Cardano Price Holds Above Crucial Support Levels

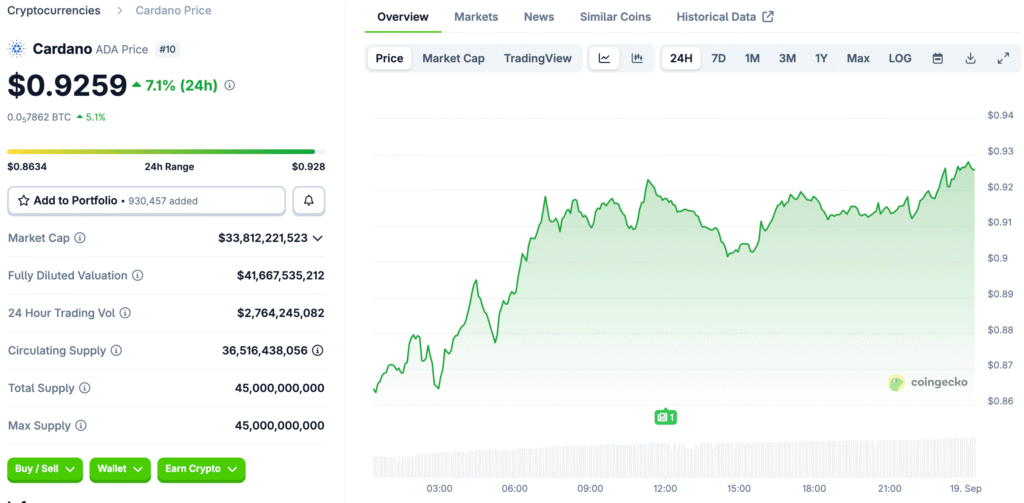

Cardano is trading close to $0.876, and the daily volume is over $1.28 billion, showing that there is still a lot of interest even though it has dropped seven percent in the past week. Critical support between $0.85 and $0.87 has held up several times, keeping higher lows in place even when the market is bearish.

On-chain data shows that investors are taking profits. The network’s realized profit loss metric hit its highest point since July, which made it harder for prices to rise. This shows that things are not all good. Sellers are in charge of short-term sentiment, but supportive technical zones keep the chance of a rebound going.

Technical Patterns Indicate Possible Reversal Scenarios

Cardano is having a hard time below the 50-day EMA at $0.8819. A recent rejection near $0.923 formed a bearish engulfing candle on the daily chart. The relative strength index is close to forty-four, which means that bears are still in charge. This means that there is a chance for more downward pressure in the near term.

If you lose the $0.8528 support, you could go down to $0.8264 and $0.8033. Getting back to $0.8843 shows strength and aims for $0.9018. Analysts say to pay attention to the $0.9234 resistance level. If the break lasts, it could change people’s minds and lead to new bullish continuation phases.

Golden Cross Shows Up on Daily Trading Chart

Cardano recently confirmed a golden cross, which means that the fifty-day moving average crossed above the two-hundred-day average. This means that the trend is shifting to the bullish side. This classic sign has historically come before trend reversals, which makes people more hopeful about possible recovery phases even though prices have recently gone down.

Breakouts above a downward trendline prove that there is hope. After several failed attempts, ADA was able to successfully reclaim, putting it in a better position than it had been in earlier sessions. Analysts point to the $1 target as the next important goal. If momentum stays strong, longer-term goals include the $1.75 retracement level.

Recommended Article: Cardano Battles Resistance as Bulls Eye Recovery Move

Short Squeeze Risks Add Bullish Fuel for ADA

If ADA goes up to the $0.97 resistance level, more than $90 million in short positions could be forced to close, which would greatly increase the potential upside. Short squeezes often speed up momentum, forcing sellers to buy back their positions. This can cause sudden, rapid bullish rallies in markets that are already oversold.

Clustered liquidation levels show opportunities that aren’t equal. Bulls say that the risk-reward ratio favors the upside if ADA stays above $0.85. Traders keep a close eye on things because they expect them to change. Any big breakout could lead to a chain reaction of liquidations, which would make bullish continuation scenarios even stronger.

Fundamental Growth Strengthens Long-Term Prospects

Openbank, which is part of Santander, added Cardano for two million customers. This gave the project institutional validation and a story about long-term adoption. These kinds of partnerships help the ecosystem grow, which supports ADA’s basic case and technical indicators that point to better momentum possibilities.

Integration builds trust in institutions. Developers say that Cardano’s ability to grow and last over time sets it apart from other blockchains that are competing with it. These successes support a positive outlook beyond short-term technical changes, which is good news for both retail and institutional investors around the world.

Market Sentiment Remains Divided Despite Bullish Signals

Chain data shows that $6.7 million has left exchanges, which suggests that investors are still being careful even though technical structures are getting stronger. Mixed feelings show that people are unsure. Just a few traders are still bullish, which some people see as a sign that the market could go up.

Aggressive bears want prices to drop below $0.8528. Conservative bulls are waiting for confirmation above $0.90 before getting back into positions with confidence. This difference shows how divided people’s views are, which shows how risky it is to trade ADA right now on short-term timeframes.

ADA’s Recovery Case Strengthened by Technicals

$0.85–$0.87 is still the most important battleground for Cardano. Holding this support lets the market move up toward the $1 psychological resistance zone. Breakouts above $0.90 make people more hopeful, which supports the idea of a golden cross and higher low formations that can be seen on daily charts.

The risk of failure goes down to $0.82 or $0.78. But patterns of consolidation suggest accumulation, which sets the stage for stronger upward moves. Analysts say that buyers staying above support could confirm bullish continuation scenarios, which would make ADA’s recovery case much stronger.