Hyperliquid Records Higher Fees Than Ethereum and Solana

Hyperliquid’s blockchain recorded $3.2 million in fees in just 24 hours, which is a lot more than the combined fees of Solana, Ethereum, and Tron. This milestone showed that more and more people wanted to use Hyperliquid, putting it ahead of its bigger competitors in tracking real network activity across decentralized finance platforms.

Transaction fees are a good way to tell how many people are actually using the Hyperliquid network, and they show that it is growing quickly. Analysts pointed to this success as proof that more and more users prefer it over traditional options because it is more efficient and scalable.

Rising Network Activity Strengthens Price Momentum

On-chain data showed that more user transactions helped Hyperliquid’s momentum, which led to a rally of almost ten percent. As traders expected high demand for decentralized applications in HYPE’s ecosystem, positive sentiment spread quickly, pushing HYPE to all-time highs.

Analysts think that prices will stay strong as transaction activity grows, which means that prices may go up if adoption stays strong. More stablecoins on the network provide more support, confirming more people are participating in the market and boosting bullish momentum.

Stablecoin Growth Adds Ecosystem Liquidity

DefiLlama said that the supply of stablecoins on Hyperliquid’s network went up by five percent in the past week. This growth means that more capital is being put to use, as investors are actively using their assets on the blockchain, which increases transaction volume and the growth of the ecosystem as a whole.

More liquidity makes trading smoother, lowers volatility, and gives new traders access to deeper markets. This influx of money shows that people trust Hyperliquid’s stability, which raises hopes that HYPE will keep going up for the foreseeable future.

Recommended Article: HYPE Price Hits Record High As Rally Momentum Remains Strong

Technical Outlook Highlights Potential New Highs

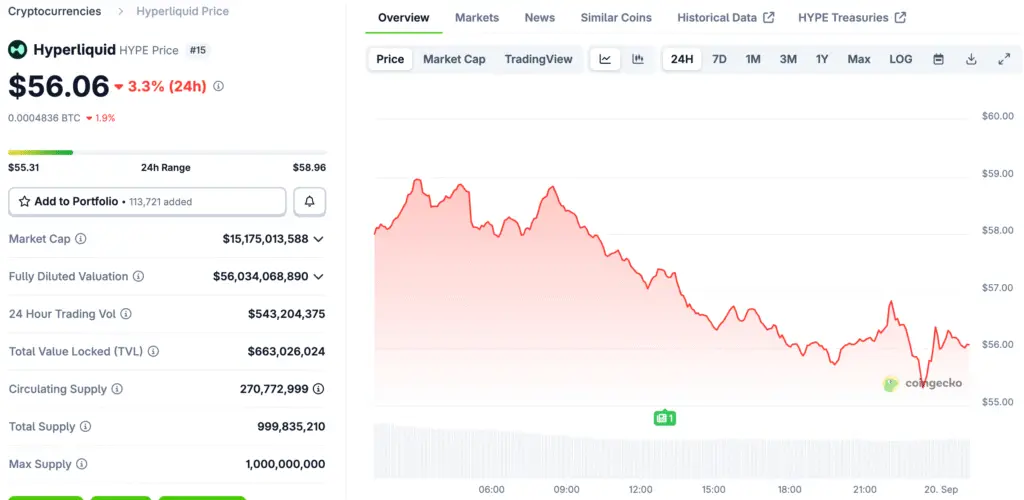

Since prices have already gone above previous highs, traders think HYPE might try to break out above $59.41 soon. Bulls think that momentum is building because structural indicators keep pointing up, which makes it more likely that another big extension will form across the chart.

Analysts think that if buying pressure stays high, short-term targets near $65 could happen. Strong fundamentals and technical alignment together make people more hopeful that Hyperliquid may reach new highs that are higher than current records.

Risks of Correction Still Remain

Even though things are going well, people might take profits and prices could drop back to $48.84, which is seen as key support. Traders say that if this level isn’t defended, prices could drop even more, testing other support zones closer to the $40 area.

Bearish scenarios stress that rallies that get too hot often need to cool down before they can start going up again. Market participants are still keeping a close eye on trading volumes to see if buying pressure is strong enough to hold up against possible sell-offs.

Hyperliquid Adoption Expands Across DeFi Market

Hyperliquid’s quick rise shows how decentralized finance markets are changing, with more people interested in scalability and lower transaction costs. It became more popular as a settlement layer among active crypto users when its fees went up higher than those of Ethereum and Solana.

Analysts say that this momentum could lead to more interest from developers, which could lead to more projects being built. This kind of ecosystem growth makes HYPE an even stronger competitor in blockchain markets, which adds value to the network’s long-term growth.

Hyperliquid Gains Momentum With Strong Liquidity and Record Fees

Hyperliquid looks good because it has strong fundamentals, more liquidity, and record fee performance. Traders are still hopeful because they see aligned catalysts that could keep the market going up in the short and medium term.

If adoption rates keep going up and more money comes in, HYPE could become a major blockchain asset. In the next few weeks, we’ll find out if the bullish predictions come true. If they do, prices could keep breaking records.