ETF Filings Mark a Turning Point for Dogecoin

Recent ETF filings, like Grayscale’s GDOG, are a big step toward getting Dogecoin into the mainstream financial system. These filings create legal ways to get exposure without having to trade cryptocurrencies directly. Experts say they could make things more legitimate, like Bitcoin and Ethereum ETFs.

Approval would make it easier for both retail and institutional investors to get in, which would increase visibility and demand. But for Dogecoin to be sustainable, it needs to grow beyond its meme reputation. To get long-term interest from institutions, it will be important to show how the technology can be used in real life.

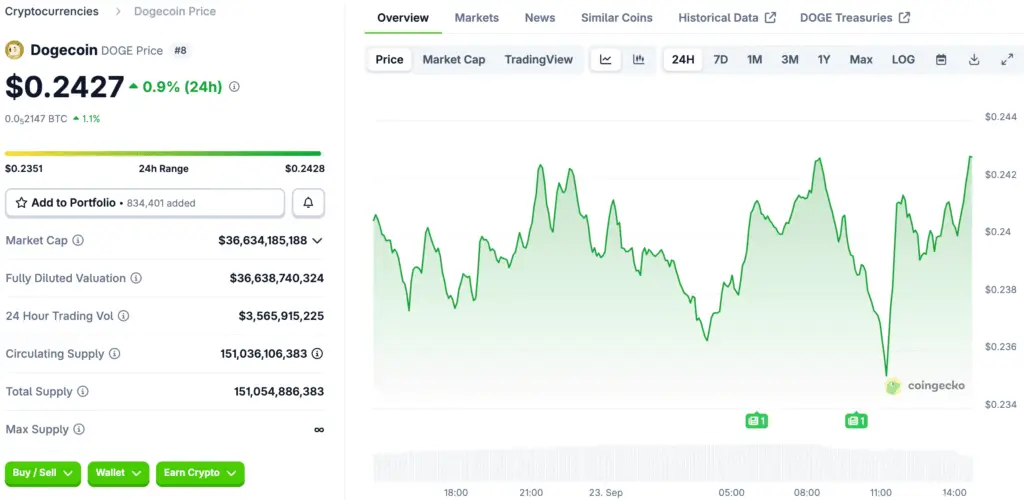

Volatility Remains a Barrier for Payroll Solutions

The price of Dogecoin changes too much for it to be used as a payroll medium. Rapid rises and falls make it hard to keep salaries steady. Businesses can’t plan their budgets, and employees can’t buy things when prices change so much.

Also, Dogecoin’s inflationary model makes billions of new tokens every year. This dynamic could cause salaries to lose value over time. Unclear rules and inefficient networks make it even less useful for payroll systems.

Using Dogecoin Poses Unique Risks for SMEs

When small and medium-sized businesses use Dogecoin to pay their employees, they are at greater risk. Salary instability caused by volatility makes it hard to plan your finances. It is also harder to convert to fiat currencies for operational costs because of liquidity issues.

The challenge is made worse by the many rules and regulations. SMEs have to deal with changing tax laws and compliance standards, which can be very expensive. Having a lot of people own Dogecoin makes it even more likely to be hit by sudden price changes.

Recommended Article: Dogecoin Price Faces Key Test After 25% Rally

Market Changes Affect Crypto Payroll Trends

The value of Dogecoin changes all the time, which has a direct impact on the growth of crypto payroll systems. Interest in crypto-based payments is growing, but the fact that they are so volatile makes people less likely to use them. By 2025, 25% of businesses may use crypto for payroll, according to projections.

Stablecoins are the most popular type of cryptocurrency for payroll right now because their prices don’t change. Some new businesses, on the other hand, are trying out hybrid models that use Dogecoin. These businesses say they have lower fees and faster transactions, but they need to be careful about managing the risks of volatility.

Popular Culture Fuels Payroll Adoption Momentum

Cultural endorsements make crypto payroll adoption more visible. Athletes, influencers, and tech leaders all want to get paid in digital assets. This kind of adoption gives even unstable assets like Dogecoin a boost.

Both new businesses and established ones are interested in this cultural trend. Employers are looking for new ways to get younger, crypto-native workers to work for them. Still, the long-term viability of payroll depends on price stability and compliance measures.

Strategies to Lower the Risk of Payroll

Pairing Dogecoin payments with stablecoins can help businesses lower their exposure to volatility. This mixed approach protects workers from big changes in prices. Companies can also lower their legal risks by using compliance frameworks for AML and KYC.

Another option is payroll platforms that automatically convert to stablecoins. Employees keep their purchasing power by locking in values at the time of payment. Employers still benefit from the flexibility and engagement that crypto offers.

Dogecoin’s Institutional Outlook Remains Uncertain

Getting ETFs approved could make Dogecoin seem more real and draw more attention from institutions. But for interest to last, there needs to be more than just speculation. Payroll is still one test case that shows risks and limits.

To deal with volatility, Dogecoin’s evolution will depend on new ideas and good governance. Without these changes, it may be hard for institutions to adopt the technology. In the next few months, we’ll see if ETFs lead to long-term integration or just short-term excitement.