Bitwise Enters ETF Race With Hyperliquid Proposal

Bitwise has applied to start a spot ETF that will track Hyperliquid’s HYPE token. This is another move into decentralized finance markets. The proposal includes in-kind redemptions, which let investors trade shares for real tokens instead of cash. This could make the market more liquid.

This filing shows that more and more institutions are interested in decentralized derivatives platforms and that there is competition between major on-chain exchanges. Bitwise’s decision comes at a time when decentralized perpetual futures markets are seeing record-breaking growth in trading volume.

Competition Heats Up Among Perpetual DEX Leaders

The Hyperliquid ETF filing comes at a time when decentralized exchanges that focus on perpetual futures are fighting hard for business. Aster has recently outperformed Hyperliquid in both trading volume and open interest, making it a strong new competitor.

The daily volume of perpetual DEX reached an all-time high of $70 billion, showing how quickly the demand for on-chain leveraged trading is growing. Aster’s volume over 24 hours was $35.8 billion, which is more than three times Hyperliquid’s $10 billion over the same time period.

Aster’s Surge Challenges Hyperliquid’s Dominance

Aster’s quick rise is changing how competition works in decentralized derivatives markets. Open interest went from $143 million to $1.15 billion in a week, which means that more money is coming in and traders are getting more active.

This meteoric rise puts pressure on Hyperliquid to come up with new ideas and protect its market share, especially since institutional players like Bitwise are bringing attention to the ecosystem through ETF proposals. The competition could lead to better technology and more liquidity on all platforms.

Recommended Article: Hyperliquid Retests $50 Support Ahead of Token Unlocks

Regulatory Review Timeline Could Extend Approval

Bitwise filed the application under the Securities Act of 1933, which started an SEC review process that could take up to 240 days. To move forward with a possible listing, you need to get more approval for Form 19b-4.

Recent changes in SEC policy have made it easier for tokens traded on CFTC-regulated venues to get ETF approvals faster. However, Hyperliquid does not currently have any registered futures contracts. This gap could make the regulatory process for the proposed ETF more difficult and take longer.

Coinbase Custody Will Handle HYPE Token Holdings

The filing names Coinbase Custody as the asset custodian in charge of safely managing the HYPE token reserves that back the ETF. This choice fits with Bitwise’s plan to work with well-known crypto infrastructure providers to boost investor confidence.

Coinbase’s institutional custody services are now the best choice for ETF issuers who have to deal with complicated security and regulatory issues. This partnership could make it easier to follow the rules and build trust among people who work in the institutional market.

Market Reactions Show Changes in Trader Sentiment

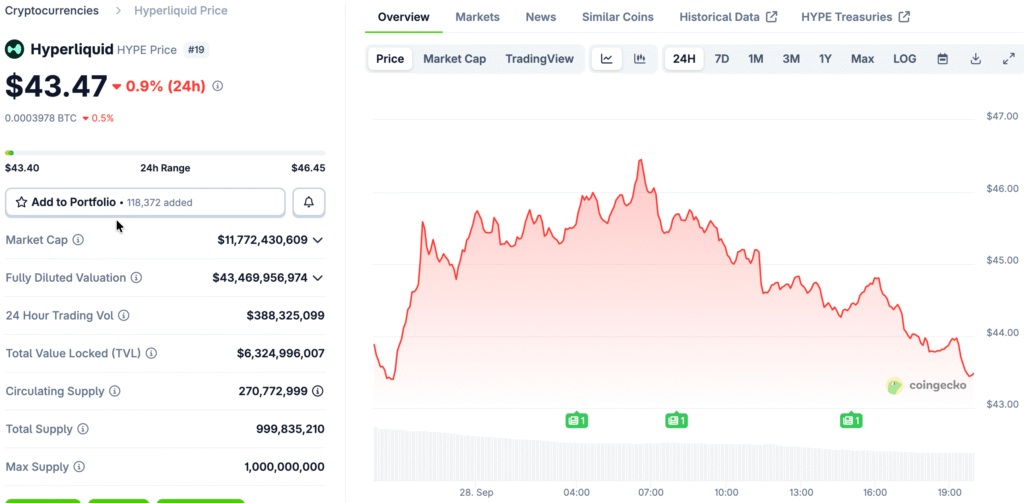

After the filing, HYPE’s open interest fell by 1.85% to $2.2 billion, and the prices of tokens fell by 3.5% to $42.50. Aster’s continued growth, on the other hand, shows that traders are spreading their risk across different platforms as competition heats up.

These changes show how decentralized derivatives markets are always changing, with liquidity changing quickly in response to new events. When people change their positions after an announcement about an ETF, it often causes volatility.

Bitwise Hyperliquid ETF Signals Institutional Push Toward DeFi Trading

Bitwise’s Hyperliquid ETF application is part of a larger effort by institutions to bring decentralized trading systems into the mainstream financial world. This change could make it easier for more people to trade on-chain perpetual futures, increase liquidity, and make it more legitimate.

If the ETF is approved, it could set a standard for other products linked to other major decentralized exchanges. This change is an important step toward connecting centralized finance with DeFi innovation and changing the way derivatives work.