Hyperliquid Gets Ready for Big Unlock Event

Starting on November 29, Hyperliquid’s governance token HYPE will go through a huge unlock that will let go of 237.8 million tokens. This unlock will happen in a straight line over two years, adding about $500 million to the circulating supply every month. The total release is worth $11.9 billion in tokens, with a reference price of $50.

People in the market are keeping a close eye on whether there will be enough liquidity to handle this new supply pressure. Analysts say that investor confidence will depend on whether structured buybacks can effectively ease the selling pressure caused by unlocks.

Fundraising Efforts Fall Short of Unlock Scale

Hyperliquid and Decentralized Asset Trusts (DATs) have set up fundraising campaigns to stop dilution. Sonnet, the biggest DAT, raised HYPE, which was worth $583 million and had $305 million in cash reserves. A few smaller DAT pools have also helped, but the total coverage is still very low.

These fundraising efforts aren’t enough to fully cover issuance when compared to the $11.9 billion unlock pipeline. Analysts say that without more money coming in, dilution effects could get worse in secondary markets and make investors feel even worse.

Trading Activity Declines Ahead of Unlock

According to new information, Hyperliquid’s perpetual futures volume fell to $5.3 billion in September. This is a big drop of 58% from the $25 billion highs in August. Analysts say that traders are being careful and cutting back on their positions before vesting starts.

The drop in trading activity suggests that liquidity may become even thinner during the unlock period. These kinds of drops are often like pre-event risk aversion, which means that people are getting ready for more volatility after the unlock.

Recommended Article: Hyperliquid Price Prediction as $50 Support Faces Critical Test

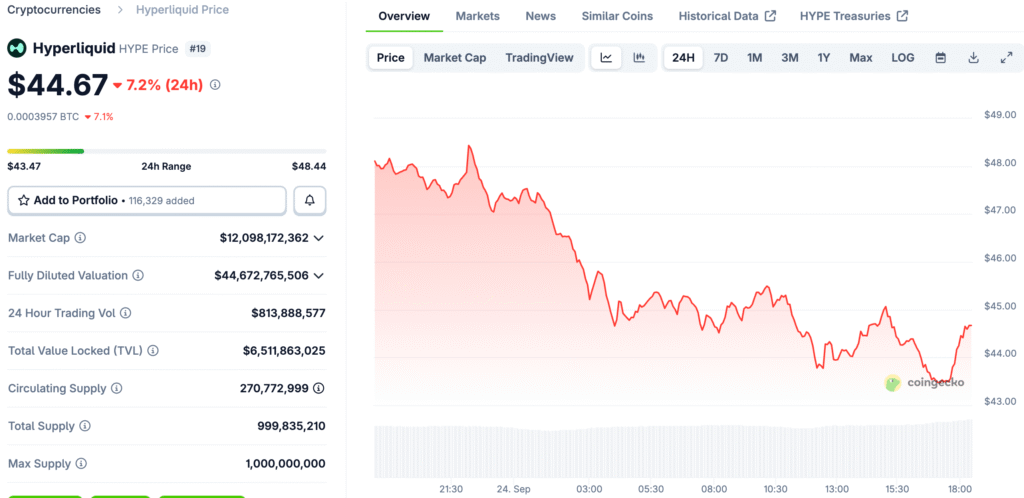

HYPE Price Retests Critical Support Zone

HYPE has tested support around the $49–$50 zone on price charts, which is an important structural level. This area is in line with the lower edge of a medium-term upward channel. It is very important to hold this intersection in order to keep the bullish structure and stop a breakdown.

If the price goes back up, it could reach $60. If it doesn’t, it could drop into the $40s. Traders say that if prices stay above $50, it would show strength. On the other hand, if prices keep falling, the chances of cascading liquidations go up.

Ecosystem Expansion Continues Despite Risks

Hyperliquid’s ecosystem is still growing in popularity, even though there are problems with supply. The platform has on-chain derivatives and stablecoins pegged to the dollar that traders and liquidity providers are interested in. These basics help keep demand for HYPE strong over time.

But people may still be worried about the upcoming unlock, which could make their feelings about the near future fragile. However, ongoing innovation in the ecosystem may lessen the effects of supply shocks and boost confidence in the fundamentals.

Market Context and Broader Volatility Trends

The unlock happens at a time when the crypto market as a whole is very unstable. Changes in Bitcoin’s derivative flows and funding rates are affecting how much people want to buy smaller assets. HYPE’s connection to bigger markets may make price swings bigger as sentiment changes.

Supply shocks related to unlocks could make this volatility worse, so it’s important to manage risk. Analysts also say that uncertainty in the economy as a whole could make these pressures worse, which could change how much money is put into mid-cap tokens like HYPE.

Hyperliquid Faces Major Supply Test in Q4 2025 Amid Market Uncertainty

Hyperliquid is set to face a significant supply test in Q4 2025, with a growing ecosystem and the need to balance it. The outcome depends on the collaboration between DAT treasuries, internal buybacks, and liquidity providers.

If there is sufficient liquidity, issuance can occur smoothly, but thin conditions could cause price fluctuations. If pending ETF applications are approved, they could help offset dilution with new demand. The long-term position of investors during this unlock phase could set the course for Hyperliquid for the future, even into 2026 and beyond.