Dogecoin Declines After Weekend Pullback

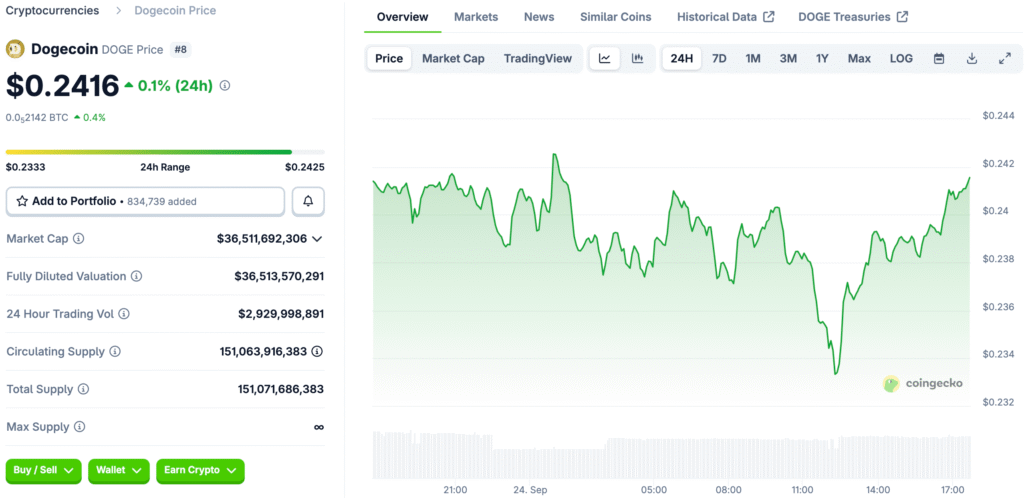

This week, Dogecoin fell more than 11%, going below $0.24 as the rest of the crypto market fell. This drop came after an earlier rise toward $0.30 that didn’t last. Traders are still being careful because they are weighing resistance levels and short-term risks.

But the way smart money is acting shows that people are becoming more sure of Dogecoin’s long-term future. If accumulation keeps going during weak times, it could strengthen the bullish base for DOGE’s next big chance to break out upward.

Retail Participation Remains Muted

CryptoQuant data shows that retail interest in DOGE is still neutral, unlike previous times when it was very high. In the past, big spikes in retail activity came before major tops, like DOGE’s high of $0.69 in 2021. Without too much guesswork, the current state of the market suggests that there is room for more organic growth.

This lack of retail craziness could give Dogecoin the space it needs to go up even more. The late entry of retail investors often lengthens accumulation periods, which makes it easier for long-term rallies to last.

Smart Money Accumulation Signals Confidence

Analysts say that institutional and larger holders are quietly buying DOGE even when the price goes down. This phase of accumulation shows a strategic approach, since they expect retail to come back in later in the cycle. In the past, smart money positioning ahead of mainstream hype has led to huge gains.

The trend shows that more and more people believe that Dogecoin can break out of its previous patterns. Consistent buying pressure from bigger players strengthens support zones, making them more resistant to sudden changes in price and opportunistic sell-offs.

Recommended Article: Dogecoin ETF Filing Sparks Debate Over Institutional Future

Dogecoin’s Price Cycles Show Accumulation Followed by Retail Frenzies

The price of DOGE has often gone through a cycle of quiet accumulation, a retail frenzy, and huge rallies. When retail traders figured out what was going on, breakouts from descending trendlines in 2022 and 2024 caused quick price jumps. Analysts now see a similar setup forming, which could mean that history will repeat itself.

If retail gets in after the consolidation, DOGE could start another strong upward leg. These patterns that happen over and over again show that Dogecoin’s market behavior is cyclical and that it often goes up in big, unpredictable ways.

Analysts Watch for Key Resistance Breakout

Trader Tardigrade says that the $0.28–$0.32 range is the most important resistance area to watch. A strong breakout above this range could mean that the market is going up. DOGE’s rise to all-time highs in 2021 was fueled by similar technical confirmations.

Some experts say that breaking through resistance levels now would start a new upward trend. If the market stays strong above resistance levels, it may also get more traders who are on the sidelines to join in and look for confirmation of the trend continuing.

Consolidation Phase May Precede Next Bull Run

DOGE’s current position suggests that a consolidation zone is forming at levels higher than in previous cycles. This base-building usually means strength, which can lead to long-term upward moves. People who watch the market say this pattern is similar to what happened in 2021, when long periods of consolidation came before huge gains.

The similarities make it seem like DOGE is getting ready for its next big bull cycle. Long-term holders who are patient during consolidation often get rewards as breakout momentum builds on established support levels.

Lack of Retail Mania Suggests Dogecoin Still Has Significant Growth Room

The fact that there isn’t any retail-driven mania means that DOGE still has room to grow. Smart money positioning, past patterns, and technical resistance tests all point to a bullish outlook. If retail interest comes back later, it could give the last push to the momentum.

Analysts say not to ignore Dogecoin because its cyclical nature often catches skeptics off guard with big, quick rallies. If retail demand and institutional support rise at the same time, DOGE could reach new price highs that are even higher than before.