Crypto Market Suffers Heavy Liquidations

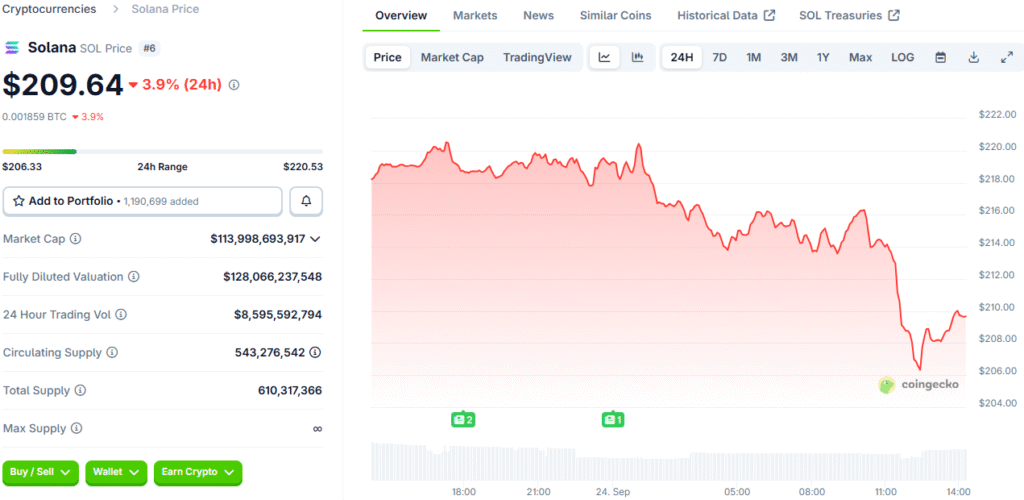

There was a lot of trouble in the cryptocurrency market, with almost $1.7 billion in leveraged positions being sold on several exchanges. Among the major altcoins, Dogecoin, Solana, and Ethereum lost the most value, between 6% and 10%. Bitcoin also dropped 2.3%, but its drop wasn’t as big as those of riskier tokens.

CoinGecko reported that the total market cap for cryptocurrencies fell to $3.98 trillion, a 3.7% drop in one day. More than 390,000 traders lost their money, showing how far-reaching the effects of this event were. Analysts say that the sudden flush shows weaknesses that come from using too much leverage in unstable digital asset markets.

Dogecoin Hit Hardest in Daily Declines

Dogecoin had the biggest drop, losing almost 10% in just 24 hours and losing $61 million in liquidations. Ethereum came next with $501 million in liquidations, showing that long positions were heavily exposed to speculation during its recent market retreat. Solana also had a lot of pressure and lost 6.9% of its value as positions closed one after the other.

Experts say that the size of Dogecoin’s drop shows that it is more likely to be affected by sell-offs that are driven by leverage. When speculative traders go too far, these tokens fall more quickly than their larger-cap counterparts. This event makes people even more worried about how long retail-driven rallies can last without enough institutional depth.

Long Positions Dominate Liquidations

Data from Coinglass showed that more than $1.6 billion of liquidated positions were from longs, not shorts. Analysts said that this was not a short squeeze but rather bulls who were too exposed and had to get out of their positions quickly. At the peak, more than $1 billion was sold in just one hour.

Dan Dadybayo from Unstoppable Wallet said that once Ethereum and Dogecoin rolled over, cascading margin calls sped up the liquidation process. This chain reaction made liquidity even lower on exchanges, forcing traders to scramble to cover collateral. The wipeout shows how dangerous it is to use too much leverage in crypto markets.

Recommended Article: Solana Treasury Launch in South Korea Fuels $300 Outlook

Classic Liquidity Spiral Unfolds

Vincent Liu of Kronos Research called the chaos a “classic liquidity spiral” caused by leveraged futures positions. He said that leveraged longs were the first to be squeezed, which made the market less deep and spreads wider across exchanges. This made declines happen faster and made volatility worse in many types of assets.

Liu said that even though the short-term pain was bad, these liquidations reset stretched positions and made it possible for gradual accumulation. When too much leverage is cleared, it often gives stronger hands a chance to build up market depth over time. Still, traders are being careful because the macroeconomic signals ahead are not clear.

Macroeconomic Backdrop Adds Pressure

The selloff happened at the same time as a volatile macro environment after the U.S. Federal Reserve cut interest rates. Even though people thought the cut would help, it didn’t keep the market from going back up and caused more uncertainty. Since then, Bitcoin and altcoins have had a hard time finding strong support levels because interest rates keep changing.

The next U.S. jobless claims and August PCE inflation data could have an effect on how the market feels. Analysts think that dovish readings could help the market recover, while hawkish surprises could make crypto’s problems worse. Economic indicators are still the most important things to look at when figuring out short-term risks in digital asset markets.

Solana Leads Liquidation Wave as Altcoins Struggle With Instability

In the current downturn, which is driven by liquidations, large-cap altcoins and leveraged DeFi tokens seem to be the most at risk. Liu said that tokens with less liquidity were hit first, which showed that there are problems with the way speculative parts of crypto work. This market shows a general “risk-off” attitude that makes traders close out their positions without thinking.

The large number of liquidations on Ethereum, Solana, and Dogecoin shows how risky concentrated leverage can be. Analysts say that a strong recovery needs better liquidity and investors who are disciplined. For now, the market is still focused on finding stability in the face of unstable macroeconomic conditions and constant volatility.

Wider Effects on the Crypto Markets

The $1.7 billion wave of liquidations shows that systemic leverage is still a big problem in digital asset markets. Bitcoin handled losses better than most other cryptocurrencies, but altcoins took the brunt of the cascading margin calls. This shows how important it is for both retail and institutional investors to manage their risks.

Analysts say that these kinds of liquidations often lead to healthier long-term foundations, even though they hurt in the short term. By getting rid of too much leverage, the market makes room for new, long-lasting growth. Still, the risks are high, and crypto investors need to be careful because the economy and government rules are still unclear.