Cardano Breakout Sparks Investor Optimism

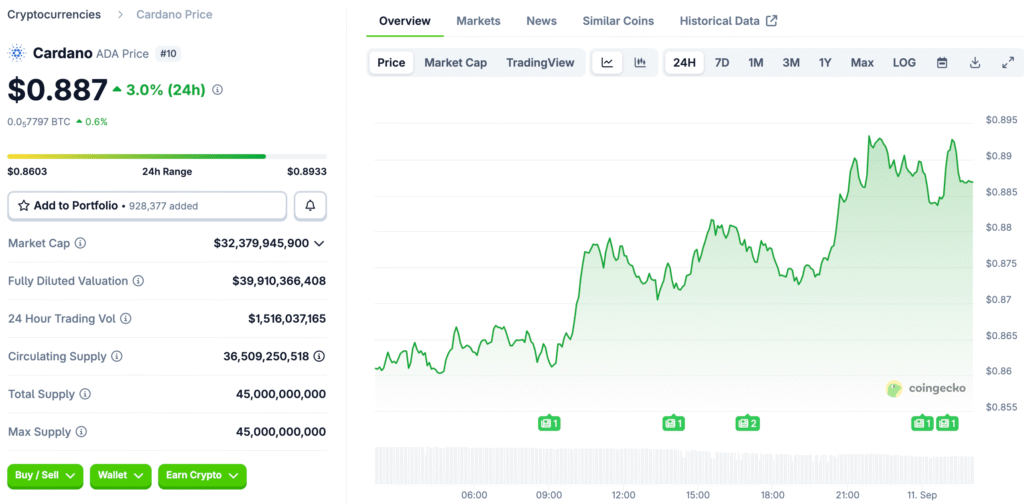

Cardano broke out of a consolidation pattern, potentially leading to an increase in its price due to increased investor confidence on various exchanges. This move cancels out previous bearish pressure, indicating a market shift. As the cryptocurrency markets stabilize, investors anticipate ADA’s strength, boosting bullish participants.

Cardano’s price stabilization above resistance levels indicates increased confidence from institutional and retail buyers, indicating future growth. Technical strength supports the bullish movement, supported by positive sentiment across multiple market segments. As ADA shows potential for recovery, traders’ confidence increases, reducing fears of another long correction.

Technical Indicators Reinforce Uptrend Strength

The directional movement index indicates a steady increase in prices during the Cardano price rally due to breakouts. Average directional signals confirm the strength of the current price action, suggesting potential for more upside in the coming sessions. Traders closely monitor technical indicators to ensure their conviction aligns with the overall upward trend.

The breakout of ADA is supported by strong belief, ensuring the price movement won’t be short-lived or weak. Strong technical signals provide investors with peace of mind before investing in Cardano in an unstable market environment. Accumulation driven by momentum indicates buyer interest, highlighting bullish continuation patterns despite potential resistance zones in the next trading activity.

Resistance Levels Show Market Opportunities

Cardano is struggling to break past the $0.95 and $1.01 levels, affecting short-term investor opportunities and setting the tone for longer-term bullish expectations. Successful testing of these resistance points could confirm stronger uptrend structures and allow ADA to retest higher valuations over longer periods.

Traders expect ADA to react volatilely as it gets closer to these technical zones, creating opportunities for both entries and exits. As long as ADA keeps prices above $0.86, the bullish case strengthens, and traders focus on testing psychological and technical resistance points. Sustained price action above these levels indicates market strength and lowers the risk of sudden breakdowns.

Recommended Article: Cardano Leads Crypto Gains With 141 Percent Annual Growth

Market Flows Indicate Reduced Selling Pressure

Millions of ADA investors are leaving centralized platforms, indicating a preference for holding assets rather than actively selling. This trend aligns with Cardano’s technical breakout and bullish continuation patterns, indicating a global optimism in the investment community. Less selling activity supports bullish continuation patterns and more momentum towards resistance points.

This trend indicates a stronger long-term holding conviction, reducing the risk of short-term corrections hindering bullish progress. The market flows and technical strength suggest a broader shift in sentiment towards optimism in ADA’s ongoing market trajectory. The trend supports a broader shift in sentiment towards optimism in ADA’s ongoing market trajectory.

Increase in Open Interest and Futures Capitalization

Open interest in ADA futures has surged, indicating increased investor interest in trading Cardano positions with leverage. This indicates increased market involvement and institutional involvement in the ADA market, indicating potential growth. The surge in open interest strengthens bullish setups and prepares traders for potential long-term upward momentum.

ADA’s popularity in futures markets makes it more credible and increases liquidity in larger cryptocurrency ecosystems. More participation in price discovery mechanisms strengthens overall bullish market structures, supporting Cardano’s plan to test psychological resistance levels near one dollar. This surge in interest supports Cardano’s plan to test significant psychological resistance levels near one dollar.

Long Positions Dominate Across Major Exchanges

Binance data indicates that most investors are long in Cardano, indicating confidence in its growth and strength. This sentiment is shared by both retail and institutional investors, who see the skewed long-to-short ratio as a sign of valid long-term bullish expectations for Cardano.

Despite short-term resistance levels, the high level of long exposure indicates optimism about future price movements, aligning with technical and market flow signals that support bullish continuation. This agreement in sentiment between technical and trading activity strengthens Cardano’s case for higher price targets in the near term.

Optimizing Cardano Investment Through Pionex

Pionex is a top choice for investors trading Cardano due to its safe onboarding processes and fast spot market transactions worldwide. It offers low fees and an easy-to-use interface, allowing both new and experienced traders to participate effectively.

Pionex also provides safe custody options for global investors, offering cold storage protections and easy-to-use wallets. Its reputation as a fast and trustworthy platform boosts investor confidence and helps people safely participate in the ongoing market momentum of ADA. This accessibility helps diversify holdings and support long-term price stability.