Ethereum Outpaces Solana in Capital Rotation

Ethereum (ETH) has recently emerged as the primary beneficiary of a significant capital rotation within the altcoin market. According to on-chain analytics firm Glassnode, the SOL/ETH Hot Capital Ratio, a measure of short-term realised capital movement, has dropped to a year-to-date low of 0.045. This represents a substantial 42% decline since April, suggesting that while both ETH and SOL saw inflows in July, the flow of capital is now heavily favouring Ether. The Hot Realised Cap metric, which tracks which asset short-term speculators are favouring, clearly shows this shift. With the ETH/SOL trading pair in a multi-month downtrend, the data signals a “fading but notable ETH-led rotation,” indicating a preference for Ethereum among speculative capital.

Furthermore, another powerful bullish sign for Ether is the ETH/BTC pair, which is also back to multi-month highs, rising above its 200-day exponential moving average for the first time in over two years. This divergence highlights Ethereum’s relative strength, especially as Bitcoin continues to face heavy selling pressure at the $116,000 level and below, a crucial sign that Ethereum’s fundamentals and narrative are gaining strength against its larger peer.

Futures Market Dominance and Healthy Funding Rates

Ethereum’s market dominance is evident in both capital flows and the futures market. Its open interest (OI), a measure of outstanding derivative contracts, reached an all-time high of $58 billion, reflecting increased network participation and money entering the market. Ethereum’s share of total OI across major exchanges has risen to 34.8%, while Bitcoin’s share has declined from 59.3% to 47.1%. This shift in dominance reflects confidence in Ethereum’s ecosystem and its potential for future growth.

Futures funding rates, which are payments between traders holding long and short positions, are a key indicator of market sentiment. Current aggregated funding rates for Ether remain significantly lower than previous attempts to breach $4,000 in March and December 2024. This is a powerful bullish signal, as lower funding rates indicate traders are not overly leveraged on the long side and the current price action is driven more by spot demand rather than excessive speculative positioning.

Institutional Demand and a New Investment Paradigm

The low funding rates and high open interest directly point to a new and powerful source of demand: institutional capital. This capital is flowing into Ethereum through two primary channels that are creating a new investment paradigm. As NovaDius president Nate Geraci highlighted, “Eth treasury companies & spot eth ETFs have each bought approx 1.6% of current total eth supply since the beginning of June.” This is a massive point to consider, as it shows two distinct, yet equally powerful, streams of institutional capital flowing into the Ethereum ecosystem.

- Ethereum Treasury Companies: These are publicly traded firms that hold Ethereum as their primary reserve asset. Unlike passive investments, these companies can generate yields through staking and deploying funds across Decentralised Finance (DeFi) protocols, offering investors a more comprehensive and lucrative way to gain exposure to ETH. The rise of firms like BitMine Immersion and SharpLink Gaming exemplifies this trend.

- Spot ETH ETFs: The increasing traction of applications from financial giants like BlackRock, Fidelity, and Franklin Templeton signals that a new wave of capital from traditional investors is on the horizon. These ETFs offer a familiar, regulated vehicle for investors to gain exposure to ETH price movements without the complexities of direct crypto ownership.

The combined buying power from these two sources provides a robust and consistent source of demand for Ether, making the current rally far more sustainable than previous cycles that were driven primarily by speculative retail trading.

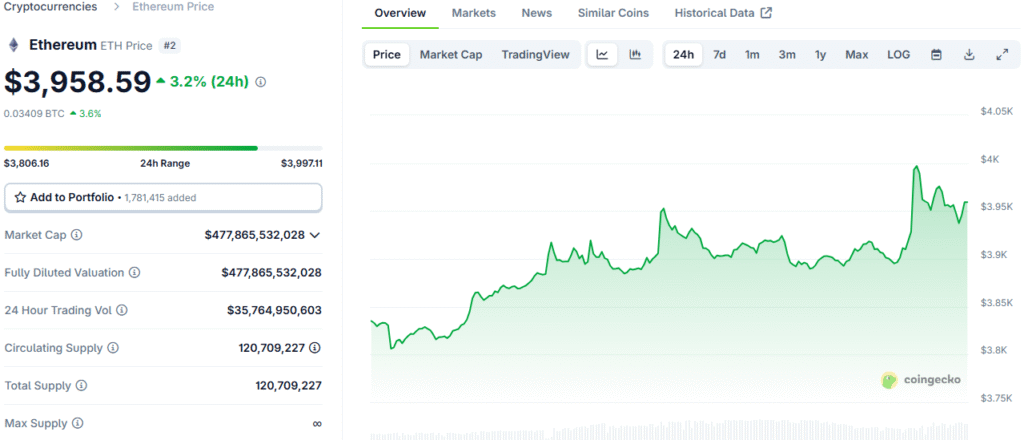

The $4,000 Showdown The Path to Price Discovery

Ethereum is preparing for a significant showdown at the $4,000 resistance level, following a 9.72% correction over the past seven days. The price has recovered 9%, retesting the $3,800 level. Crypto analyst Jelle believes that the $4,000 psychological level has been a long-standing resistance since forever, and a decisive breach could propel Ethereum into a new price range where its true value is determined without historical reference points.

This move would likely be fueled by spot demand from institutional players and mark a new, more mature phase for Ethereum’s market. The successful retest of $3,800 on Thursday indicates that bullish momentum is building, with all eyes now on the final push towards the $4,000 mark.

Broader Implications for the Altcoin Market

Ethereum’s strong performance and its outperformance of other major cryptocurrencies have significant implications for the broader altcoin market. The “Hot Capital Ratio” from Glassnode shows that capital is actively rotating into ETH, which could be a precursor to a wider altcoin rally. When ETH shows strength, it often pulls other altcoins up with it, but the current data suggests that ETH is a primary focus for smart capital.

This indicates that investors are moving into a more mature, infrastructure-focused asset rather than chasing purely speculative returns. This shift in sentiment, combined with Ethereum’s record-high daily transaction count, suggests a healthier ecosystem where fundamental network health is a key driver of value. The outcome of the $4,000 showdown will not only determine Ethereum’s price trajectory but also set the tone for the rest of the altcoin market, making it a pivotal moment for the entire crypto ecosystem.

Ethereum Poised for Explosive Gains

Ethereum is now at a critical juncture, with multiple bullish signals pointing towards a significant breakout. Its outperformance of Solana and Bitcoin in capital inflows and futures dominance, coupled with a sustainable demand from institutional players, positions it for a potential surge. The low funding rates and high open interest suggest that this rally is being driven by fundamental spot demand, making it a much healthier and more sustainable move than previous cycles.

All eyes are now on the $4,000 resistance level, a psychological and technical barrier that, if broken, could lead to a new phase of “price discovery.” For investors, Ethereum presents a compelling opportunity, with a blend of institutional backing, strong technicals, and a growing ecosystem. The next few weeks will be crucial, as Ethereum attempts to overcome this final hurdle and solidify its position as a dominant force in the digital economy.

Read More: Ethereum Price Outlook: Testing $3,500 Support for a Potential Rally to $4,800