Generative and Agentic AI Redefine Modern Credit Evaluation Models

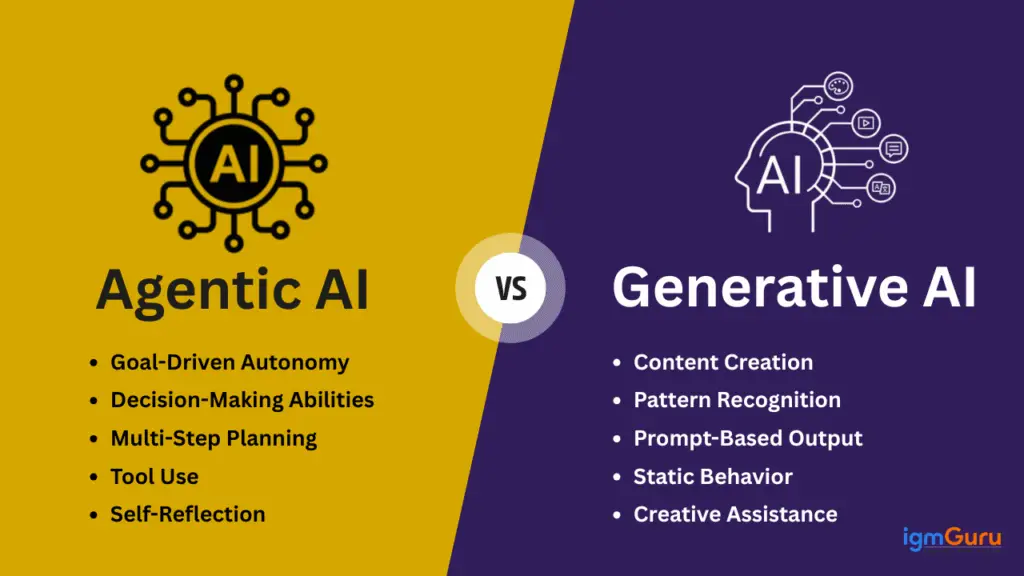

Generative and agentic AI are transforming how banks and financial institutions design and execute credit evaluation processes. Adaptive, intelligent systems are replacing traditional decision-making frameworks. These new models leverage automation, predictive analytics, and governance-aware controls to deliver more accurate and efficient outcomes.

Credit evaluation is no longer confined to rigid workflows or static scoring mechanisms. AI-driven architectures enable continuous learning, scenario simulation, and context-based decision-making. This evolution allows lenders to act with greater agility while maintaining strict regulatory compliance.

Source: igmGuru

Intelligent Data Enrichment Expands Underwriting Insight and Accuracy

Data remains the foundation of every credit decision, but legacy systems often struggle with unstructured data sources. Generative AI can extract insights from documents, statements, and behavioral records, enhancing underwriting depth and contextual understanding.

Unstructured inputs—such as income narratives, spending habits, and employment trends—are converted into structured analytical signals. These insights improve risk assessment accuracy and reduce the need for manual review. Lenders gain a clearer picture of an applicant’s financial resilience and repayment capacity.

Synthetic Data Strengthens Modeling Resilience and Edge Case Coverage

Generative AI can produce synthetic data to fill gaps in rare or extreme financial scenarios. These datasets simulate fluctuations in income, liquidity stress, or market shocks, allowing models to perform robustly under uncertainty.

Privacy-preserving synthetic data improves validation processes without exposing sensitive customer information. Models trained on these expanded datasets handle a broader range of borrower profiles and tail risks. This resilience ensures system stability even in volatile market conditions.

Recommended Article: Microsoft Expands Retail Automation With Agentic AI Solutions

Agentic AI Orchestrates Autonomous Credit Decision Workflows

Agentic AI introduces autonomous agents that independently execute components of the credit evaluation process. These agents perform identity verification, document validation, bureau checks, and risk scoring simultaneously, significantly reducing processing time and operational friction.

Each agent operates under predefined objectives, confidence thresholds, and escalation procedures. Cases with lower confidence are automatically routed to human underwriters for review. This structure maintains both speed and accountability within automated decision systems.

Human-in-the-Loop Governance Balances Automation and Responsibility

Despite advances in automation, human oversight remains central to critical credit decisions. Agentic systems escalate ambiguous or sensitive cases for manual evaluation, ensuring transparency and adherence to compliance requirements.

Explainability frameworks make it clear which factors influence a decision, supporting audits and regulator reviews. Human reviewers provide judgment for exceptional cases, reinforcing trust among regulators and customers alike.

Conversational AI Improves Borrower Engagement and Completion Rates

Conversational AI agents interact directly with applicants during the evaluation process using natural language understanding. They clarify missing details, resolve inconsistencies, and guide users through next steps in real time, improving satisfaction and completion rates.

Voice-enabled and multilingual interfaces make the process more accessible to underserved or hesitant borrowers. Applicants receive seamless, personalized assistance, reducing abandonment and strengthening customer relationships.

Hybrid AI Architectures Enable Scalable and Compliant Credit Systems

By combining generative AI with agentic orchestration, institutions create scalable and transparent credit platforms. Generative models enhance data and generate synthetic insights, while agentic systems execute workflows and enforce policies in real time.

Together, these technologies foster continuous learning, operational efficiency, and embedded governance. Institutions adopting such architectures gain a strategic advantage—turning smart underwriting from a compliance requirement into a driver of sustainable growth.