Solana Faces Decline Amid Ecosystem Slowdown

Solana (SOL) has dropped 16% in the past 30 days, becoming one of the weakest performers among major cryptocurrencies. The network’s ecosystem growth appears to be slowing as activity shifts toward competitors like Ethereum and BNB Chain. The lack of a new all-time high contrasts with surging prices elsewhere, signaling market fatigue. Investors are questioning whether Solana can sustain momentum without major upgrades or ecosystem catalysts.

On-Chain Data Reveals Drop in Daily Users

Recent data shows Solana’s daily active users fell from 6.9 million in January to 2.9 million this week. This steady decline suggests fading retail engagement and reduced transaction volumes across decentralized applications. Analysts view the drop as a warning sign of cooling demand within Solana’s ecosystem. Without a rebound in activity, long-term network growth could stall despite institutional inflows.

Institutional Interest Offers Partial Lifeline

Despite weakening user metrics, institutional confidence in Solana remains strong. The first Solana ETF from REX-Osprey raised $400 million since its July debut, showing sustained capital inflows. Nine corporate treasuries also disclosed combined $2 billion investments into SOL holdings. These developments demonstrate that large investors still view Solana as a high-performance blockchain with long-term value potential.

Recommended Article: Solana’s Accelerate APAC 2025 Opens as SOL Rebounds and Builders Mobilize

The Alpenglow Upgrade Could Revitalize Network Performance

The upcoming Alpenglow upgrade promises to enhance Solana’s transaction throughput and network efficiency. Developers claim it will deliver internet-level processing speeds, reducing congestion during peak activity. If successful, the update could re-ignite developer enthusiasm and reverse the current slowdown. Analysts expect testing to conclude before year-end, potentially driving renewed speculative demand.

Technical Outlook: $175 Support Defines Market Direction

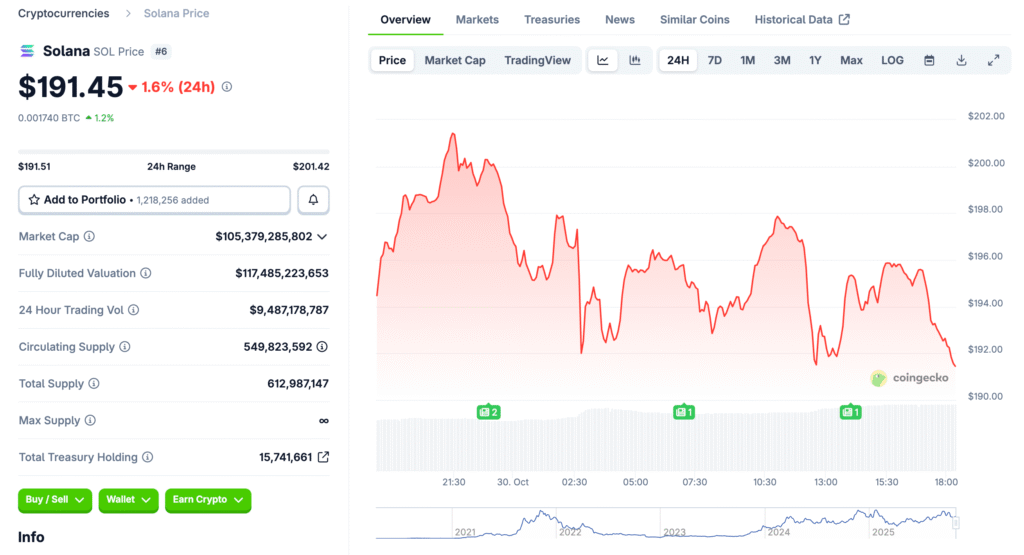

The $175 level remains Solana’s key short-term support zone, acting as both historical resistance and pivot area. A break below this threshold could push prices toward $130, representing a 30% downside risk. Conversely, holding above $175 keeps the door open for recovery toward $200. The next move will likely depend on broader market sentiment and macroeconomic data.

RSI and Momentum Indicators Suggest Caution

Technical indicators show Solana’s Relative Strength Index (RSI) trending below its 14-day average. This setup reflects persistent bearish pressure and lack of strong buying momentum. Since RSI hasn’t reached oversold conditions, analysts warn that downside potential remains. A decisive bullish reversal requires a clear break above the $190 mark accompanied by rising volume.

Altcoin Season and Competitive Pressure Intensify

Solana faces mounting competition from Ethereum’s Pectra upgrade and the fast-growing BNB Chain ecosystem. New applications like Aster have siphoned liquidity and developer attention away from Solana. However, rising institutional allocations may offset some of the lost retail enthusiasm. For now, investors are watching to see if Solana can stabilize before losing further ground to rivals.

Outlook: Solana’s Long-Term Story Still Intact

Despite near-term headwinds, Solana retains a strong position within the blockchain ecosystem. Its developer community and institutional partnerships provide a foundation for eventual recovery. If the Alpenglow upgrade delivers as expected, Solana could regain its place among top-performing altcoins. In the meantime, traders remain cautious, with $175 as the crucial level defining whether recovery or deeper correction comes next.