The Final Act in the Ripple-SEC Legal Drama

The long-running legal confrontation between Ripple Labs Inc. and the U.S. Securities and Exchange Commission, or SEC, has officially come to a close. On August 22, 2025, the U.S. Court of Appeals for the Second Circuit formally acknowledged that both parties had dismissed their respective appeals. This concise procedural ruling, which accepted the joint stipulation under Federal Rule of Appellate Procedure 42, brings an end to the appellate chapter of the multi-year legal saga.

The final disposition of the case also included Ripple executives Brad Garlinghouse and Chris Larsen, who were listed as appellees. The court’s endorsement of the dismissal came with minimal commentary, concluding the order with the simple but powerful statement: “The stipulation is hereby ‘So Ordered.’”

How XRP Challenged the SEC’s Framework

The legal battle began in December 2020, when the SEC filed a complaint alleging that Ripple had conducted an unregistered securities offering through its XRP token sales. The SEC contended that XRP met the statutory definition of a security and was therefore subject to regulatory requirements under U.S. securities law. The core of the SEC’s argument was based on the Howey Test, a legal standard used to determine whether a transaction qualifies as an investment contract.

The SEC claimed that Ripple’s sales of XRP represented a clear investment contract, as investors were pooling their money in an expectation of profit from the efforts of a common enterprise, namely Ripple. Ripple, in its defense, disputed this framework, asserting that XRP did not satisfy the criteria of the Howey Test.

The Split Judgment and Its Widespread Impact

The case reached a pivotal moment when District Judge Analisa Torres issued a groundbreaking ruling. She concluded that XRP sales on public exchanges to retail investors did not constitute securities transactions. However, she also ruled that direct sales of XRP to institutional buyers did qualify as securities. This split judgment was a major development in the case, offering no absolute victory to either side but establishing a crucial precedent for the crypto industry.

The decision created a legal distinction between different types of crypto sales, a nuance that had not been addressed in a court of law before. This ruling immediately influenced digital asset regulatory discourse in the United States, as it provided a legal framework for interpreting the classification of digital tokens in future enforcement actions.

The Outcome of the Case and Penalties

Subsequent to the court’s decision, the legal proceedings shifted to the issue of penalties. The court imposed a civil monetary penalty of $125 million on Ripple, a substantial reduction from the $2 billion that the SEC had initially sought. This reduction was a key point of negotiation and a sign of the court’s nuanced approach to the case.

Following the penalty, Ripple and the SEC reached a resolution, but their joint settlement motion was rejected by the court, which maintained the integrity of its original judgment. This refusal meant that the legal findings of Judge Torres’s ruling would stand, regardless of any private agreement between the parties.

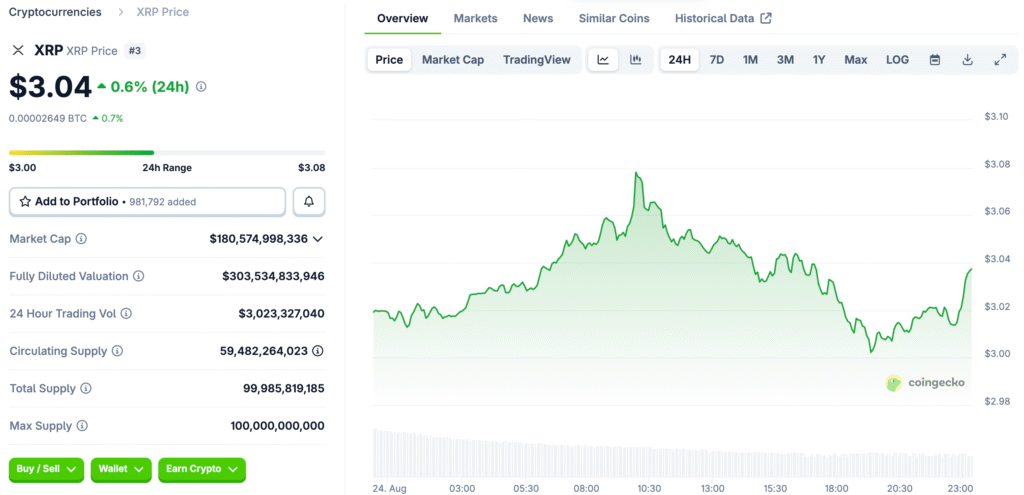

Read More: XRP Price Prediction: SEC ETF Delay Sends XRP Below $3 as Investors Brace for Volatility

Withdrawal of Appeals and Finalization of the Ruling

With no viable path to alter the outcome through continued litigation, both sides elected to withdraw their appeals. This decision was a final acknowledgment that the court’s ruling would stand as the definitive legal precedent. The withdrawal of the appeals finalized the ruling and the associated penalty without any further modification.

The multi-year legal confrontation was finally over, with the lower court’s findings left in place. The dismissal of the appeals formally closed the case, bringing to an end one of the most closely followed legal battles in the history of the cryptocurrency industry.

The Precedent Set for the Crypto Industry

The resolution of the Ripple v. SEC case sets a powerful precedent for the entire crypto industry. The court’s decision has now been cemented, with the appellate chapter officially closed. This means that Judge Torres’s split judgment on the nature of XRP sales is now a key point of reference for future legal cases involving digital assets.

It provides a legal framework for distinguishing between different types of crypto transactions and offers a degree of regulatory clarity that the industry has long sought. This clarity could pave the way for a new wave of institutional investment and innovation in the U.S. crypto market.

Cementing XRP’s Place in the Regulatory Landscape

In conclusion, the court’s formal closure of the Ripple v. SEC case marks a historic moment for the cryptocurrency industry. The dismissal of appeals from both sides has locked in XRP’s legal status, providing a clear regulatory precedent for the future. The split ruling, which differentiates between institutional and retail sales, is a significant development that may shape how courts interpret the classification of digital tokens in future enforcement actions.

With the legal uncertainty now behind it, XRP is poised to play a central role in the evolving landscape of U.S. crypto regulation, with its legal status cemented in a way that few other tokens can claim.