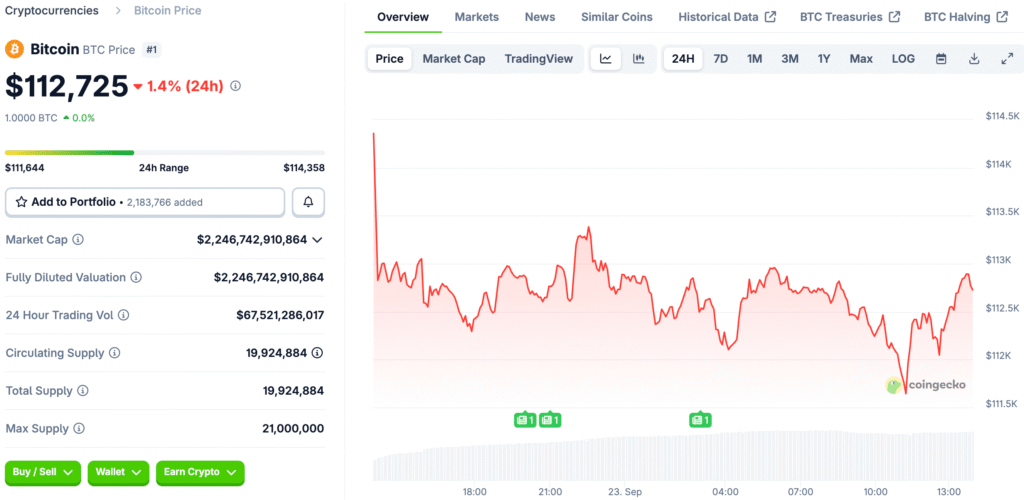

Bitcoin Leads Market Drop

Bitcoin dropped 3% overnight, which brought down the prices of other cryptocurrencies around the world and wiped out billions of dollars in market capitalization. As traders panicked, almost all of the major cryptocurrencies saw big drops. The drop brought the total market value below $4 trillion, which made investors in the whole sector more cautious.

Ether fell 6% and Solana fell 7%, both of which were worse than Bitcoin. World Liberty Financial and Dogecoin both lost 10%, showing how weak the market is overall. Analysts said that the synchronized selling showed that there was a broad-based rout caused by both macroeconomic and technical factors.

Liquidations Amplify Market Volatility

According to Coinglass data, more than $1.7 billion in derivatives positions were sold off during trading on Sunday night. These forced sales played a big role in speeding up the market’s declines. Traders who made leveraged bullish bets lost a lot of money as stop-outs spread through exchanges.

94% of the liquidations came from long positions, and Ethereum contracts were the hardest hit, losing more than $500 million. Bitcoin traders also lost a lot of money, with $280 million in liquidations. OKX had the biggest liquidation, worth $12.7 million, which shows how risky trading with a lot of leverage can be.

Federal Reserve Policy Adds Market Pressure

The sell-off came after the Federal Reserve said it would lower rates by 0.25 percentage points. The timing, though, made markets that were already shaky from too many bullish positions even more so. Many investors looked at their exposure again as liquidity conditions got worse.

Some crypto analysts said that the Fed’s announcement caused more uncertainty than reassurance. Traders were expecting things to get easier, but they were also worried about the economy slowing down. This environment made fears worse, leading to more liquidations and pushing crypto markets down even more.

Recommended Article: Ethereum Price Prediction Sees $4K to $5K Trading Range

Bitcoin Treasury Models Struggle as Volatility Hits Public Firms

Companies that have bitcoin on their balance sheets have been under more and more pressure during the downturn. More than 180 public companies have started using bitcoin treasury strategies in the hopes of getting the same huge gains that Strategy did. Many people are now dealing with prices that change quickly and a lack of trust in the market.

There are about 94 copies of Strategy, but many of them don’t have the same size or financial strength. About a quarter of them now trade for less than what their bitcoins are worth. This disconnect has made people question whether Bitcoin treasury models can last during times of high volatility.

Strategy and Imitators Show Mixed Results

Michael Saylor’s Strategy saw its stock drop 1.3% on Monday, even though it has been going up for a long time. The company became a bitcoin giant by making a lot of aggressive purchases starting in 2020. Its recent problems show how volatile bitcoin-linked stocks can be, even though they have gone up 2,200% since then.

Smaller copies have done worse in the current market. Because their balance sheets aren’t very strong, they are more at risk when prices go down. Analysts say that consolidation may continue as weaker companies try to stay stable during long downturns.

First Merger Signals Consolidation Trend

Semler Scientific’s stock jumped 27% after the company said it would merge with Strive Inc. in an all-stock deal backed by Vivek Ramaswamy. The deal shows that bitcoin treasury firms are under pressure to merge. To stay alive during times of volatility, smaller companies may merge with bigger ones more and more.

People think this merger is the start of a larger wave of mergers. Since prices are going down, stronger companies may go after acquisitions more aggressively. In the next few quarters, this trend could change the bitcoin treasury sector a lot.

Altcoins and IPOs Also Hit Hard

Altcoins and stocks linked to cryptocurrencies also lost a lot of value during Monday’s crash. Bitmine Immersion Technologies’ stock fell 7% even though they recently named Tom Lee as executive chairman. Its ether holdings weren’t enough to keep people from being negative about the stock.

Circle, Figure, Bullish, and Gemini are some US-listed crypto companies that also saw their stocks drop. Circle fell 5% and Figure fell 4%. Bullish and Gemini both lost 7% and 4%, respectively, showing that many investors are pulling out of crypto stocks.

Analysts Warn Rules Alone Can’t Shield Crypto From Market Rout

Even though there have been improvements in regulations, like support from the Trump administration, markets are still open to sudden changes. Analysts say that regulation has made IPOs more common, but fundamentals can’t make up for extreme trading conditions. Market optimism based on regulatory wins hasn’t kept investors safe from short-term risks.

The string of IPOs in 2025 showed that more institutions were interested. But the most recent route shows that investor sentiment is still fragile. People who watch the market say that regulation alone can’t keep crypto stable when leverage and macro uncertainty come together.