Dogecoin Price Drop Raises Concerns About Crypto Payroll Viability

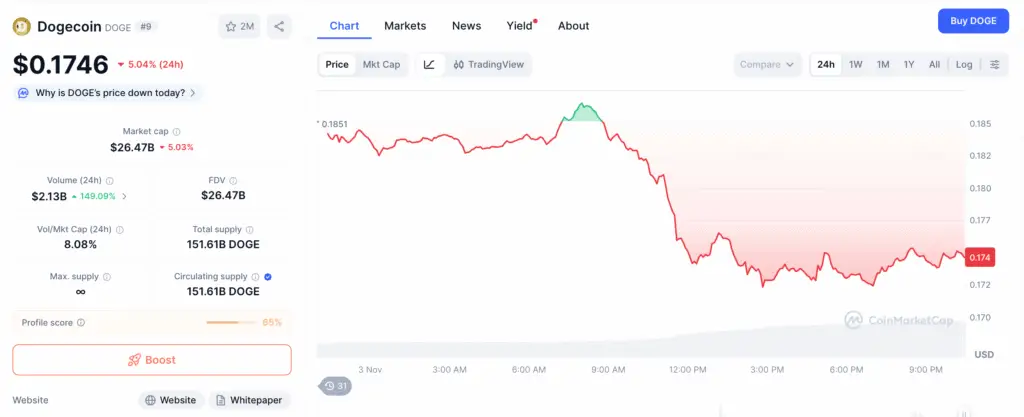

Dogecoin’s recent price slide has reignited discussions about the risks and opportunities of crypto payroll integration, a growing trend among fintech startups. The meme coin’s decline below critical support levels has once again underscored the volatility challenge that comes with paying salaries in digital assets.

Dogecoin’s value has fallen sharply over the past week, forming a technical death cross — a bearish signal that often precedes extended downtrends. For startups and tech firms exploring crypto payroll systems, the event has become a case study in balancing innovation with stability.

Market Volatility Challenges Employee Compensation Models

As companies explore alternative payment systems, Dogecoin’s fluctuation highlights a critical issue: salary consistency. Employees receiving wages in volatile assets may see the value of their earnings fluctuate dramatically in a single pay cycle.

“Volatility directly impacts payroll predictability,” said fintech strategist Laura Mendez. “When Dogecoin drops 10% in a day, that’s the equivalent of a pay cut employees didn’t agree to.” This instability can lead to dissatisfaction and retention issues, especially in the tech industry, where demand for blockchain-savvy professionals remains high.

Crypto Payroll Adoption Offers Speed and Transparency Benefits

Despite its risks, crypto payroll adoption continues to rise globally. Companies are drawn to faster settlements, reduced transaction fees, and enhanced transparency enabled by blockchain technology. Payroll transactions in cryptocurrencies can bypass traditional intermediaries, allowing instant international transfers and eliminating conversion delays.

However, as Dogecoin’s performance shows, price volatility can offset those operational benefits. To address this, many businesses are experimenting with stablecoins such as USDC or USDT, which maintain value parity with the U.S. dollar. These digital currencies offer the same blockchain efficiencies without exposing employees to severe price swings.

Recommended Article: Dogecoin Slips to $0.18 as Long-Term Holders Exit

Startups Turn to Hedging and Hybrid Compensation Strategies

To mitigate risks, forward-looking fintech firms are introducing hedging mechanisms within their crypto payroll systems. By locking in exchange rates or using derivatives, they aim to protect employees from value losses caused by market downturns.

Others adopt hybrid payroll models, where a percentage of earnings is paid in stablecoins or fiat currency, while the remainder is distributed in cryptocurrencies like Bitcoin or Dogecoin. This approach balances innovation with financial security, allowing staff to participate in the crypto economy without undue exposure.

Education and Transparency Become Key HR Priorities

As more firms explore crypto-based compensation, employee education has emerged as a crucial factor. Clear communication about crypto’s risks and potential rewards can help foster trust and informed participation.

“Transparency is essential,” said HR consultant David Lin. “Employees should understand both the upside and downside of being paid in digital assets. Companies that prioritize financial literacy will have a competitive advantage as crypto payroll adoption expands.”

Regulatory Compliance Defines the Future of Crypto Payroll

Beyond market volatility, compliance remains a major concern for fintech companies. As governments worldwide refine their crypto regulations, businesses integrating blockchain-based payment systems must adhere to evolving anti-money laundering (AML) and know-your-customer (KYC) standards.

Legal experts emphasize the need for proactive compliance strategies. Investing in proper documentation, tax reporting systems, and transparent transaction trails ensures that startups stay ahead of scrutiny while maintaining credibility with regulators and investors alike.

Outlook: Stability and Adaptation Key to Crypto Payroll Success

Dogecoin’s recent price drop serves as a reminder that the path toward mainstream crypto payroll adoption requires robust risk management and strategic flexibility. Industry observers believe that stablecoin integration, comprehensive compliance frameworks, and employee education will shape the future of crypto-based compensation systems.

“Volatility doesn’t disqualify crypto payroll—it just demands smarter execution,” said Mendez. “With the right safeguards, blockchain-based salaries can redefine how global workforces are paid.”