Gold Rally Signals Structural Shift In Global Investor Behavior

Gold’s rise above $5,000 is more and more a sign of structural demand than of speculative momentum caused by short-term positioning. Investors are taking into account long-term currency debasement, persistent geopolitical risk, and central bank accumulation when they value gold. This behavior shows that markets see gold as a safe haven during a long-lasting change in the economy.

Gold’s strength is different from previous rallies because a wide range of institutional, sovereign, and retail investors are involved. Demand has stayed strong even though other asset classes have been very volatile. This consistency makes people think that gold’s breakout is not just a temporary problem.

Bitcoin Consolidates Near Key Levels Amid Weak Conviction

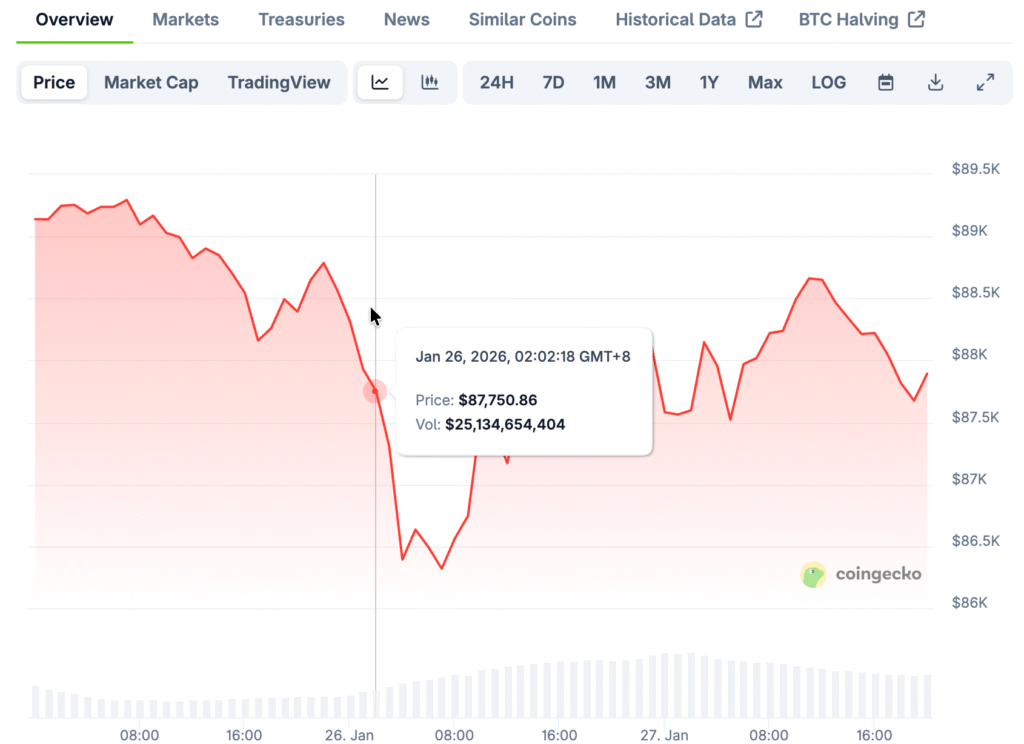

Bitcoin is still trading around $87,000, but there is not much direction in either the spot or derivatives markets. According to onchain data, older holders are selling, while newer buyers are taking losses during recent pullbacks. This kind of movement is more common in consolidation phases than in sustained trend acceleration.

Rallies toward higher levels keep running into overhead supply that was built up during previous accumulation periods. This supply overhang slows down upside momentum and makes people less optimistic, even though there are long-term stories that support it. Because of this, bitcoin has a hard time finding a clear way to new highs.

Onchain Data Shows How Supply Overhang Works

According to CryptoQuant data, people who own bitcoin have started to lose money for the first time since late 2023. This change shows that people in the market are changing their positions instead of increasing their overall exposure. The pattern usually comes before long periods of sideways movement instead of sharp reversals.

Glassnode analysis shows that people keep selling near short-term holder cost bases that are less than $98,000. These zones are like mechanical barriers where sellers who want to break even leave their positions. This behavior strengthens the ceiling that keeps prices from going up too quickly.

Recommended Article: CrunchUpdates Expands Digital Newsroom Covering Cryptos AIX

Derivatives Markets Reflect Cautious Risk Appetite

Futures volumes in bitcoin markets are still low, which means that traders are not using a lot of leverage. When liquidity is low, prices can change without a lot of people participating or following through. This setting makes it easier for sharp but short-lived swings to happen.

Options markets show more uncertainty, with downside protection still in demand even though implied volatility is low. Traders do not seem willing to price in aggressive upside scenarios in the near future. This is very different from the confidence that comes with gold-related derivatives.

Prediction Markets Think Gold Will Do Better Than Crypto

More and more, prediction platforms say that gold is more likely to stay above $5,500. People in the market think that gold’s path is in line with ongoing macro stress and policy uncertainty. These expectations make more money flow into traditional hedging assets.

On the other hand, traders expect bitcoin to consolidate more before it breaks out again. Bets are on the digestion of internal supply rather than the continuation of the current trend. This difference shows that different asset classes have different time horizons.

Macro Forces Cause Different Responses From Asset Classes

Gold is currently taking in global macro stress from things like geopolitical tension, changes in monetary policy, and uncertainty about the economy. Investors think that the metal is safe from the effects of internal market mechanics on digital assets. This position makes gold more appealing when regimes are unstable.

Bitcoin, on the other hand, is still affected by changes in liquidity and how holders act. Even though it has a macro hedge story, its short-term performance shows that structural supply changes are happening. This difference explains why assets are performing worse than they used to.

Outlook Suggests Continued Divergence In Near Term

Bitcoin’s upside momentum may stay limited until it breaks through thick supply zones above $100,000. To absorb the current overhead supply, spot demand would have to keep growing. That condition has not yet become real in a convincing way.

Gold, on the other hand, looks like it will stay in charge as demand for macro hedging stays high. In the short term, the structure of the market supports continuation instead of mean reversion. This difference shows how investors’ preferences change over time during times of global uncertainty.