Bitcoin’s Historical Cycles Retain Influence

Bitcoin’s price movements have long followed a recurring four-year cycle, typically anchored around halving events. Saad Ahmed, Gemini’s head of APAC, believes this pattern will continue in some form. He attributes its persistence to human emotional cycles driving overexcitement and eventual corrections. These behavioral patterns often create predictable phases of euphoria, correction, and recovery in crypto markets.

Emotional Drivers Behind Market Movements

Ahmed explained that investor psychology remains a core factor behind Bitcoin’s cyclical trends. Excitement during bull runs often leads to excessive risk-taking and inflated valuations. This overextension typically precedes sharp downturns, resetting the market to a more sustainable equilibrium. Such emotional dynamics ensure that even if cycles evolve, they won’t disappear entirely.

Institutional Participation May Smooth Volatility

Ahmed noted that increasing institutional involvement could help reduce Bitcoin’s volatility over time. Large financial players bring deeper liquidity, professional risk management, and longer investment horizons. These factors may dampen extreme price swings compared to previous cycles dominated by retail traders. Still, emotional behavior will likely sustain some cyclical structure within market trends.

Recommended Article: Bitcoin Breaks $121K As Ether Hits Three‑Week High

Analysts Debate Relevance Of Cycles Today

Industry experts remain divided on whether Bitcoin’s classic four-year cycle still holds full predictive power. Some analysts argue that greater market maturity and macroeconomic influences have altered its trajectory. Others, like Glassnode, highlight that Bitcoin’s recent price action still closely resembles historical halving cycles. This debate underscores how evolving market conditions interact with entrenched investor behaviors.

October Could Mark A Cycle Peak

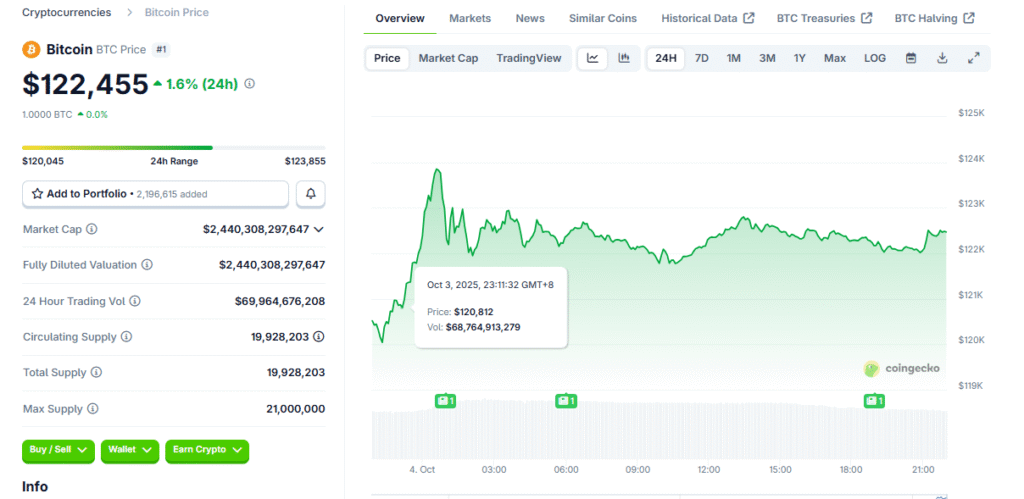

Historical data suggests Bitcoin often peaks around 550 days after halving events. Analyst Rekt Capital predicts that October could represent the current cycle’s price peak if patterns repeat. Previous cycles have shown Q4 to be Bitcoin’s strongest quarter since 2013, averaging returns near 79%. Recent price surges to $123,850 hint that the market may be approaching a climactic phase.

Differing Views From Industry Leaders

Not all industry leaders expect Bitcoin to follow previous cycles strictly. Bitwise CIO Matt Hougan believes upcoming years may bring strong growth independent of halving timelines. He forecasts 2026 as another positive year for Bitcoin, pointing to institutional adoption and macro trends. Such views reflect growing diversity in how experts interpret Bitcoin’s evolving market structure.

Human Behavior Ensures Cycles Persist

Despite technological and structural changes, human emotion remains a constant market force. Fear and greed continue to shape collective decision-making during both bullish and bearish periods. These psychological factors create patterns that technical models and cycle analyses attempt to quantify. Ahmed concludes that Bitcoin cycles will likely persist in some form as long as human nature drives markets.