Ethereum Consolidates Below Key Resistance Levels

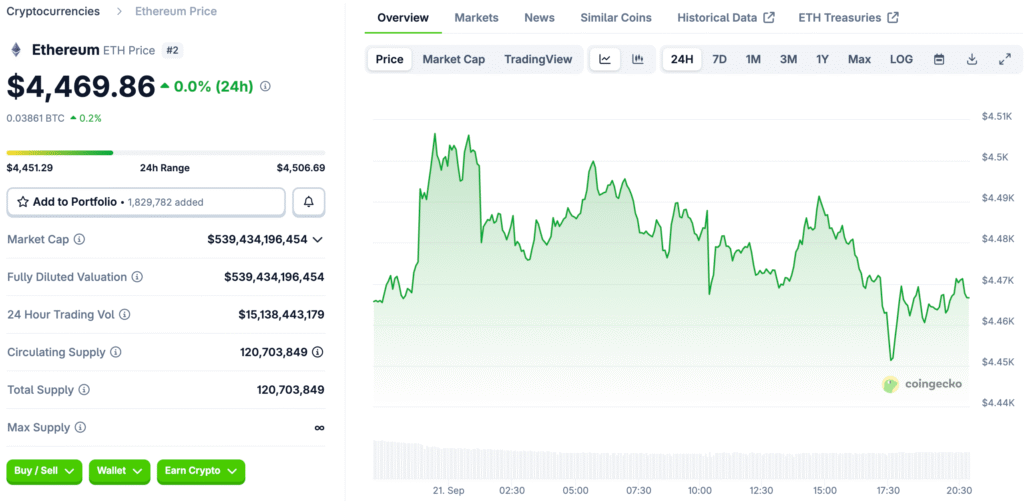

Ethereum, trading just below its 2021 high of $4,878, is gaining attention from investors due to its recent struggles to break above $4,500. Analysts believe that if Ethereum continues to rise above resistance, it could signal a bullish long-term trend.

Ted Pillows, a renowned analyst, compared Ethereum’s current consolidation to its 2021 cycle, where it dropped sharply before reaching new all-time highs. This situation aligns with cyclical market psychology, where pauses often precede significant gains.

Short-Term Correction Before Major Rally

Pillows says that Ethereum might soon go through a correction phase that takes it to the $3,700–$3,800 range. He stressed that these kinds of drops, while scary for short-term traders, are often needed to reset things. This situation could get rid of too much leverage and make room for more long-term bullish activity in the future.

The analyst thinks that Ethereum could start a big rally after this phase is over. He thinks that ETH will hit the $10,000 mark by the beginning of 2026. Such a rally would strengthen Ethereum’s position as the leader in the altcoin market, giving investors more confidence even after recent problems.

Historical Comparison Supports the Bullish Case

Pillows looked at the market today and compared it to 2021, when Ethereum tested its 2017 ATH of about $1,400. ETH went up to over $4,800 in the same cycle after a 25% drop. The fact that this behavior keeps happening shows that looking at past market behavior can help you guess what will happen in the future.

This pattern that keeps happening suggests that the current consolidation and possible correction may end up making Ethereum’s long-term bullish outlook even stronger. Investors are now closely watching these levels to see if they hold. Strong confirmation signals could bring in money from institutions, which would make it even more likely that Ethereum will reach higher prices.

Recommended Article: Ethereum Targets 75% Surge vs. Bitcoin By Year End

Ethereum Maintains Role as DeFi Backbone

Ethereum remains the top leader in decentralized finance (DeFi), with over $3.5 trillion in DEX volumes built on the platform. This success strengthens Ethereum’s network as the main base for global decentralized financial infrastructure.

Ethereum’s network is crucial for liquidity and trading infrastructure, and its importance in DeFi growth and development is evident in the increasing dependency of protocols on the network for blockchain-based financial apps worldwide.

Recent Market Weakness Pressures ETH Price

Ethereum’s price has been having a hard time lately, even though the fundamentals are good. ETH is worth about $4,470, which is more than 4% less than it was last week. This drop shows that the cryptocurrency market is still very volatile, which is a defining feature of the market as a whole.

Trading volumes also went down by 47%, with daily activity dropping to about $17.1 billion. This lower volume makes the chances of a short-term correction more likely. When liquidity is low, price swings tend to get bigger, which affects both retail and institutional sentiment at the same time.

Important Support Levels for Ethereum Bulls

Pillows said that if Ethereum can’t get back above $4,500, the next strong support level is between $4,000 and $4,200. These levels will be very important for keeping the overall bullish trend going. If Ethereum can hold these zones, it could be ready to go up again.

The correction could still fit into a healthy bull market structure, even if ETH drops below $4,000. Analysts say to be patient until the market settles down before it breaks out to the upside. Long-term investors stress the importance of having a long-term view, pointing out that historical cycles often reward those who stay the course through ups and downs.

Ethereum’s Roadmap Toward $10,000

Ethereum’s path to $10,000 in the future will depend on both technical and fundamental factors. Strong adoption of DeFi, continued growth of DEXs, and better scaling solutions could speed things up. New institutional adoption could also be a big factor that makes demand go up a lot.

If history repeats itself and more investors want Ethereum, it could really break out and reach the ambitious $10,000 target by 2026. This kind of milestone would show that years of progress in development, community resilience, and Ethereum’s continued relevance in the changing crypto industry have paid off.