Cardano Whale Activity and Social Volume Fuel ADA’s Rally

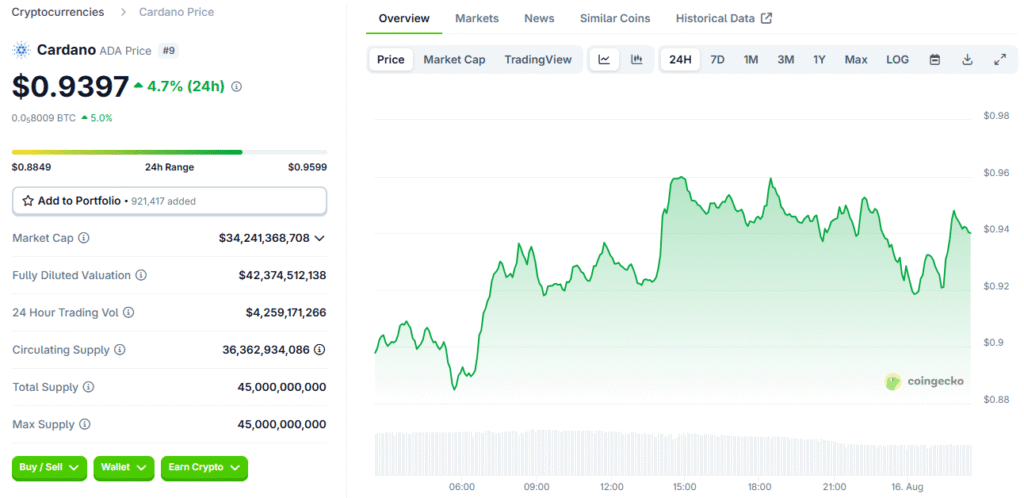

After a five-month period of consolidation, Cardano (ADA) is showing impressive momentum, with its price gaining over 30% in the past week. The cryptocurrency has now broken through the critical $0.90 resistance level, marking a significant turning point in its price behaviour. This breakout was not an isolated event; it coincided with a sharp increase in social volume, which surpassed 20k, signalling renewed interest from the broader community.

The price movement has also been supported by a significant increase in whale activity, with the number of transactions involving more than $100k increasing from 86 to over 1,000 in a single week. These large-scale accumulation patterns are often associated with short-term liquidity squeezes, which can drive rapid price appreciation. The combination of these factors has put ADA on a clear upward trajectory, with all eyes now on the crucial $1 price level.

Greyscale’s ETF Filing: A Catalyst for Institutional Interest

One of the most significant drivers of Cardano’s recent rally is the news of Greyscale’s recent filing for a spot ADA Exchange-Traded Fund (ETF). This move is seen as a major catalyst for ADA’s price, as it indicates a growing recognition of the asset among institutional investors. An ETF would provide a regulated and secure way for traditional investors to gain exposure to ADA, potentially leading to a significant influx of capital into the ecosystem.

The filing itself is a powerful signal of institutional confidence in the asset’s legitimacy and its long-term potential. This new institutional interest is a key factor that differentiates the current rally from previous ones, suggesting that the momentum is not just driven by retail speculation but also by a more fundamental shift in institutional sentiment.

The Bullish Outlook from On-Chain and Derivatives Data

The bullish outlook for Cardano is further supported by both on-chain and derivatives market data. The derivatives market, in particular, is showing strong signs of confidence, with the open interest for ADA surging by 24% in a single 24-hour period, reaching $1.88 billion. This is a staggering figure, as it is more than five times the growth of the largest altcoin, and it suggests that a significant number of investors are positioning themselves for further upside.

On-chain metrics also support this bullish sentiment, with the ADA/BTC ratio recently hitting a five-month high, indicating a shift in market sentiment favouring Cardano. The combination of rising open interest, strong whale accumulation, and positive social volume creates a powerful narrative that is reinforcing ADA’s case for a breakout above $1.

Outperforming Major Cryptocurrencies

Cardano’s recent performance is particularly impressive when compared to other major cryptocurrencies. The token has outperformed competitors on both 24-hour and monthly charts, with gains of over 15% in the last 24 hours and more than 71% in the past quarter. This outperformance, particularly against other Layer 1 assets like Bitcoin and Solana, is a strong signal that capital is rotating into ADA.

The fact that the ADA/BTC ratio has hit a five-month high indicates that investors are now more bullish on Cardano than they are on Bitcoin. This is a classic sign of an “altcoin season”, where high-beta tokens like ADA tend to outperform the market leader. This sustained outperformance is a key factor that is driving new investors into the ecosystem and fuelling the current price rally.

A Path to $1 and Beyond

The $1 price level is a major psychological and technical barrier for Cardano, one that has been historically difficult to break. However, the current momentum suggests that ADA is gaining the necessary strength to push through. Analysts like Javon Marks have noted that ADA has the potential to reach at least $1.20 and even $2.91 in the future, which would represent a 206% increase from its current price.

His forecast is based on ADA’s historical tendency to reverse downward trends and enter new bullish phases after reaching certain levels. With the confluence of whale activity, institutional interest, and positive market sentiment, many in the market believe that ADA is on the cusp of a significant price move. If the token can successfully break the $1 barrier, the next targets of $1.20 and beyond are seen as highly probable.

The Importance of Social Sentiment

Social sentiment remains overwhelmingly positive for Cardano, with its founder, Charles Hoskinson, expressing optimism about the recent price action. This strong community support is a crucial factor for a project’s success, as it helps to build a loyal and dedicated base of holders. Despite some early profit-taking, the overall sentiment remains bullish as the market enters a risk-on phase.

The combination of rising open interest, strong whale accumulation, and positive social volume continues to reinforce ADA’s case for a breakout above $1. The community’s belief in the project’s long-term potential is a key asset that will help to sustain the price rally and provide a floor for the token’s value.

The Future of Cardano

The recent price surge of Cardano is not just a short-term rally; it is a sign of a maturing ecosystem and a growing confidence in its long-term potential. The combination of whale accumulation, institutional interest from a Greyscale ETF filing, and a shift in market sentiment is creating a powerful narrative for the project. While the $1 level remains a major barrier, the current momentum suggests that ADA is well-positioned to break through.

If successful, the token could enter a new bullish phase that would take it to new highs. The future of Cardano will be defined by its ability to continue to attract new capital, build its ecosystem, and deliver on its promise of a scalable and secure blockchain network. The current trajectory and institutional developments suggest that the project is on the cusp of a significant price move that could reshape its future.

Read More: Cardano’s ADA Shows Signs of Life, but Key Levels Await