Cardano Builds Strength Below The Key One-Dollar Resistance

Cardano’s price is holding steady just below the important one-dollar level, creating strong support zones while bulls wait for a clear breakout confirmation. This slow buildup is a sign that a bullish push is coming, as it combines technical patterns with increasing confidence from both long-term holders and institutional investors.

Traders are keeping a close eye on the one-dollar psychological resistance level. If prices break through this level, it could start a strong trend that pushes ADA prices much higher. The consolidation makes a strong base that gives bulls faith that ADA can hold up against downward pressure while long-term participants keep buying. These factors all work together to make the market more confident and show that Cardano is ready to grow beyond its current trading limits.

Cup and Handle Pattern Supports Bullish Outlook

Cardano charts show a cup and handle pattern, a bullish continuation pattern that often precedes price breakouts. This suggests that ADA will remain near ninety cents, making it easier to break out technically above one dollar. The neckline resistance is close to ninety-two cents, where ADA’s next bullish move will start.

If successful, it could confirm price targets up to $1.10, completing the cup pattern projection. This setup has led to big rallies in the past, making Cardano’s price action appealing to both short-term traders and long-term investors.

Long-Term Holders Increase Strategic Accumulation

On-chain data shows that Cardano’s biggest wallets are steadily adding to their holdings. This shows confidence during consolidation and helps keep prices stable over the long term. This trend shows how strong accumulation is, which lowers selling pressure and gives ADA a stronger base for bullish continuation.

The top 100 wallets are getting bigger and bigger, which shows that smart money is confident in Cardano’s improving technical and fundamental situation. As weaker hands slowly leave, supply shifts toward stronger holders. This creates conditions that have historically led to big rallies when the market is doing well. This slow but steady buildup makes Cardano’s structure stronger, which makes people think that upward momentum may pick up speed once resistance zones finally break.

Recommended Article: Cardano Price Retest Signals Renewed Bullish Momentum Building

Important Support and Resistance Levels for Cardano

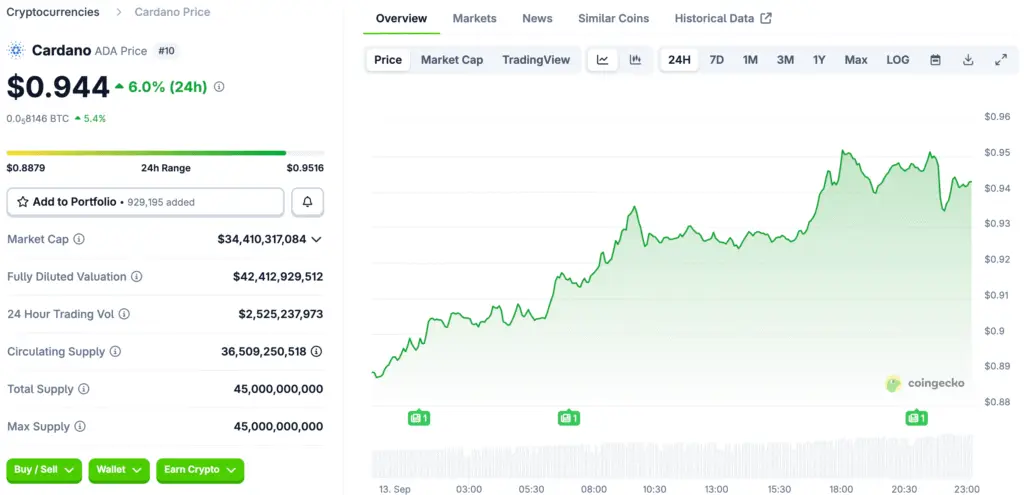

Cardano is currently holding its support at 87 to 88 cents, thanks to moving averages and rising trendlines from early September. This combination of technical factors strengthens the bullish structure and gives traders confidence that ADA has strong foundations even though it has been volatile recently.

Immediate resistance levels are still between 92 and 94 cents, where several failed attempts show how important it is to have a confirmed bullish breakout. If ADA breaks through one dollar clearly, the targets will quickly move toward one dollar ten cents, which is in line with what the cup and handle says. This setup gives bulls clear levels, which reduces uncertainty and gives them structured trade opportunities with clear support and resistance levels.

Long Positions Outperform as Short Sellers Struggle

Recent data on derivatives reveals a significant bullish trend, with long positions making significant profits and short sellers losing significant money. Long positions, worth over four million dollars, have made 15% gains as ADA settles near resistance. Short positions are losing over twenty percent of their value, indicating a market belief in Cardano’s continued rise.

This difference between longs and shorts indicates market strength, while bears remain stuck against Cardano’s increasingly stronger technical structure. This positioning data suggests strong bullish sentiment and shorts could potentially fuel an upside breakout.

Market Sentiment Improves With Technical And On-Chain Strength

Cardano’s stable price, increased long-term holdings, and strong derivatives position in the cryptocurrency community indicate a growing positive mood. This combination of technical strength and fundamental support ensures Cardano’s long-term growth, even when it hits resistance levels.

Retail and institutional investors are optimistic about Cardano’s long-term value rise, as it aligns market structure with fundamentals, making it a good altcoin to invest in. This consistency supports bullish stories and reduces the risk of short-term speculative trading pressure, making it a top altcoin among the best.

Cardano’s Rally Driven by On-Chain and Technical Alignment

The outlook for Cardano is still good because technical and on-chain indicators are in agreement, which suggests that the price will continue to rise above the important one-dollar level. Long-term accumulation makes stability even stronger, putting ADA in a good position to keep going once it breaks through immediate resistance levels.

The cup and handle pattern is almost finished, and ADA bulls are getting ready for possible breakouts that could go as high as $1.10. This bullish setup shows how accumulation, technical structures, and sentiment all work together to create a strong story about Cardano’s potential upside. If ADA breaks through the one-dollar resistance level, momentum could pick up quickly, confirming predictions of a long-term bullish run in the coming months.