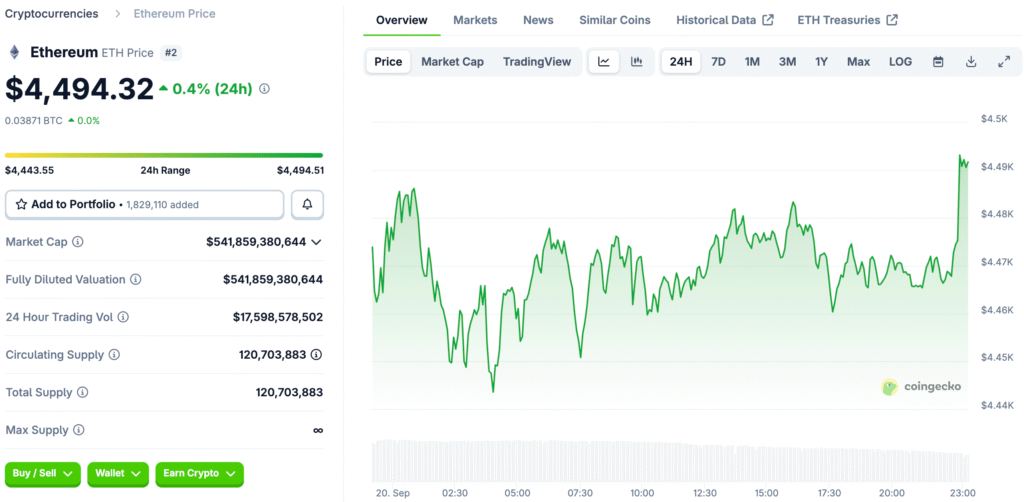

Ethereum Consolidates Near Critical Levels

Ethereum has been trading sideways for more than a month, having trouble breaking through the important $5,000 resistance level. After a strong rally that started in April, this consolidation happened. The asset regained several important resistance zones and formed a steady upward trend.

Analysts say that if the momentum isn’t kept up, the price could drop to $4,000. But if Ethereum can get above $4,800 in the next few weeks, analysts think that momentum could take the token to new highs.

Daily Chart Reveals Strong Ascending Channel

Ethereum’s daily chart shows that it is steadily moving up within a large ascending channel that formed during its rally earlier this year. Price changes have brought back the 100-day and 200-day moving averages, which are now strong support levels at around $3,700 and $2,900, respectively.

ETH is currently trading in the middle of a smaller, rising channel within the larger formation. If the price breaks down, it could go back to the $4,000 support area. If it bounces back and breaks above $4,800, it could start a rally toward $5,000 and beyond.

Four-Hour Chart Suggests Tight Range-Bound Trading

In the four-hour time frame, Ethereum’s consolidation seems to be limited to the $4,300 demand zone and the $4,800 supply zone. This range-bound structure shows that the market is unsure, with buyers and sellers pushing the limits as momentum builds in the current trading range.

The tightening formation suggests that things will soon get unstable. If the price falls below demand levels, it could drop to $3,850. If it breaks above $4,800, it could rise to its long-awaited $5,000 target level within the larger bullish framework.

Recommended Article: Ethereum Targets 75% Surge vs. Bitcoin By Year End

Ethereum Eyes $5K if Bulls Hold Rising Channel Amid Volatility

Traders know how important the trendline convergence is that is coming up within Ethereum’s rising channels. Market conditions suggest that consolidation can’t last forever, and the upcoming volatility will likely determine Ethereum’s medium-term direction across the cryptocurrency landscape.

Ethereum could reach new highs above $5,000 if bullish momentum continues. On the other hand, bearish breakdowns could bring back volatility and undo recent gains, testing the lower limits of the larger ascending channel before stabilizing again.

Funding Rates Indicate Balanced Market Behavior

The seven-day moving average of Ethereum’s funding rates has always shown positive values in futures markets. This shows that buyers are being aggressive, but not as much as they were at the peaks in early and late 2024.

Balanced levels of funding suggest that the market can still grow without getting too hot. But there are always risks of liquidation with positive funding, so traders should be careful even though futures activity is showing signs of being bullish.

Market Still Shows Room for Further Growth

An analysis of funding rates suggests that Ethereum’s rise could go on for a while longer before it runs out of steam. Futures aren’t too hot right now, so there’s still room for prices to go up, especially if demand in the spot market matches the excitement in the derivatives market across all types of investors.

Be careful, though, because sudden changes in price could lead to liquidation cascades. Still, healthy on-chain indicators and supportive technical structures suggest that Ethereum is still in a position to continue going up rather than down sharply.

Ethereum Bulls Eye Historic Rally if $4,800 Resistance Is Broken

Ethereum’s future depends on whether it breaks through $4,800 or falls back to $4,000. People in the market think the decision point will come soon, based on both technical patterns and how derivatives traders feel.

Analysts think that if Ethereum breaks higher, it could lead to a historic rally toward $5,000 and maybe even more. On the other hand, not being able to hold important support levels could slow down bullish momentum and keep the market in a range until the next big leg in Ethereum’s market cycle.