Decoding Chainlink’s Impact on DeFi

Chainlink’s oracle network solves the trust gap by delivering tamper‑resistant, real‑world data to smart contracts. This data integrity unlocks lending, insurance, and settlement use cases that require dependable price and event feeds. As institutions explore tokenization, Chainlink’s standardized data flows reduce operational friction across chains. The result is a DeFi stack that behaves more like traditional market infrastructure without sacrificing composability.

Institutional Solutions That Boost Market Assurance

Enterprises demand controls, audit trails, and predictability before deploying capital onchain. Chainlink’s proof‑of‑reserve, risk scoring, and automated compliance primitives help map those requirements into smart‑contract logic. Stablecoin and RWA issuers can publish verifiable reserves that counterparties can monitor in near real time. With clearer disclosures and deterministic execution, institutional treasuries gain confidence to scale pilot programs into production.

Partnerships as Chainlink’s Strategic Flywheel

Partnerships with ratings firms, market operators, and payment networks extend Chainlink’s reach where regulated value already flows. Each integration compounds the network effect by standardizing how data and messages move between chains and financial systems. Shared standards reduce bespoke engineering, shortening time‑to‑market for compliant apps. Over time, the oracle layer becomes the neutral bridge that many participants can rely on.

Recommended Article: Chainlink Eyes $14 Support As Head And Shoulders Pattern Breaks

Navigating DeFi’s Rising Compliance and Resilience Bar

DeFi’s next phase requires resilience against market stress, oracle manipulation, and governance capture. Chainlink’s decentralized node operators, multiple data sources, and circuit breakers mitigate single‑point failures. Emerging compliance engines promise jurisdiction‑aware routing and policy enforcement at the messaging layer. These safeguards help protocols remain permissionless while meeting obligations institutions cannot ignore.

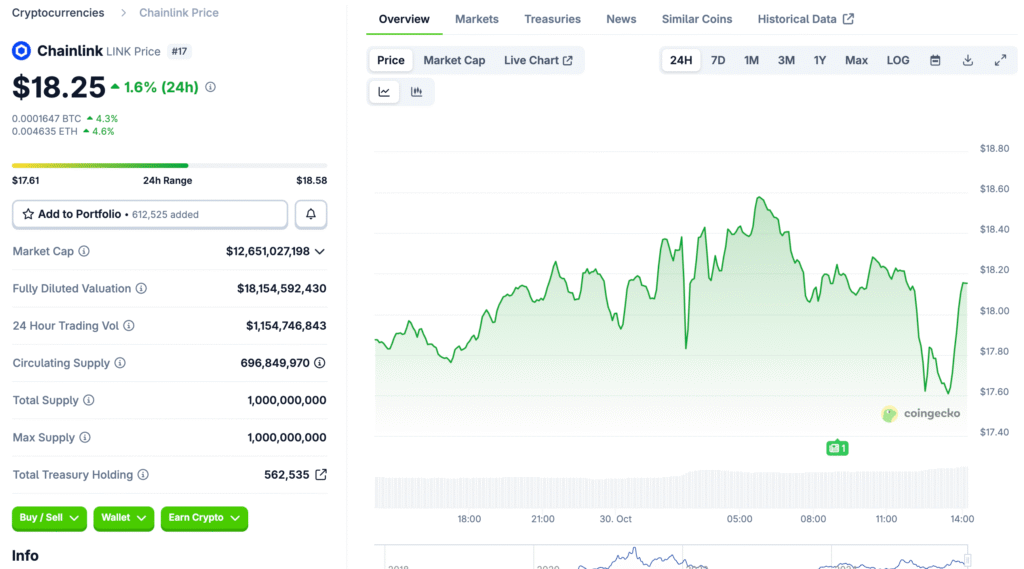

Institutional Investment and LINK’s Long‑Term Thesis

Institutional experiments increasingly revolve around tokenized deposits, RWAs, and cross‑chain settlement. Each use case expands onchain data needs, reinforcing demand for secure oracles and messaging. For LINK, utility accrues as more transactions pay for data, automation, and interoperability services. Volatility will persist, but expanding network usage strengthens the foundation for multi‑cycle value creation.

Competitive Landscape, Risks, and Execution Priorities

Competing oracle and interoperability stacks will push on price, features, and standards. Execution risk centers on delivering throughput, minimizing latency, and hardening compliance tooling without fragmenting UX. Regulatory shifts could reshape disclosure rules for stablecoins and RWAs, altering integration priorities. Robust documentation, audits, and transparent economics will remain essential to preserve trust at scale.

Looking Ahead: From Pilots to Production Liquidity

The near‑term milestone is converting proofs‑of‑concept into production flows with measurable volumes. Expect growth in cross‑chain payments, post‑trade messaging, and automated reconciliations between custodians and venues. As standardized interfaces mature, secondary markets for tokenized assets can deepen liquidity. This progression turns isolated wins into a durable flywheel for institutions and developers alike.