Hyperliquid Holds Key Support Zone

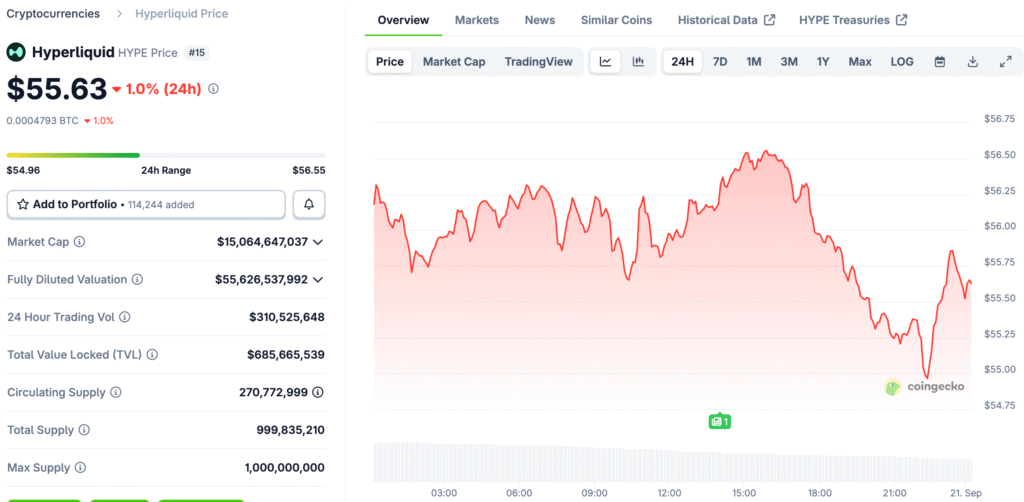

Recently, Hyperliquid rose to an all-time high of $59.39 before falling back to $55.63. Even though it is volatile, the token stays stable above $55. This support level is still very important, with bulls determined to protect it from falling prices and sellers keeping a close eye on any possible breakdown risks.

Over the past 24 hours, trading volume dropped by more than 30%, which slowed down momentum and cut down on immediate speculative activity. Still, the market capitalization of $18.68 billion shows that investors and institutions are very interested, so the $55 mark is very important for shaping short-term sentiment and overall confidence.

Market Watches $55 as a Key Level

The $55 level has already been tested many times, and buyers have shown a lot of interest. Analysts say that as long as HYPE stays above this level, bullish scenarios are still possible, and prices could go even higher.

If this support goes away, prices could drop to $52.50 and maybe even $45.75. Until then, buyers are expected to keep protecting the zone, which will set Hyperliquid up for another rise toward recent highs.

Resistance Looms Near $60 Range

Between $59.46 and $60.07, there is resistance above the $55 base. This band marks the previous peak and is the main barrier to further gains. Traders think this is the last thing that needs to happen before new record highs.

If the price breaks above $60, it could start price discovery again, which could lead to a sustained upward trend. A clean breakout could attract more people to the market, which would increase liquidity and push prices to new highs in the next few weeks.

Recommended Article: Hyperliquid Price Hits Record as Network Fees Surpass Ethereum

Technical Indicators Signal Neutral Momentum

The relative strength index is around 49, which means that markets are moving in a neutral way. This balance between levels that are too high and too low gives the market room to move in either direction based on volume and sentiment.

Consolidation at these levels fits in with larger bullish patterns. The neutral indicator shows that the market still has enough room to grow without the risk of running out of steam or turning around right away.

MetaMask Partnership Adds Bullish Momentum

MetaMask’s announcement that Hyperliquid will allow perpetual trading makes the token more useful. This integration could lead to more people using HYPE, which would strengthen its fundamentals by linking it to a bigger network of decentralized trading.

Market experts see the partnership as a way to spur long-term growth. Hyperliquid stays competitive with other decentralized platforms by adding new features. This gives traders and long-term investors more confidence.

Short-Term Scenarios for Hyperliquid Price

If Hyperliquid can hold the $55 support, the next target is the $60 resistance zone. If the volume and buying pressure stay high, a breakout could happen, confirming bullish hopes for more momentum.

If $55 doesn’t hold, there is a risk of corrections that go deeper into support levels. Traders are still being careful, though, and changing their positions based on changes around key price levels, even though momentum is currently in favor of bulls.

Hyperliquid Holds $55 Support as Traders Brace for Next Big Move

Hyperliquid’s short-term future depends on being able to hold support while testing overhead resistance. Analysts say that a big move is about to happen, and it could either break out or break down, which will set the next path.

For now, optimism stays high because prices are holding above $55 and MetaMask is driving adoption. Traders and investors are keeping a close eye on Hyperliquid as it balances between consolidation and the possibility of continuing to rise in value.