The Rise of Ethereum Treasury Companies

The cryptocurrency market is witnessing a significant shift in corporate strategy, as more companies are adopting a “crypto treasury” model. This approach, pioneered by firms like MicroStrategy with Bitcoin, involves using corporate funds to acquire and hold large amounts of cryptocurrency on their balance sheets. Bitmine Immersion Technologies (BMNR) is a leading example of this trend within the Ethereum ecosystem.

The company has announced an ambitious plan to sell up to $20 billion worth of new stock with the explicit goal of increasing its holdings of Ethereum (ETH). This bold move underscores a growing institutional confidence in digital assets as a store of value and a strategic reserve. Bitmain’s stock price has surged in response, indicating that investors are embracing this new corporate strategy and see the value in a company that is heavily invested in the future of the Ethereum network.

Bitmain’s Ambitious Goal to Acquire More ETH

Bitmine Immersion is not just making a small bet on Ethereum; it has an ambitious goal to become a dominant holder of the cryptocurrency. The company’s recent announcement revealed that its current holdings of ETH stand at a staggering $4.96 billion, representing a little over 1.15 million tokens. This means the company already owns roughly 1% of all the Ethereum tokens in circulation. However, this is just the beginning.

The company has set a target to eventually acquire 5% of the world’s outstanding ETH tokens. This level of accumulation is a strong vote of confidence in Ethereum’s long-term value and its central role in the decentralised finance ecosystem. By issuing new stock to fund these purchases, Bitmine is essentially allowing its shareholders to gain exposure to Ethereum’s price appreciation without buying the cryptocurrency directly, a strategy that is proving to be very popular with investors.

The “Crypto Treasury” Strategy in Action

The “crypto treasury” strategy is gaining momentum across a variety of companies. At its core, the model is straightforward: a company issues new stock and uses the proceeds to buy cryptocurrencies, which are then held on its balance sheet as a treasury asset. This provides the company with a powerful new way to hedge against inflation and economic uncertainty. Bitmine Immersion’s strategy is a textbook example of this approach.

By acquiring billions of dollars’ worth of ETH, the company is tying its financial future directly to the success and growth of the Ethereum network. The strategy has also been adopted by other notable companies, including the cryptocurrency broker Coinbase and the perennial meme stock GameStop, which has announced its intent to hold Bitcoin on its balance sheet. This diverse range of adoption signals that the crypto treasury model is not a passing fad but a new, widely accepted corporate financial strategy.

Ether’s Recent Price Surge and Market Performance

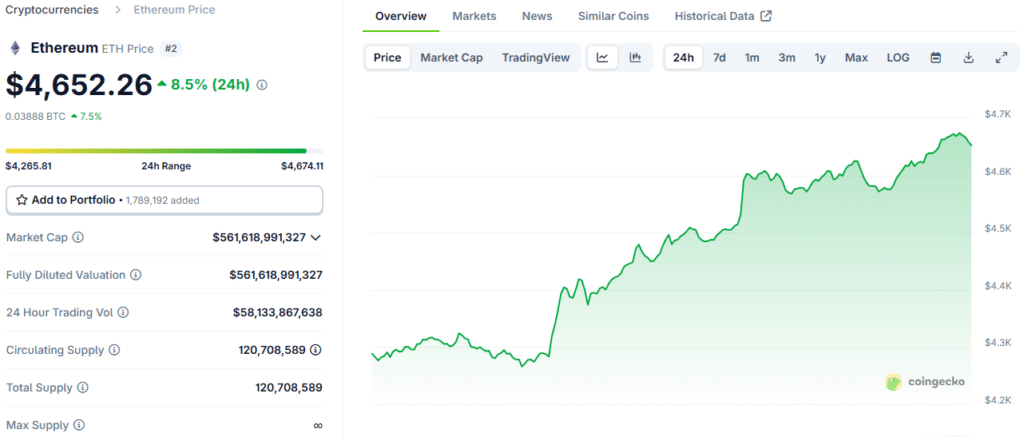

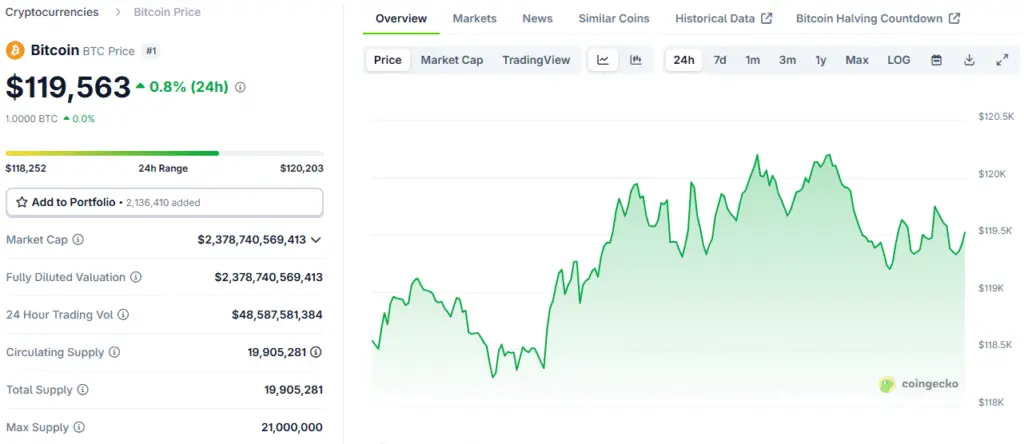

Bitmain’s strategic moves come at a time when Ethereum is experiencing a significant price surge. Over the past month, Ether has soared by more than 50%, with its price now trading above $4,500 per token. This impressive performance has brought the cryptocurrency within striking distance of its all-time high of over $4,600, which it attained in October 2021.

In comparison, Bitcoin’s price has seen a more modest increase of just over 1% in the same period. This recent strength in Ethereum’s price is providing a powerful tailwind for companies like Bitmine Immersion, as their existing holdings are appreciating in value, and their stock becomes more attractive to investors. The surge in Ether’s price is not just a result of market dynamics but is also a reflection of its growing utility and its central role in the wider crypto ecosystem.

Key Factors Behind Ethereum’s Momentum

The momentum behind Ethereum is being driven by a combination of key factors that have solidified its position as a leading cryptocurrency. One of the most significant recent boons was the highly successful Initial Public Offering (IPO) of Circle Internet Group, the fintech giant behind the stablecoin USD Coin (USDC). Circle’s success further validates the legitimacy of blockchain technology and its potential to revolutionise traditional finance.

The Ethereum network has also gained widespread recognition as the ecosystem of choice for most stablecoin mintings. This is a critical point, as stablecoins are a cornerstone of the DeFi space, providing a stable medium of exchange. The dominance of Ethereum in this sector highlights its robustness and reliability as a platform. These factors, combined with its ongoing technological upgrades and a vibrant developer community, are all contributing to Ethereum’s sustained growth and market leadership.

Coinbase’s Role as a Major Market Holder

Bitmine Immersion is not the only company with significant Ethereum holdings. Cryptocurrency broker Coinbase (COIN) is another major market participant. The company, which operates one of the largest transaction-processing chains on Ethereum, holds a substantial amount of the cryptocurrency on its balance sheet. According to CoinDesk, Coinbase holds more than 100,000 tokens, with a total value of over $500 million.

Coinbase’s stock has also been performing well, with shares rising in premarket trading. This indicates that the market is rewarding companies that are not only providing services within the crypto space but are also directly invested in the success of the underlying assets. The presence of major, publicly traded companies like Coinbase and Bitmine Immersion as large-scale holders of Ethereum provides a strong layer of institutional support that helps to stabilise the market and legitimise the asset class.

Bitmine Immersion Issuing Stock to Fuel ETH Treasury

Bitmine Immersion’s bold move to issue new stock to buy more Ethereum is a clear sign of what the future of corporate crypto adoption might look like. This strategy, which marries traditional finance with the innovative world of decentralised assets, is gaining traction at an incredible pace. As Ethereum’s price continues to surge and its utility as a platform for stablecoins and other DeFi applications grows, more companies are likely to follow Bitmine’s lead.

The success of this model will not only reshape corporate treasuries but will also have a profound impact on the entire cryptocurrency market. It signals a new era where institutional players are not just observers but active participants and stakeholders in the digital asset revolution. The path forward for companies like Bitmine Immersion is a clear indication that a new, more integrated financial system is on the horizon.

Read More: Early Ethereum Investor Cashes in on a Portion of Their Holdings