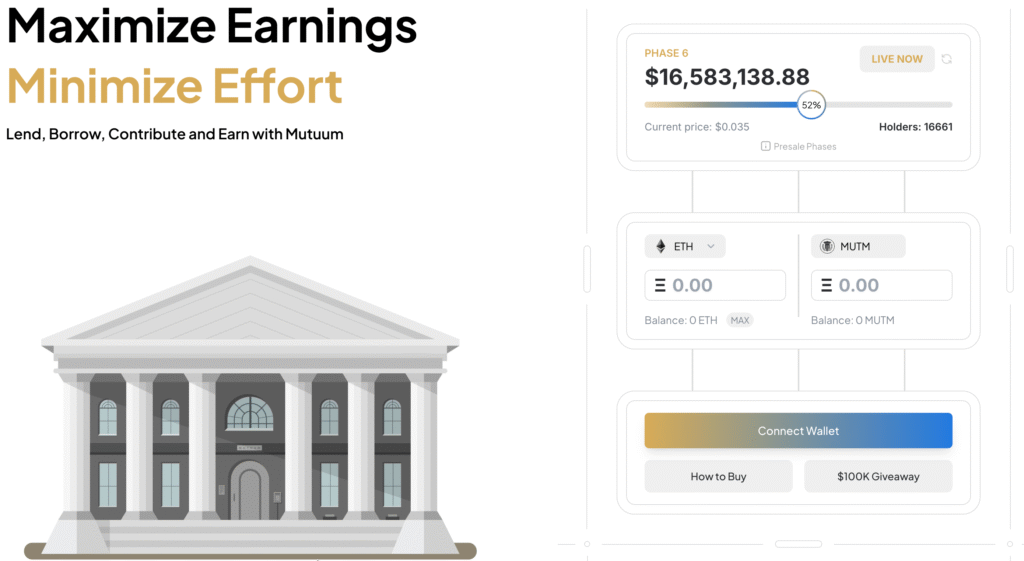

During its sixth presale phase, Mutuum Finance has attracted investors by selling tokens for a low price of $0.035. More than 16,000 investors have taken part, bringing the total amount raised to more than $16.3 million in record time.

This impressive momentum shows that there is a lot of interest from investors in new DeFi protocols that have a lot of potential for growth. Analysts say that this kind of early excitement often comes before huge growth in the months after a launch, especially when it is backed up by strong fundamentals and stories that focus on how useful the product is.

The DeFi Framework Sets Mutuum Up for Huge Growth

Mutuum Finance stands out because it has a dual lending-and-borrowing architecture that aims to make the most of capital while lowering systemic risk. This new structure combines peer-to-peer and peer-to-contract systems, which allows for flexible liquidity provision in a wide range of market conditions.

Mutuum is a flexible platform because it gives users more options for borrowing while still keeping strict rules about collateral. These mechanics help both institutional players and retail investors take advantage of better chances to make money in a DeFi ecosystem that is becoming more competitive.

Recommended Article: Shiba Inu vs Mutuum Finance: 250% vs 7,250% Growth Potential

Chainlink Oracle Integration Strengthens Stability

Chainlink oracles are used by Mutuum to make sure that pricing information is always accurate and reliable, even in unstable markets. The platform makes sure that operations stay consistent even in extreme conditions by using composite feeds, fallback mechanisms, and time-weighted averages.

This kind of redundancy makes things more stable, so lending, borrowing, and insurance can all work together without a hitch, even when the market suddenly changes. This promise to keep data safe is a big plus over weaker protocols that don’t have full oracle systems.

Dynamic Risk Management Makes Users Safer

Mutuum Finance uses proportional loan-to-value ratios and reserve multipliers that are specific to each asset’s risk level to keep your money safe. Low-risk assets get conservative buffers, while higher-risk positions are capped more tightly to limit losses during downturns.

This layered structure strikes a balance between being easy to use and having safety features, which lowers the risk of liquidation for users. Strategies for managing liquidity protocol risks further reduce downside exposure, making Mutuum’s system strong against sudden changes in the market and sudden drops in liquidity.

Ethereum Struggles While Mutuum Presents Opportunity

Ethereum is still under pressure around the $4,000 mark, and it could go down to important support levels near $3,560. Traders are being careful and waiting for signs of stability before getting back into big positions within the established support range.

Mutuum Finance, on the other hand, is a high-growth option for investors who want to look beyond mature assets. It has strong fundamentals, a strong security framework, and a growing community, which makes it one of the most promising DeFi presales of 2020.

What Makes Mutuum Finance Stand Out for 36x Returns

Mutuum Finance has a lot of growth potential because it has fast presale traction, an advanced technical architecture, and risk-aware systems. Its deflationary structure and incentives for liquidity align the interests of long-term participants, which helps the ecosystem grow in a way that lasts beyond short-term hype cycles.

Early supporters who buy Stage 6 tokens at current prices could see big returns as more people start using them. Ethereum is currently weak, but Mutuum Finance’s unique DeFi approach makes it a great investment in the changing world of cryptocurrencies.