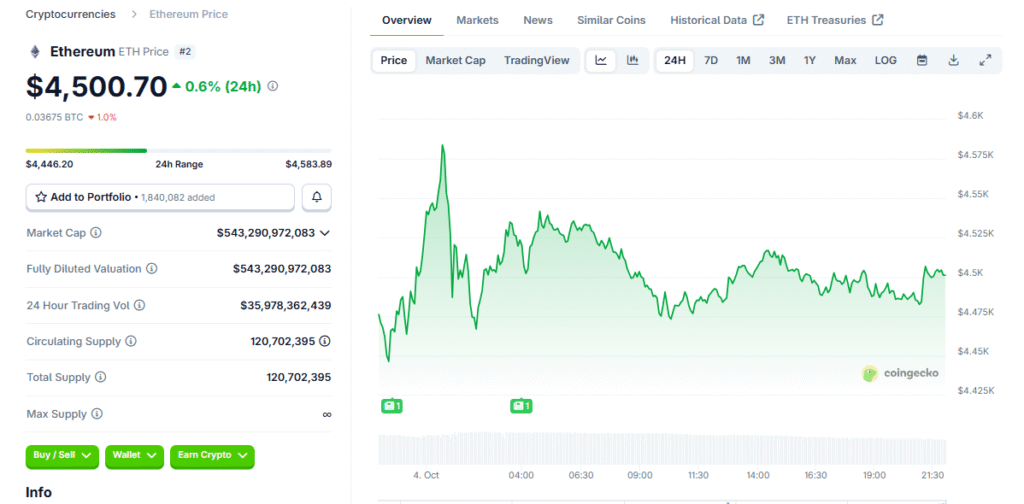

Ethereum Trades Near $4,500 Resistance Zone

Ethereum is trading near $4,491 after a steady uptrend from earlier lows this month. The price climbed from $4,000 to $4,500–$4,600 resistance, showing renewed market activity. Momentum is slowing as buyers take profits and markets consolidate gains after the rally. Analysts note that Ethereum is in a crucial zone where support and resistance are tightly aligned.

Consolidation Phase Hints at Market Indecision

The current sideways trading reflects hesitation among bulls and bears after a strong advance. Buyers remain present, but momentum has cooled compared to early moves upward. If support between $4,300–$4,400 holds firm, ETH might sustain its base for another rally. A breakdown from this range would indicate fading enthusiasm and invite stronger selling pressure.

Short-Term Forecast Shows Upside With Caveats

Over the coming week, Ethereum may retest upper resistance levels if momentum persists. A break above $4,600 could trigger a push toward the $5,000 psychological barrier. Sustained flows, positive news, or macro tailwinds are required to strengthen bullish conviction. However, if resistance holds, Ethereum may correct back to $4,200 or even $4,000.

Recommended Article: Ethereum Bulls Target $4,500 Breakout As Rally Builds

Resistance Strength Could Dictate Market Moves

If resistance around $4,600 remains firm, sellers may exploit market fatigue to push prices lower. Analysts warn that the recent run-up could lead to exhaustion if buyers hesitate. Pullbacks would test lower supports and reveal whether bullish sentiment remains strong. The week ahead will likely be defined by how Ethereum responds to these technical barriers.

Institutional Flows Remain Key Price Driver

Institutional inflows to ETH products can create sustained upward pressure if enthusiasm continues. ETF allocations and tokenization projects are driving capital toward Ethereum this quarter. Strong inflows typically support price bases during periods of consolidation and uncertainty. Traders are closely monitoring these flows to gauge future breakouts or declines.

Regulatory Developments Could Shift Sentiment

Crypto regulation in the U.S. and Europe remains an important factor for Ethereum’s price path. Clear rules around stablecoins and DeFi frameworks can unlock institutional capital inflows quickly. Conversely, ambiguous or restrictive measures could spook markets and dampen bullish momentum. The regulatory narrative will influence Ethereum’s near-term trajectory significantly.

Technical Upgrades May Provide Catalysts

Ethereum’s infrastructure upgrades and adoption announcements often act as bullish catalysts during consolidations. Any significant development could trigger renewed momentum toward higher resistance zones. Traders watch these technical milestones closely for signs of renewed enthusiasm in the ecosystem. These factors may determine whether Ethereum sustains its upward path or corrects lower.