Bitcoin’s Momentum Stalls as Bearish Signals Emerge

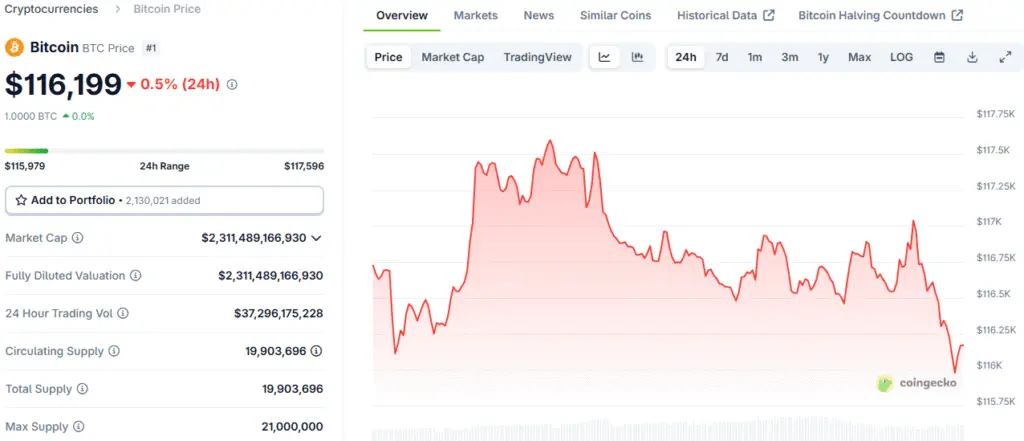

Bitcoin’s recovery momentum has stalled, with on-chain data and derivatives markets now flashing multiple bearish signals. This pullback from recent all-time highs suggests that the market is in a period of consolidation, a crucial phase for any asset after a significant rally. The price of Bitcoin has dropped by 1.5% in August, a period that historically has been more positive, with a median August return of 0.96% over the last 12 years.

This divergence highlights a shift in market dynamics and sentiment, indicating that the current market environment is not entirely typical. The founder of TYMIO predicts that Bitcoin could see sideways trading throughout August before momentum resumes, suggesting that the market is currently in a state of re-evaluation rather than a clear upward or downward trend. This period of price consolidation is a critical juncture, as it will determine the asset’s next significant move, with the market awaiting a new catalyst to dictate its direction.

On-Chain and Derivatives Data Show Bearish Trends

Bitcoin’s stalled momentum is attributed to bearish signals from on-chain and derivatives data. Dormant whales, who have started taking profits after years of inactivity, have moved 3,000 Bitcoin, indicating local price tops. Taker sell volume on futures contracts has surged, reaching levels last seen on July 30, suggesting urgency among sellers who prioritise execution speed over price.

The options skew, which measures the demand for calls versus puts, has turned negative, shifting from +2% to -2%, indicating more traders are buying downside protection, signalling a rising fear of a near-term price drop. These signals collectively suggest that a significant portion of the market, particularly long-term holders and sophisticated traders, are preparing for a potential price correction.

Institutional Inflows Reverse, ETF Outflows Emerge

Institutional sentiment, which has been a major driver of Bitcoin’s recent rally, is also showing signs of cooling. Spot Bitcoin ETFs have seen a significant reversal, with $1.2 billion in outflows over two days. This is a stark change from the sustained inflows that characterised the early months of the year. The outflows reflect a decline in institutional appetite and a cautious approach to the current market environment. This reversal in institutional flow is a powerful signal that the major players are taking a step back, which can have a significant impact on Bitcoin’s supply and demand balance.

The first outflows in 15 weeks, totalling $223 million, were also reported from digital asset investment products by CoinShares. This move by institutional investors is a crucial development, as their actions can often precede broader market movements. The sustained capital inflow from this group has been a key pillar of Bitcoin’s recent rally, and a reversal in this trend highlights a potential vulnerability in the market’s support structure. The market’s ability to absorb these outflows will be a key test of its underlying strength and resilience in the coming weeks.

Read More: Bitcoin’s August Dip: Analyst Warns $110K Support is Key Amid Bearish Trends

Macroeconomic Events and Bitcoin’s Price Pullback

The price pullback follows a series of macroeconomic events that have contributed to market uncertainty. A recent hawkish FOMC (Federal Open Market Committee) meeting and better-than-expected U.S. economic data releases have created a climate where investors are reassessing their risk exposure. While strong economic data can be a positive sign for the broader economy, it can sometimes lead to a hawkish stance from the Federal Reserve, which can be seen as bearish for risk assets like Bitcoin.

The fear is that a hawkish Fed could raise interest rates, making riskier assets less attractive. This interplay of economic factors and market sentiment is a key driver of Bitcoin’s volatility. The market is constantly trying to price in the future actions of the Fed and the performance of the broader economy. This makes Bitcoin a sensitive asset to global economic developments.

Sovereign Adoption as a Potential Bullish Catalyst

Brazil’s upcoming Congressional hearing on August 20 could potentially trigger Bitcoin’s rise in value. The country is considering adding Bitcoin to its national reserves, a move that could set a precedent for sovereign adoption. This move would elevate Bitcoin from a niche investment to a legitimate national asset, potentially inspiring other nations to follow suit.

This move would also provide a non-speculative source of demand, potentially impacting Bitcoin’s long-term price trajectory. The outcome of this hearing will be closely monitored by the crypto community, potentially turning a significant turning point for the market.

Bitcoin Sideways Trading and the Wait for a New Catalyst

The current market situation for Bitcoin is a complex interplay of on-chain data, institutional behaviour, and macroeconomic factors. While the recent pullback has introduced bearish signals, the market’s ability to hold its ground and not enter a free-fall is a sign of underlying resilience. The founder of TYMIO’s prediction of sideways trading throughout August suggests that the market may be in a reaccumulation phase, where weaker hands are shaken out and stronger hands acquire more Bitcoin.

The key for a sustained rally will be a new catalyst that can absorb the selling pressure and push the price back up. This could come from a variety of sources, including a positive outcome from Brazil’s congressional hearing, a shift in the Fed’s stance, or a return of institutional inflows. The coming weeks will be crucial in determining whether Bitcoin can overcome these challenges and resume its upward trajectory. The story of Bitcoin’s price is not just about a chart; it’s about a complex ecosystem of investors, governments, and technologies that are all influencing its path forward.