Crypto Market Reacts to Fed Decision

The U.S. Federal Reserve announced its first interest rate cut of 2025, which made digital assets even more volatile. Market capitalization briefly rose above $4.19 trillion before falling to $4.12 trillion as excitement quickly faded.

At first, the rate cut made people more hopeful, but soon the rally stopped because people were taking profits and investors were being cautious. Analysts argued about whether the move meant that cryptocurrencies would keep growing or just get a short-term boost.

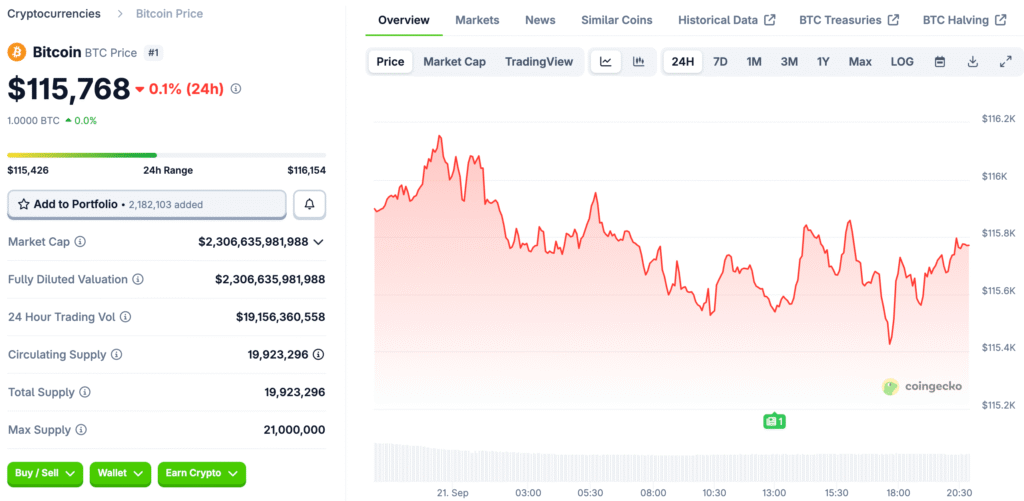

Bitcoin Struggles at Key Resistance Levels

On September 18, Bitcoin almost broke $118,000, but by the end of the week, it was only 0.2% higher at $115,792. Traders pointed out $117,000 as the next big pivot point, and short-term momentum is likely to be based on volume spikes.

If it doesn’t stay above that level, it could mean that the top is near and that it could go back down to lower support. Bulls are still confident and expect to see more pushes past the $118,000–$119,000 resistance level if trading picks up even more.

Altcoins Deliver Mixed Weekly Performance

After the early post-FOMC strength faded, Ethereum and XRP both fell into the red, with Ethereum losing 3.4% and XRP losing 4.4%. Dogecoin and Chainlink did worse, losing 7.2% and 6.1%, which shows that some investors are moving their money around.

Other tokens fell a lot, with FORM, TROLL, and PYTHIA all losing more than 35% in the same week. Even though traders were looking for new opportunities, the volatility of smaller-cap altcoins made risks even more clear.

Recommended Article: Bitcoin Analysts Eye $150K Price Target Within Weeks

Standout Winners Amid Market Turbulence

BNB rose to an all-time high of $1,027.17, bringing its market cap above $140 billion for the first time. The token went up by almost 10% over the week, making it one of the best high-cap performers.

Avalanche also did well, going up 12% because there was a lot of demand for it in the ecosystem and developers were using it. Even though the market was under a lot of pressure, smaller altcoins like WFLI were able to make small weekly gains of about 5.8%.

Explosive Rallies Among Emerging Tokens

APX went up more than 1,691% in just one week, which shocked even the most experienced traders. CDL went up more than 400%, and AVNT went up 192%, both of which were helped by speculative momentum.

Analysts say that these kinds of sharp rises often come before corrections, but they do show that people are still interested in high-risk, high-reward tokens. These unexpected breakouts are still mostly due to retail excitement and aggressive liquidity flows.

Analysts Debate Short-Term Outlook

Some experts say that Bitcoin may have reached its peak around $118,000 and that the lack of momentum suggests that it could drop back down soon. Some people think that an increase in volume will confirm a bullish continuation, keeping $119,000 and higher within reach.

People who watch altcoins say that selective rotation will be the main trend in the markets, with institutional favorites doing better than riskier meme-driven tokens. Broader macroeconomic factors, like when interest rates will be cut, will keep affecting people’s feelings.

The Fed Policy Shift Sparks Crypto Volatility as Bitcoin Tests Resistance

The Fed’s change in policy made crypto more volatile, which added to its reputation as a market that is very sensitive to changes in the economy. Bitcoin was strong but had trouble with resistance, while altcoins had different winners and losers.

The week showed traders both chances and risks, which showed how important timing, volume, and trend confirmation are.