Coinbase Announces Withdrawal From Senate Crypto Structure Legislation

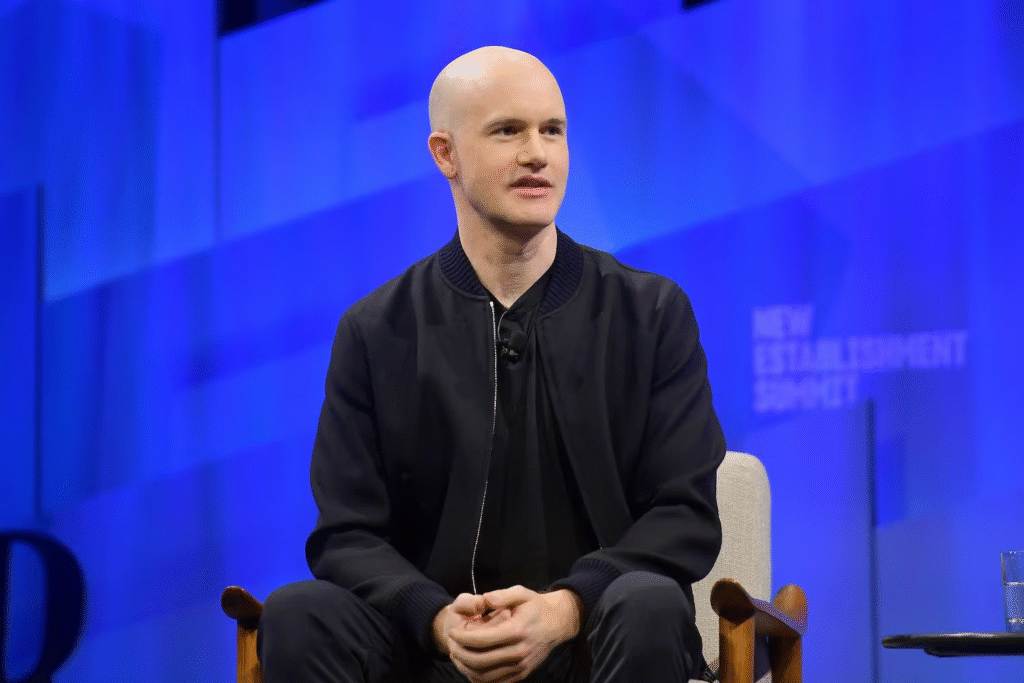

Brian Armstrong, the CEO of Coinbase, said that his company would no longer support the Senate’s crypto structure legislation. During the Washington negotiations, Armstrong pointed out many problems with the draft text and suggested changes. The Senate Banking Committee will hold hearings and vote this week to formally move the bill forward.

Armstrong said on X that the proposal had too many problems for Coinbase to back it. He said that the company would rather not have any laws than have a framework that makes things worse for businesses that are already regulated. Armstrong later said he was still hopeful that ongoing talks could lead to acceptable compromises for everyone in the industry.

Source: CoinDesk

Senate Committee Process Continues Despite Industry Disagreement

More than seventy-five changes were suggested by lawmakers, but many of them are likely to be withdrawn before the final committee markup starts on Thursday. People who are watching say that the final law is still up in the air because negotiations are still going on behind closed committee doors this month. Chairman Tim Scott said that lawmakers are working hard even though there have been strong disagreements and emotional debates lately.

This Thursday morning, the committee will officially talk about the limits of its authority over the regulators in charge of digital asset markets. One of the main questions is how the SEC and CFTC share power over trading platforms and the issuance of tokens. Stablecoin yield provisions are still one of the most hotly debated issues that are dividing support among different industry groups across the country.

Crypto Industry Reactions Reveal Growing Internal Divisions

The Digital Chamber said it still supports the process and is pushing for specific changes through public amendments. Brad Garlinghouse, the CEO of Ripple, said that the bill was a step toward clearer and more effective consumer protections. Different responses show that the crypto industry is becoming more divided over how to reach a compromise on regulations this legislative cycle.

The Blockchain Association said it is looking into Coinbase’s position before making its own public statement. Trade groups stressed that they will stay involved no matter what happens with the committee vote on Thursday in Washington. Coinbase’s exit makes it look like the industry isn’t as united as it could be at a time when lawmakers across the country are making important decisions.

Recommended Article: Former NYC Mayor Eric Adams Accused of Ties to Crypto Scam

Disputed Provisions Include Tokenized Assets and DeFi Regulation

Armstrong said that language that effectively bans tokenized equities is bad for financial innovation and competition in the market. He also didn’t like the idea of applying bank-style compliance standards to decentralized finance platforms that work all over the world. Coinbase asked how the bill changes the Commodity Futures Trading Commission’s (CFTC) new powers over spot markets.

It’s still not clear how crypto companies can register, which could make it more expensive for both startups and exchanges to follow the rules. Industry leaders have warned many times this year that lawmakers’ proposed disclosure rules could be similar to traditional securities rules. Globally, decentralized financial services frameworks still don’t have clear rules for anti-money laundering and knowing your customer.

Banking Industry Intensifies Opposition to Stablecoin Yield Rewards

Thousands of banks across the country signed a petition against stablecoin rewards that the American Bankers Association sent to Congress. Banks say that stablecoins that pay interest could take money out of local lending communities and make it harder to get credit. The petition said that trillions of dollars could leave mortgages, farms, cars, and small businesses across the country every year.

Crypto companies disagree with those claims, saying that rewards encourage competition and give consumers more options in digital payment systems. Coinbase said that protecting yield features was so important that they would be willing to drop the law completely if they had to. Chairman Scott said that new compromise language had been shared recently, but stakeholders and agencies still can’t agree.

Ethics Concerns Complicate Bipartisan Negotiations in Congress

Democratic lawmakers were worried that President Trump’s family was making money off of cryptocurrency businesses while they were trying to make rules better. They say that any final bill must have strict rules about ethics and conflicts of interest for the public officials who are involved. As the election season gets closer and political priorities change across party lines, those arguments could slow down the passage of the bill.

Some lobbyists are worried that Congress’s focus on midterm campaigns will make it less likely that the bill will be passed before the session ends. Without laws, businesses would have to rely on regulatory guidance that could change under new administrations in the future. Leaders in the industry say that long periods of uncertainty make people less likely to invest and come up with new ideas in domestic blockchain markets.

Outlook Remains Uncertain as Negotiations Continue in Washington

Coinbase said it will keep taking part in talks even though it has officially stopped supporting the current draft. Armstrong said he was sure that lawmakers could still come up with a balanced framework that would help innovation, consumers, and the country’s competitiveness. The legislative timeline is still unclear because there are more and more amendments and political pressure is growing in Washington policy circles.

The crypto industry is at a crossroads: it can either accept a compromise or wait years for clear rules. Markets and international partners are keeping a close eye on whether Congress can make rules for digital assets that last soon enough. The result will affect how competitive the US is, how well it protects consumers, and how blockchain finance regulation will look in the future.