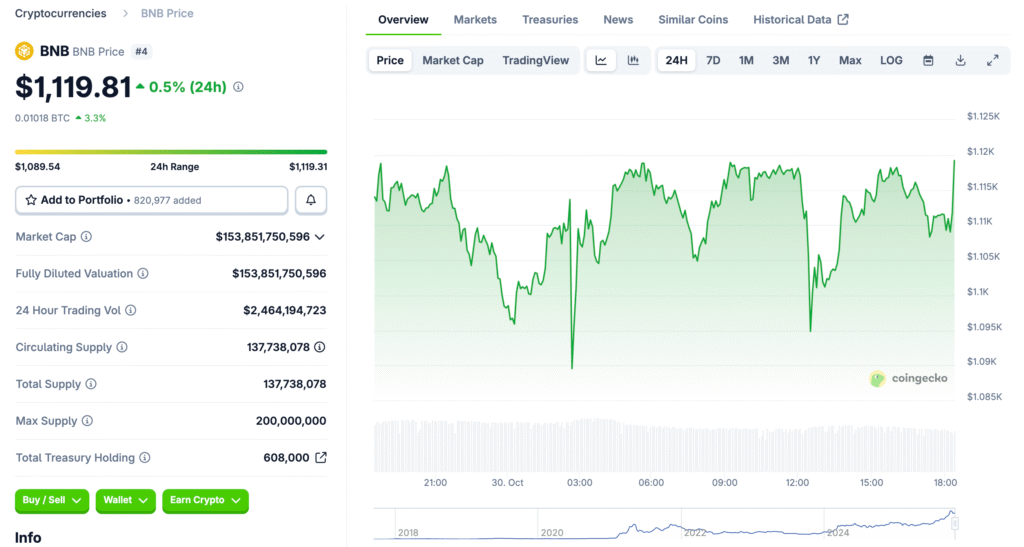

Massive Decline Across BNB Ecosystem

The BNB Chain sector endured one of its most severe drawdowns, losing roughly $24 billion in capitalization. This decline mirrors heightened risk aversion spreading across the broader altcoin landscape. Nearly three-quarters of BEP-20 tokens saw double-digit losses during the week. Such market contractions test investor patience and expose weaker projects to consolidation.

Altcoin Sentiment and Fear Indicators

The CMC Fear and Greed Index plunged to 29, signaling pervasive caution among traders. Liquidity remained thin as retail investors retreated from volatile positions. Analysts attribute this fear cycle to macro uncertainty and reduced leverage appetite. Historically, periods of intense fear have preceded rebounds for resilient ecosystems.

Resilient Tokens Defy the Downtrend

Despite the overall sell-off, a handful of BNB-based assets achieved remarkable gains. XPIN Network soared over 350% after its Binance Alpha listing. River and Bitlight also rallied due to RWA narratives and Futures exposure. These outliers suggest that selective innovation can attract liquidity even during risk-off phases.

Recommended Article: BNB Joins Polymarket Increasing Access for 2.2M Active Users

On-Chain Metrics and Ecosystem Stability

Key metrics such as daily transactions, TVL, and stablecoin volume posted minor declines. However, BNB Chain still leads among L1 networks in on-chain revenue. This dominance stems from its robust DeFi base and consistent developer engagement. While activity softens, revenue leadership signals enduring network relevance.

Exchange Transparency and User Confidence

Coinbase’s decision to include BNB on its asset roadmap added legitimacy to the token. Such recognition enhances transparency and broadens investor reach. Greater U.S. exchange exposure could mitigate liquidity fragmentation in the medium term. Regulatory clarity remains a prerequisite for sustained institutional adoption.

Institutional Tokenization Efforts Gain Ground

CMB International tokenized a $3.8 billion USD money market fund on BNB Chain. This milestone underscores institutional interest in leveraging blockchain for real-world assets. Partnerships with DigiFT and regional banks expand the network’s enterprise footprint. Tokenized funds may become BNB Chain’s key growth vector in 2026.

Conclusion: Cautious Optimism Amid Volatility

BNB Chain’s correction highlights short-term fragility but long-term opportunity. Resilient listings, growing tokenization, and exchange validation offer structural positives. Traders should expect continued volatility before stabilization returns. In the long run, sustained developer and institutional participation could rebuild momentum across the ecosystem.