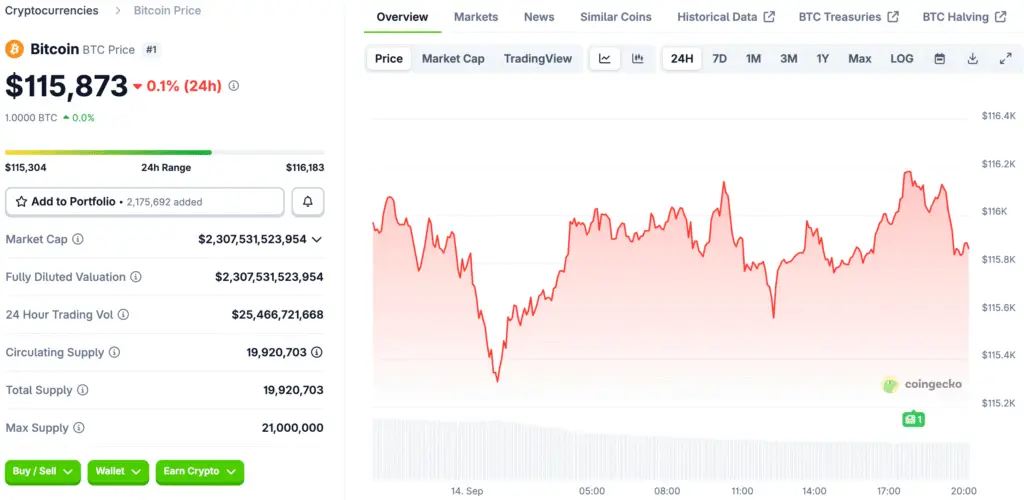

Bitcoin Reclaims Key Futures Gap Above $117K

Bitcoin surged to $117,000, filling a significant CME futures gap in August, indicating a strong market and renewed investor confidence. Futures ended at $117,320, easing concerns about gaps holding back bullish sentiment.

Analysts believe maintaining this level is crucial to prevent exposure to levels below $108,000, which could hurt bullish stories. This recovery boosts optimism about the market, believing Bitcoin is still worth more despite volatile global conditions. The recovery is expected to continue as long as resistance doesn’t turn into new weakness.

Analysts See Signals of a Breakout Above Resistance Levels

Investor Ted Pillows stressed how important it is to fully reclaim the gap, saying that not doing so could send Bitcoin back to local lows. These observations show how high the stakes are in the battle going on as traders try to confirm strength above recently reclaimed resistance levels.

Keith Alan of Material Indicators said that Bitcoin’s rise is far from over and that projections point to much higher targets. He said that $124,500 was not the peak of the cycle because institutional demand and steady ETF inflows were driving long-term upside expectations. These new pieces of information make the case for Bitcoin’s upward trend even stronger, showing that it is still on track to reach new all-time highs.

Institutional Demand Drives Bitcoin Market Momentum

Institutional buying is still supporting Bitcoin, with U.S. spot ETFs reporting net inflows of more than $2.3 billion in just five days. This rise shows that more people are using Bitcoin, which shows that mainstream investors believe it could be a good long-term hedge and digital asset.

ETF inflows help keep the market stable by stopping big drops and giving rallies a boost whenever technical resistance zones finally give way to bullish momentum. More institutional involvement means that market participants are committed, which supports long-term bullish stories and helps to absorb retail-driven volatility. This kind of demand is a strong catalyst that keeps Bitcoin in a position to break past previous highs and set stronger valuation baselines.

Recommended Article: US Bitcoin Reserve Expected in 2025 as Market Misses Odds

Federal Reserve Policy Adds Fuel to Optimism

Market participants keep an eye on future Federal Reserve policy decisions, where expected interest rate cuts could boost rallies in riskier assets. The CME FedWatch Tool says that the market was fully ready for a cut on September 17th.

Lower interest rates could bring more money into Bitcoin as liquidity grows, which would make people more positive about the crypto and financial markets as a whole. This environment makes ETF inflows bigger, which gives the market more upward momentum as investors get ready for changes in monetary policy. These kinds of changes make Bitcoin more appealing, making it both a speculative and macro-sensitive hedge asset at the same time.

Traders Predict All-Time Highs Within Weeks

BitBull, a well-known trader, says that Bitcoin will hit new highs in two to three weeks because it has successfully reclaimed a key long-term trendline. In August, the eight-year support was lost for a short time, but it has now been regained, which means that bullish control over price has returned.

A breakout candle confirmed the momentum, making it more likely that Bitcoin will keep going up in the next few sessions. Patterns in historical charts show that cycles are still going strong, which is more proof that new peaks are getting closer to being possible in the short term. As technical milestones are reclaimed, traders’ confidence grows, which supports a bullish outlook as September comes to a close.

Historical Patterns Suggest Bull Market Still Intact

Rekt Capital analysts concluded that Bitcoin has not yet reached the highest point of the bull market, citing historical patterns of mid-cycle consolidations before stronger rallies. The ability of Bitcoin to continue rising even after corrections indicates strong demand, similar to past breakout environments.

Cycles tend to repeat, providing traders with clues about when new highs might occur over longer periods. This perspective makes people more hopeful, suggesting that Bitcoin’s rise is ongoing and not coming to an end.

Analysts Predict Bitcoin All-Time Highs in 2-3 Weeks

Bitcoin is still set up for growth because ETF inflows, institutional adoption, and good macroeconomic conditions are all in line with technical recoveries. Closing the $117,000 futures gap gives bulls more confidence that they can keep making progress toward all-time highs.

Traders and institutional investors are both very sure that new highs will happen in the next two to three weeks. Even though there are risks of volatility, underlying demand provides structural support, which lowers the chances of losses while improving long-term outlooks. Bitcoin looks like it’s ready to test historical highs as momentum picks up. This strengthens its position as the leader in global cryptocurrency markets.