Ethereum Leads Market Recovery Amid Turbulence

Ethereum (ETH) stood out this week, attracting $205 million in inflows despite broader crypto outflows. The surge highlights rising investor conviction in Ethereum’s long-term growth potential. Its performance reinforces the network’s dominance as a key player in decentralized finance and blockchain innovation.

Ethereum Defies Broader Market Outflows

While Bitcoin experienced nearly $946 million in withdrawals, Ethereum bucked the trend by attracting fresh institutional capital. The latest CoinShares data shows leveraged ETH ETPs absorbing most of the inflows, indicating renewed confidence among investors positioning for a potential market rebound.

Institutional Demand Strengthens Ethereum’s Position

Trading activity in Ethereum-based ETPs reached $51 billion, nearly double the yearly average. This spike underscores strong participation from institutional players who view Ethereum’s current weakness as an entry opportunity. Many expect further upside once Layer-2 scaling solutions improve transaction efficiency and network throughput.

Recommended Article: Tom Lee’s $281M Ethereum Bet Sparks Speculation on ETH’s Next Move

Altcoins Ride Ethereum’s Positive Wave

Ethereum’s bullish momentum has lifted other altcoins, with Solana, XRP, and Cardano seeing notable inflows. Solana recorded $156 million, XRP gained $73.9 million, while Chainlink and Sui attracted smaller but steady investments. These inflows indicate sustained interest in diversified blockchain assets.

Bitcoin Sees Short-Term Pullback

Bitcoin’s outflows, though significant, appear to be a temporary correction rather than a shift in long-term sentiment. Analysts suggest that retail investors reacted more sharply to recent volatility than institutions, which continued holding positions. The decline may have redirected capital toward high-growth alternatives like Ethereum.

Regional Crypto Flow Trends

Geographically, the U.S. saw $621 million in outflows, while Europe painted a more optimistic picture. Germany and Switzerland attracted $54.2 million and $48 million in inflows, respectively, as investors took advantage of discounted valuations. Canada also contributed $42.4 million, showcasing resilient confidence in the asset class.

Global Economic Factors Shaping Market Sentiment

Tensions between the U.S. and China have introduced volatility into traditional and digital markets. Yet, analysts note that crypto assets remain relatively insulated from trade-related shocks. Ethereum’s appeal as a hedge against global uncertainty continues to strengthen.

Ethereum’s Bullish Outlook for Q4 2025

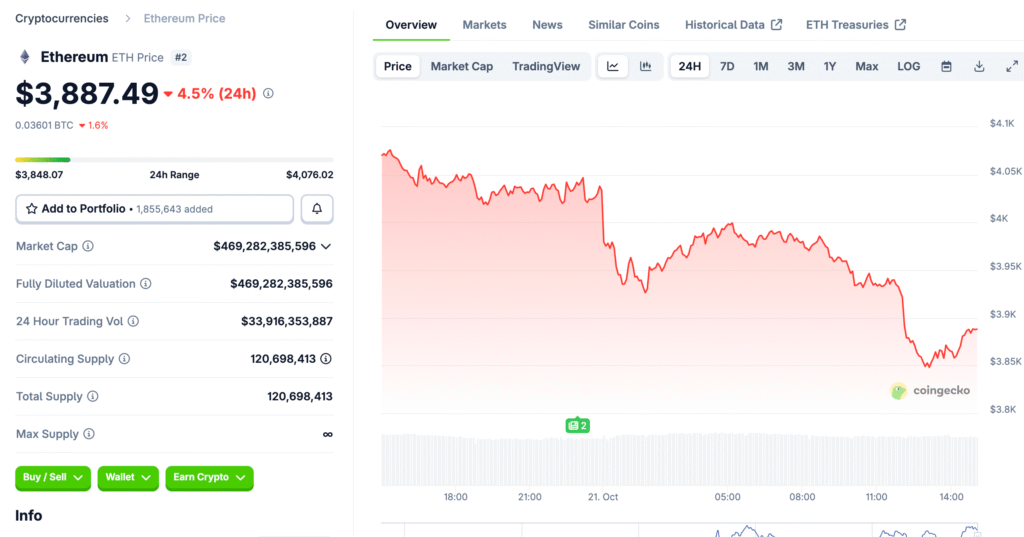

Technical analysis supports a bullish outlook as Ethereum consolidates above critical support levels. The combination of strong inflows, institutional backing, and network expansion paints a positive picture. If momentum continues, Ethereum could lead an altcoin-driven rally heading into Q4 2025 and early 2026.