Chinese Company Buys a Lot of Bitcoin

Pop Culture Group, which is based in Xiamen, bought $33,000,000 worth of Bitcoin, adding three hundred BTC to its holdings as the price of crypto rose. The company announced the acquisition through a press release, which showed that it wanted to diversify its assets and use Web3 strategies to expand its entertainment-focused business model around the world.

This purchase shows that more and more companies from Asia are interested in doing business in the U.S., even though there are regulatory issues. Analysts say that the involvement of institutions in supporting bullish narratives is important because it makes Bitcoin a more credible reserve asset in a wide range of portfolios as blockchain finance evolves around the world.

Bitcoin Stays Strong Near Important Levels

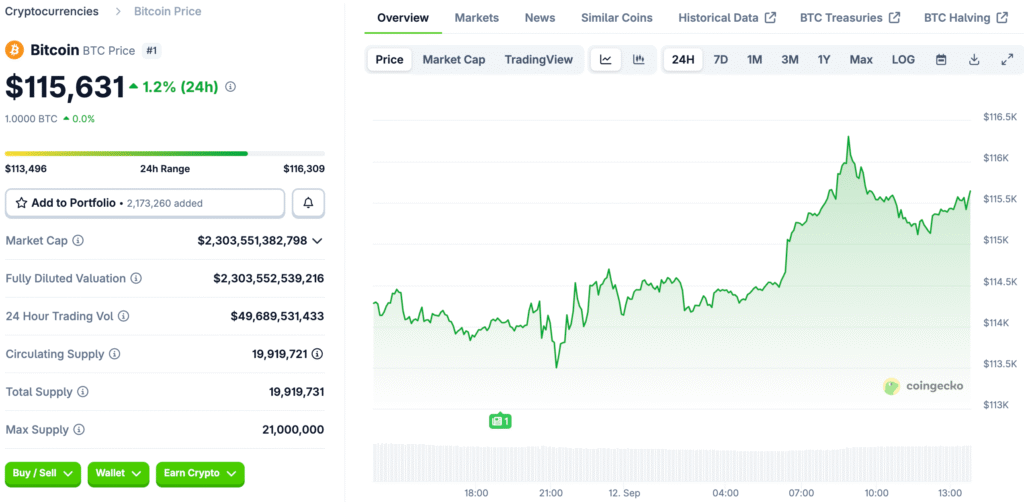

Bitcoin is worth about $114,400, but it can go up or down between $113,000 and $114,700 during the day. Technical analysis shows a bullish consolidation band forming, which has historically come before big upward moves. This is supported by steady ETF inflows that are strengthening momentum.

Analysts stress the need to keep support near $110,000 so that the bullish case stays strong. Failure could make people feel less positive. But steady inflows and institutional participation keep giving Bitcoin strong tailwinds, which boosts confidence that it will keep going up even when the global economy is very unstable.

Golden Cross Sparks Bullish Optimism

Bitcoin formed a golden cross, which is when the fifty-week moving average moves above the two-hundred-week moving average, according to crypto analyst Merlijn. In the past, these kinds of signals came before strong rallies in previous cycles. This shows that there is still bullish potential behind the recent momentum, even though some investors are skeptical.

Golden crosses in the past have caused rallies of hundreds and thousands of percent. Investors are excited because of past events, which makes them think that another growth cycle might start. Analysts point out that there is a strong connection between technical confirmation and corporate adoption trends. These two things are working together to make Bitcoin’s medium-term path more positive.

Recommended Article: Metaplanet Expands Bitcoin Strategy With $1.45B Share Sale

Bitcoin’s Path to $129K Depends on Sustained Global Demand

Titan of Crypto’s long-term target of around $129,000 is supported by an inverse head-and-shoulders breakout on weekly timeframe charts. This projection aligns with investor enthusiasm and technical indicators, leading to potential price movements in the near future.

Analysts believe that if support levels remain stable and inflows continue, prices will continue to rise. Bitcoin’s previous test near $88,000 established reliable support, and analysts predict that the bullish structure will remain if the price stays above $110,000.

Institutional Flows Bring Back Confidence in the Market

SoSoValue data shows that net inflows of $757 million were the highest in two months, showing that institutions are becoming much more confident. Positive ETF inflows cushion pullbacks, boosting optimism and showing that demand is coming back after July and August outflows temporarily hurt investor confidence around the world.

Some analysts say that institutional flows give Bitcoin structural support, which lowers the risk of price swings. Consistent inflows show that institutions are still involved, which supports the bullish trend. Positive green bars showing inflows boost confidence and build the base needed for more breakout toward resistance levels close to $115,000.

Chinese Firms Explore Web3 Opportunities

Even though there are restrictions in mainland China, companies like Pop Culture use listings in other countries to get into the cryptocurrency markets and expand their strategies into Web3. The trend shows that Asian companies are strong and willing to adopt blockchain even though there are problems in their own countries. This shows that companies around the world are trying new things.

These kinds of actions show that entertainment and decentralized technologies are becoming more similar. For example, blockchain adoption makes businesses more powerful. Pop Culture’s move is part of a bigger story about how Asian businesses are using strategic Bitcoin exposure in their future-focused financial planning to get ahead of the competition.

Bitcoin’s Path to New Highs Faces a Test of Resistance

Bitcoin is facing a big problem right now at about $115,000. This is a key level that will decide whether the momentum picks up or the consolidation continues. A breakout could cause momentum traders to jump in aggressively, pushing prices up to new highs. Failure could keep prices stuck between $104,000 and $114,000.

The future depends on whether money keeps coming in and the economy as a whole stays healthy. The Federal Reserve is leaning toward cutting rates in September, and the macroeconomic environment is supportive of institutional flows. Bitcoin’s upward trend looks good, but traders need to keep an eye on resistance zones because the market is very unstable right now.