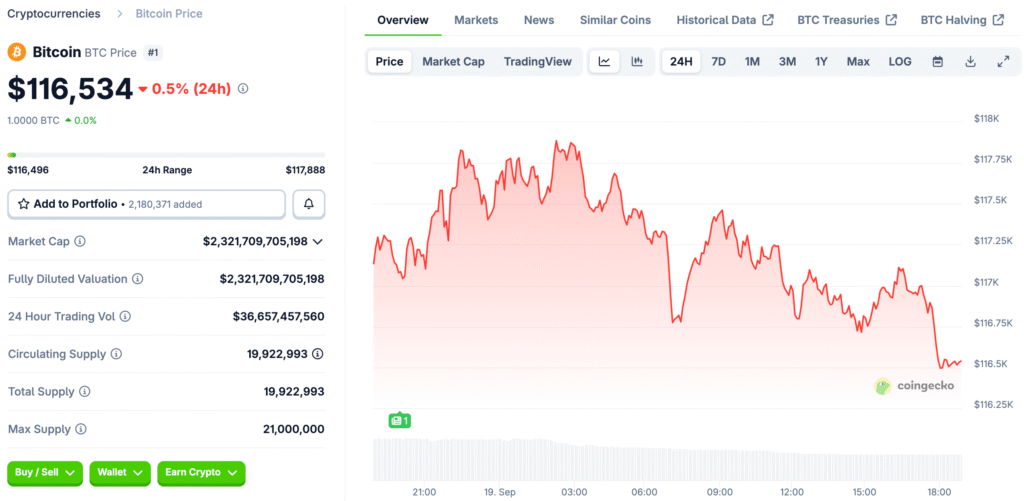

Bitcoin Maintains Healthy Uptrend Around $117,000 Levels

Bitcoin is trading at $116,534, which is a strong uptrend, and analysts expect it to keep going up. The way the market is set up shows that the crypto market as a whole is strong. Based on on-chain indicators, CryptoQuant research shows that Bitcoin has room for “expansion.” This shows that the bullish momentum in the markets will continue.

Experts say that all-time highs are about to be tested. Consolidation phases make the foundation stronger, getting the asset ready for the next big rise. The current path supports the story of rising investor confidence, and the markets expect a breakout to higher valuations soon.

NVT Golden Cross Strengthens Bitcoin’s Bullish Outlook

The value of the network to the transaction Golden Cross (NVT GC) is still in neutral territory, which keeps it from being overvalued and gives a strong bullish bias. Negative values have historically come before rallies, while high metrics usually signal reversals. Current readings suggest that prices will likely rise even more.

The most recent signal in July showed a strong buying area. The metric steadily rose, confirming that the Bitcoin markets are still in an uptrend. Investors see data as a sign that the environment is good, which lowers their worries about overheating that usually come with quick parabolic moves.

Historical Patterns Confirm Metric Reliability and Strength

NVT GC has been reliable in past cycles. Four dips into the “long” zone have happened before times when Bitcoin prices went up a lot. The indicator’s recent track record makes it more credible, which makes the case for a bullish continuation through the next few weeks even stronger.

Pelin Ay, a contributor to CryptoQuant, says that the indicator shows a healthy upward trend and that there are no signs of undervaluation or bubble conditions. There is still room for growth. This view makes traders more hopeful, which strongly supports the idea that the market will soon reach an all-time high.

Recommended Article: Bitcoin Price Struggles Below $118K As Momentum Cools

Consolidation Expected Before Potential Breakout Higher

Analysts think there will be a consolidation period of one to two weeks before the market moves to new highs. Short-term buying supports a long-term upward trend. The STH realized price positioning points to a strong foundation for continuation. People in the market see levels as important proof of a bullish structure.

Before breakout phases, there is usually a period of consolidation. These patterns are similar to ones that have happened in the past, which makes the projected bullish continuation more likely. Traders get ready for upward momentum to come back in Bitcoin markets around the world by managing risk and positioning themselves accordingly.

Additional Indicators Signal Bullish Continuation Ahead

In July, MACD gave a strong “buy” signal, which supports the idea that prices will keep going up into the last quarters of 2025. The signals match up with the NVT GC conclusions, which strengthens the belief that the Bitcoin rally is still going strong and hasn’t reached its peak yet.

The readings as a whole show that the market is strong. Traders are more confident that there is still a chance for the market to go up because there are no blow-off tops. Momentum indicators back this up, giving us multiple reasons to stay positive about Bitcoin’s price going up in the future.

Analysts Point Out That Bitcoin Could Reach $150,000

Ay, a contributor to CryptoQuant, said that Bitcoin could rise significantly over the next few months to between $120,000 and $150,000. Target fits with past periods of growth, which supports the idea that the stock will continue to rise toward higher valuation levels.

Analyst Axel Adler Jr. said that price discovery might happen again by October, but only if consolidation and breakout scenarios happen. These kinds of predictions make people more excited about Bitcoin’s future, which leads to more talk about what will happen in Q4 and beyond.

Bitcoin’s Bullish Trend is Free from Speculative Mania

Analysts say that even though Bitcoin is volatile, it is still outside of the high-risk zone, which is a good sign for its continued upward trend. The data shows that there is no speculative mania, which supports the idea of a long-term uptrend driven by natural demand and institutional activity.

The outlook is still good. Analysts say that disciplined strategies are important during consolidation and that the potential for gains outweighs the risks of short-term corrections by a large margin. Overall, the trajectory puts Bitcoin on track to test new highs, with a goal of reaching the $150,000 mark in the next few months.