Cardano Faces Challenges in Overcoming Significant Resistance

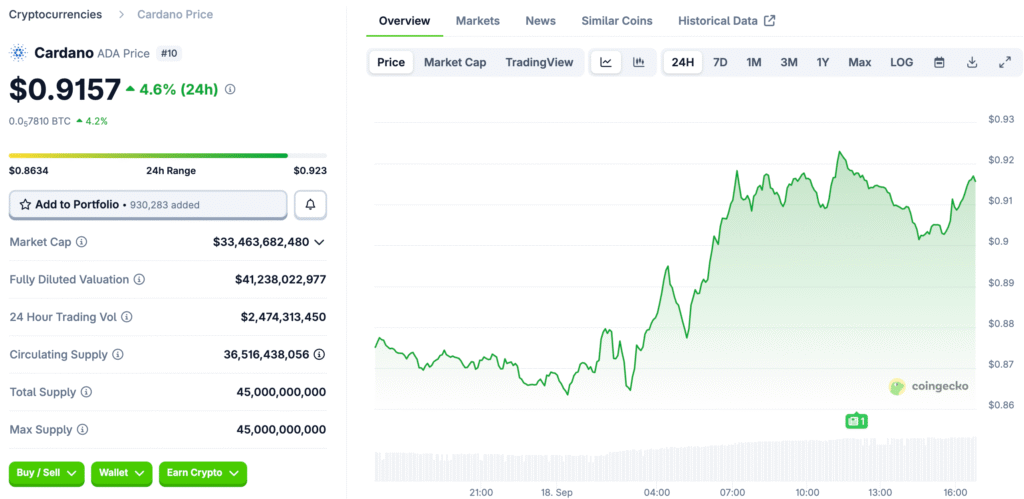

Cardano, a cryptocurrency, faced resistance at $0.90, indicating a lack of strength in its recent upward trend. This rejection disheartened buyers and boosted sellers, driving ADA down towards the $0.77 support level. As long as ADA doesn’t surpass the $0.90 mark, the price could remain at risk.

Despite this setback, investors remain cautious, as ADA has a history of making robust recoveries at significant resistance levels. If buyers regain control and rise above $0.90, a swift resurgence of bullish momentum may occur, sparking renewed optimism among those on the sidelines. This resistance is seen as a pivotal point in Cardano’s future.

Support Levels Hold Market Confidence

ADA is currently stabilizing around $0.77, a point that has provided support during past corrections and consolidation periods. This level indicates that buyers continue to hold sway, stopping further declines despite multiple unsuccessful attempts to break through the upper resistance zone.

If it falters, ADA may drop to $0.70, challenging trader confidence and dampening sentiment around the asset. Robust support levels attract buyers looking for bargain opportunities and serve as essential lifelines for bullish momentum. If ADA holds at $0.77, it may offer bulls an opportunity to strategize for potential breakouts.

Momentum Stalls After Resistance Rejection

The ADA’s rejection has led to a slowdown in price, with traders anticipating more clear signals. This phase of lateral movement indicates a lack of clarity, with buyers and sellers hesitant to take significant positions until confirmation is provided. The current consolidation phase could persist until a significant increase in market volume is achieved, establishing the conditions for significant movement.

Pennant formations beneath resistance indicate pauses before significant movements, and if momentum picks up, ADA may break through resistance. However, if sellers take control, momentum could deteriorate further, putting Cardano at risk.

Recommended Article: Cardano Price Targets $1.50 as Fed Decision Sparks Volatility

Concerns Arise from RSI Divergence

Since July, the RSI has steadily created lower highs, despite ADA’s price making efforts to rise in August. The bearish divergence observed between the RSI and price indicates a decline in momentum, suggesting to traders that ADA’s bullish trend could be faltering. If bulls do not manage to reclaim $0.90 swiftly, Cardano may experience downward pressure, pushing its price into more precarious support levels.

Bearish RSI divergence frequently signals impending corrections, offering a timely alert for prudent traders keeping an eye on fundamental market strength indicators. Divergences may not ensure reversals, but they do indicate weakening momentum, which boosts sellers’ confidence and causes buyers to hesitate in starting new positions. For ADA, regaining RSI strength above neutral would bolster confidence and support a bullish continuation past the $0.90 resistance level.

Resistance Continues to Be Essential for Breakout

Cardano’s $0.90 resistance is a key line that separates upward momentum from consolidation within trading ranges. Traders fear that if this barrier doesn’t break soon, momentum may diminish further, leading to more downward corrections.

Resistance levels act as psychological barriers, often requiring increased trading volume to validate trend changes. For ADA, surpassing $0.90 would validate its strength and set the stage for targeting $1. Buyers are cautious, holding off on committing capital to new breakout strategies until they see technical confirmation.

The Future of ADA Is Influenced by Market Sentiment

Cardano’s trajectory is influenced by the cryptocurrency market’s sentiment, with Bitcoin’s performance significantly impacting trader confidence. If Bitcoin recovers, Cardano could indirectly boost confidence and attract new buyers. Conversely, ongoing Bitcoin weakness could prolong ADA’s stagnation, preventing traders from adopting bullish narratives.

The market’s psychology, characterized by fear and uncertainty, influences short-term performance. Investors are now more cautious, waiting for clear confirmation signals rather than high-risk entry points. The future of Cardano depends on external factors and its ability to overcome technical challenges.

Cardano’s Consolidation Phase Tests Investor Patience

ADA is trading within a range with support at $0.77 and resistance at $0.90, indicating a potential bullish trend. Traders should monitor volume return and RSI recovery to see if ADA is regaining momentum. If not, it may drop to $0.70, testing lower support levels and affecting confidence in broader price recovery.

Investors should be patient, as temporary fluctuations could lead to long-term opportunities once Cardano establishes breakout strength. The consolidation phase provides entry points, but risks increase until ADA surpasses resistance. Traders should handle risk with precision, expecting significant shifts in either direction.