Binance Coin Surges Following Market Correction

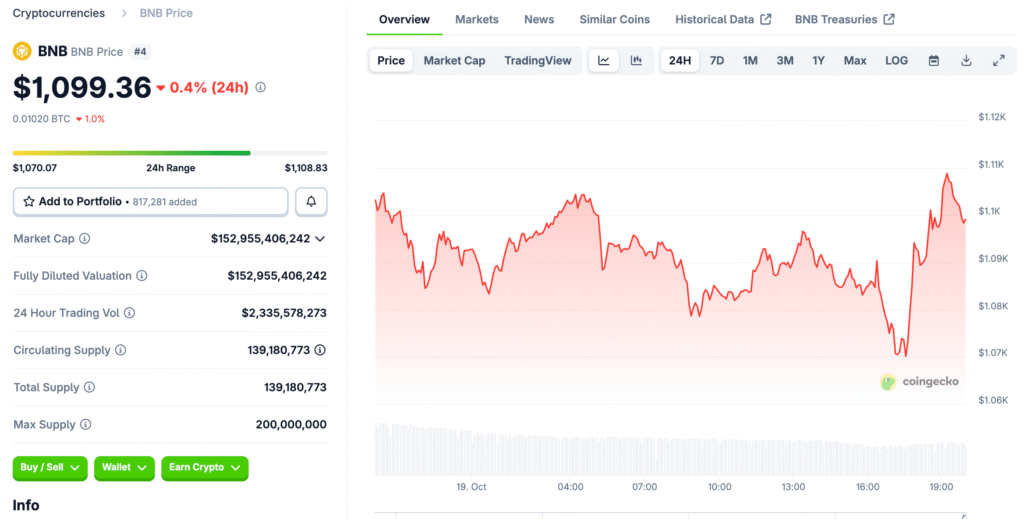

Binance Coin (BNB) has shown resilience amid a volatile trading environment, rebounding strongly above the $1,100 mark after a week of sharp corrections. The asset’s recovery highlights renewed investor confidence in the Binance ecosystem, which continues to dominate the global exchange landscape. While BNB remains down 12% on the week, its year-to-date performance of 54% reflects a broader pattern of strength within top-tier cryptocurrencies.

Binance Launches $400 Million Compensation Fund

The recent rebound was largely attributed to Binance’s decision to deploy a $400 million compensation fund to support traders affected by last week’s market-wide flash crash. The crash, which liquidated over $19 billion across major exchanges, triggered panic among retail investors. Binance’s rapid intervention—covering partial losses and offering targeted BNB airdrops—helped stabilize sentiment and restore confidence in its trading platform.

Investor Confidence Rebounds After Swift Action

While Binance did not reimburse all affected users, its prompt response prevented further market disruption. Analysts argue that the move underscored Binance’s role as a stabilizing force during crises, reinforcing trust among its global user base. The initiative not only mitigated reputational risk but also catalyzed a strong rebound in BNB’s price performance, distinguishing it from other major altcoins.

Technical Analysis: BNB Defends Critical Support Levels

From a technical standpoint, BNB is consolidating within a descending channel but continues to defend key support between $1,100 and $1,120. The token’s bounce from a weekly low of $1,040 signals accumulation at lower levels. However, short-term momentum remains fragile, with the 50-day exponential moving average (EMA) still trailing the 100-day EMA—a pattern that often precedes temporary consolidation phases.

Resistance And Momentum Indicators Suggest Mixed Outlook

Momentum indicators provide a mixed technical picture. The Relative Strength Index (RSI) currently hovers around 40, indicating neutral-to-bearish sentiment. If BNB can break above $1,138, it may invalidate the descending structure and target resistance levels at $1,192 and $1,251. Conversely, a sustained break below $1,020 could expose deeper retracement zones at $978 and $928—both historically strong accumulation areas.

Recommended Article: Solana Mirrors BNB Rally As Breakout Targets Fresh Record Highs

Long-Term Trend Remains Aligned With Rising Channel

Analyst BATMAN highlights that BNB’s long-term trajectory remains intact, with a rising trendline extending from the $600 base. This structural support reinforces the asset’s potential for gradual appreciation if stability persists above $1,100. Historically, BNB has shown the ability to recover rapidly following macro-driven pullbacks, supported by its utility across Binance’s ecosystem for trading, staking, and transaction fee discounts.

Broader Altcoin Market Follows BNB’s Lead

BNB’s rebound has sent positive ripples across the wider altcoin market, signaling a possible shift from fear to cautious optimism. Major tokens such as Ethereum, Solana, and Avalanche have recorded smaller yet meaningful recoveries following Binance’s intervention. Analysts suggest that BNB’s strength often serves as a barometer for market stability, given its correlation with trading volumes and investor activity on centralized exchanges.

Bitcoin Hyper Introduces New Layer-2 Innovation

Adding momentum to the broader ecosystem, Bitcoin Hyper ($HYPER) has drawn attention as the first Bitcoin-native Layer 2 built on Solana’s high-performance framework. This hybrid model merges Bitcoin’s security with Solana’s speed, enabling smart contracts and decentralized apps at minimal cost. The presale has already surpassed $23.9 million, signaling robust investor demand for scalable Bitcoin solutions.

Market Analysts Predict Continued Consolidation

Experts believe the coming weeks will determine whether BNB’s rally evolves into a broader altcoin recovery. With volatility cooling and macro sentiment improving, traders are closely watching key technical thresholds. A breakout above $1,192 could validate the bullish scenario, while a retracement toward $1,020 would reaffirm the consolidation outlook. In either case, BNB’s resilience highlights Binance’s continued influence over market sentiment.

Outlook: Gradual Recovery May Extend Into Late 2025

BNB’s strong defense of the $1,100 support zone demonstrates the depth of investor confidence in the Binance ecosystem. While short-term fluctuations are expected, the token’s fundamentals remain solid. With Binance expanding its institutional partnerships and maintaining market dominance, BNB is well-positioned to lead the next wave of recovery across the altcoin sector. The asset’s stability amid turbulence reaffirms its role as both a utility token and a bellwether for crypto resilience.