FLOKI Builds a Strong Base for Accumulation

FLOKI has been trading in a wide range between $0.00004 and $0.00012 for almost a year. This long base suggests that long-term holders are steadily adding to their positions, even though trading volume is low. Analysts see this structure as a base for a possible bullish breakout.

The memecoin recently shot up 60% a day and is now worth about $0.000097. Market participants pointed to repeated tests of the consolidation range as proof of strength. A clear move above resistance could lead to higher prices.

Volume Trends Reflect Market Caution

FLOKI’s trading volume is still low compared to the highs of last year. There are occasional spikes, but they don’t happen often enough to keep the momentum going. Analysts think that this lack of activity means that traders are hesitant and waiting for confirmation.

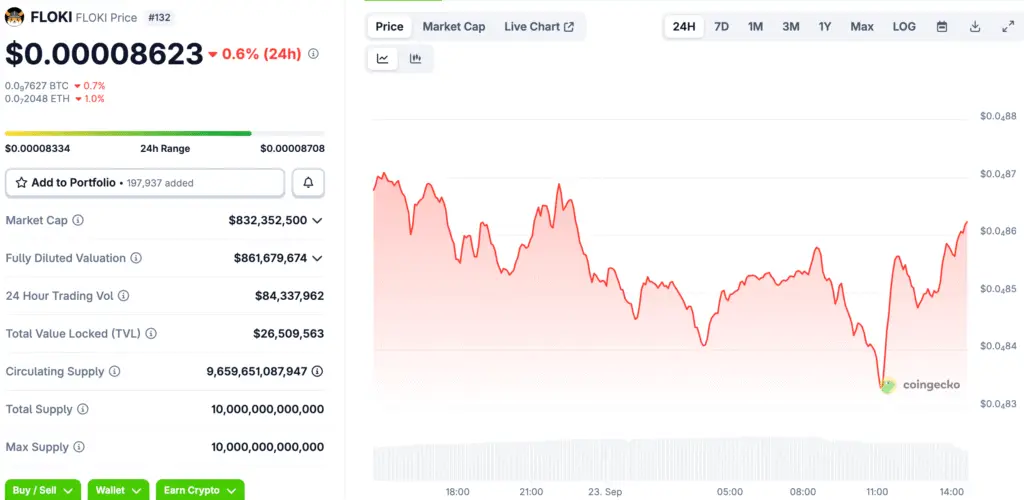

Recent sessions had mixed activity, with dips followed by more buying. FLOKI went down to $0.000085 before going back up to $0.000091. Some people say that a breakout with more volume would confirm the bullish setup.

Key Price Levels Define Market Outlook

If the market stays weak, it could test $0.000085 again, which is a key support level. Resistance levels are $0.00012, $0.00028, and $0.00033. For the upward trend to continue, strength must stay above $0.00012.

There are 9.65 trillion tokens in circulation, and the market cap is $877 million. This steady flow of money keeps FLOKI a memecoin that people are very interested in. Traders say that staying above support is important to avoid more downward pressure.

Recommended Article: FLOKI’s Bullish Setup Signals Path to Price Rally

Technical Patterns Suggest Bullish Potential

Chart patterns show that an inverted head-and-shoulders pattern is forming within the year-long range. Analysts link this setup to bullish reversals in the larger markets. The higher lows in FLOKI make this interpretation stronger, pointing to possible breakout scenarios.

The weekly chart data backs up the bullish story by showing that prices are staying in a rectangular band. If the price breaks above $0.00033, it could mean that the rally will last longer and go up to $0.00080. Analysts say that volume confirmation is still needed.

Broader Memecoin Market Adds Context

The way the rest of the memecoin market acts could affect how well FLOKI does. Renewed speculative flows could improve sentiment in other assets that are similar. When the market is hot, traders often move money between trending memecoins.

Analysts say that retail investors have historically caused huge price increases. FLOKI could do better if a lot of people get excited. Because it already has a strong base, it could be a top choice in future market cycles.

Investor Sentiment Monitors Next Steps

Investor sentiment is still cautiously optimistic, weighing the risks against strong technical foundations. People are confident that FLOKI will make more money in the future because it can keep its accumulation base. If the price breaks through resistance, this optimism could turn into aggressive participation.

Analysts say that keeping an eye on whale activity could be a possible trigger. Large holders may speed up moves by providing liquidity. Traders are still paying attention to these signals while getting ready for possible changes in the market.

Weekly Forecast for FLOKI Price Movement

In the next few weeks, we’ll see if FLOKI can keep support and fight resistance. Analysts think that the market will stay stable until stronger catalysts show up. The direction may also be affected by ETF flows and the general mood in the crypto world.

A strong weekly close above $0.00033 could start a big rally. If you don’t defend support, on the other hand, you could see a new drop. Market players still see volume trends as the best way to confirm that a breakout is possible.