Wilcke’s ETH Transfer Stirs Market Curiosity

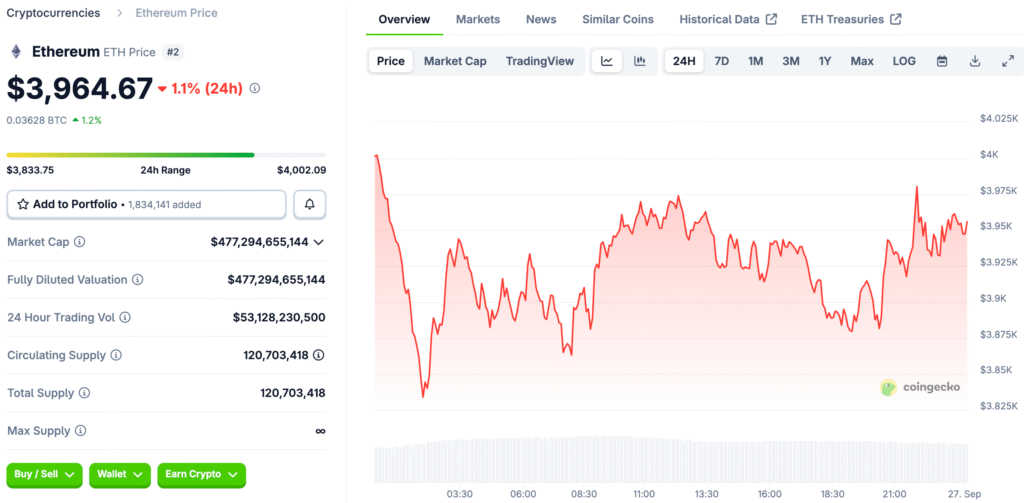

Jeffrey Wilcke, one of the founders of Ethereum, sent about 1,500 ETH, worth $6 million, to Kraken exchange accounts. The move happened at the same time that Ethereum’s price dropped from $4,000 to $3,900, which made people even more curious about what would happen next. This led to a lot of discussion among investors who were keeping an eye on the founders’ activities.

Wilcke has made similar big transfers in the past without causing huge sales. A large deposit of $9.2 million last August shows that he has a history of making sudden liquidity moves. People in the market are still split on whether his plans show caution or a bigger approach to managing his portfolio.

Market Reactions Split Between Skepticism and Optimism

Critics see Wilcke’s transfer as a sign that people are losing faith in Ethereum’s short-term growth path. Others say that the transaction is in line with normal liquidity management and that the person making it doesn’t want to sell all of their holdings. These different interpretations make the market even more uncertain.

Wilcke’s unclear comments, on the other hand, fueled rumors about possible sales without giving investors any clear information. This uncertainty comes at the same time as Ethereum’s prices are going up and down, which makes traders even more worried. These kinds of actions show how much power co-founders have over how people think about the market.

Whales Accumulate Amid Ethereum Declines

Even though Wilcke moved, big whales bought more than 406,000 ETH during recent dips. These purchases, which were worth about $1.6 billion, happened in just two days. This accumulation shows that institutions are very sure about Ethereum’s long-term value proposition.

Wilcke’s liquidity moves are the exact opposite of whale confidence. Their large-scale purchases show that people are optimistic about Ethereum’s decentralized finance and non-fungible token ecosystems. This difference makes us wonder how different people see the market and its potential for growth.

Recommended Article: BitMine Buys $1.1B Ethereum as Stock Falls After Sale

Ethereum Price Trends and General Mood

The fact that Ethereum’s price dropped by 13% in a week has made support zones and resistance targets more important. Whale accumulation suggests that prices may stabilize before they start to rise again. Even though there is some uncertainty in the short term, institutional inflows are still very important for supporting long-term bullish momentum.

Investors keep an eye on the economy and changes in regulations to see how Ethereum is doing. Improvements to blockchain infrastructure might help retail and institutional investors feel more confident again. The mood of the market seems cautiously hopeful, but it is affected by what the founders do and outside forces.

Divergent Strategies Shape Market Perception

Wilcke’s strategy of focusing on liquidity is very different from the way institutional whales think about accumulating wealth. Analysts see these different approaches as a sign of different levels of risk tolerance and investment strategies. This split makes Ethereum’s changing market story more complicated.

For some, Wilcke’s caution means that things may get harder in the future. For some, it shows how to take advantage of uncertain times to build up wealth. This dynamic shows how important it is to find a balance between individual influence and the beliefs of the whole institution.

Regulatory and Structural Factors at Play

For Ethereum to be widely used in the long term, there need to be clear rules, and it needs to be able to work with fiat currencies. Regulatory progress could boost market confidence, which would allow decentralized finance ecosystems to come up with new ideas. On the other hand, uncertainty may make it harder for more people to use the technology.

Institutional engagement shows that more and more people are seeing Ethereum as an important piece of infrastructure. Ethereum’s ability to grow on a global scale will depend on how regulation and institutional demand interact. These structural forces are more important than Wilcke’s actions, even though they had an effect.

Ethereum Whale Accumulation Offsets Concerns From Wilcke’s Transfers

Traders were worried about Wilcke’s ETH transfers, but whale accumulation makes Ethereum’s ecosystem stronger. Market trends suggest that institutional investors still have a lot of faith in Ethereum’s future, even though its founder is unclear. This hope gives rise to hopes of a full recovery.

Investors should think about what the founders do in light of how many people are using the product and how interested institutions are in it. Ethereum is still a key part of decentralized finance and innovation, and it is likely to grow even when the market is unstable. Even though there is a lot of speculation going on, Ethereum’s outlook is still based on resilience.