XRP Emerges as a Top Performer After Recent Declines

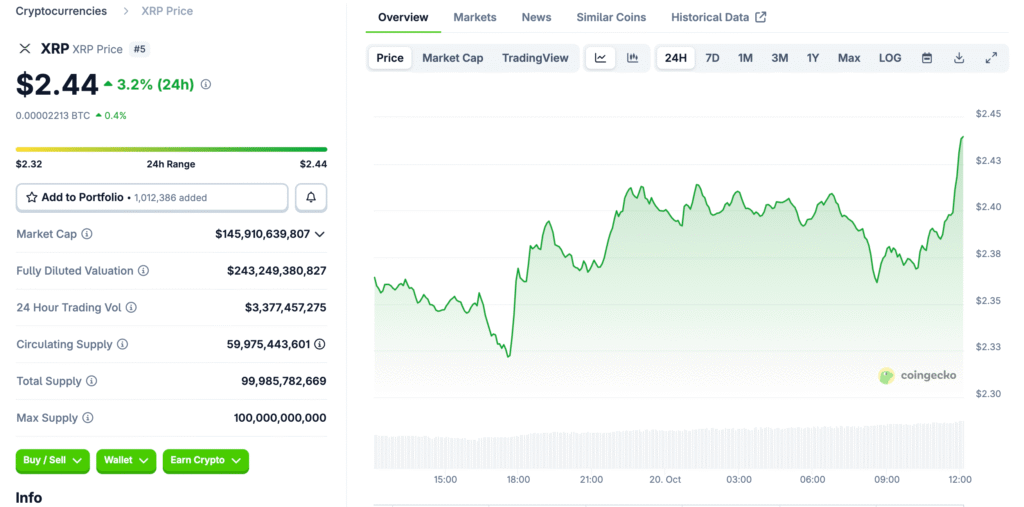

XRP has defied bearish sentiment to become one of the day’s best-performing major cryptocurrencies. After weeks of heavy selling, the token rebounded nearly 4% in the past 24 hours to trade around $2.38, recovering from a low of $2.25 on October 17. This rebound marks a notable shift in market tone as large investors continue to accumulate XRP at discounted prices.

Whale Accumulation Reaches All-Time High

According to blockchain analytics firm Santiment, the number of wallets holding at least 10,000 XRP has climbed to a record 317,500. This spike in mid- and large-tier wallet holdings suggests that investors are viewing the latest dip as a buying opportunity. Historically, such whale accumulation phases have preceded strong bullish reversals, often signaling renewed confidence in the asset’s long-term outlook.

Historical Patterns Suggest a Bottom Formation

The current whale accumulation mirrors earlier patterns observed in late 2024 when XRP first surpassed the $1 mark. Each significant correction since then has been met by aggressive buying from deep-pocketed investors. Analysts interpret this consistency as evidence that major holders view XRP’s dips as temporary setbacks rather than trend reversals, reinforcing a narrative of strategic accumulation.

Recommended Article: XRP Whale Count Hits Record High As Market Shows Signs Of Recovery

Futures Data Signals Reduced Speculation

CoinGlass data shows that open interest in XRP futures has dropped sharply to $3.49 billion, its lowest since June. The decline in leveraged positions indicates that speculative trading activity has cooled significantly. This reduction in leverage often occurs near local market bottoms, creating conditions for more stable price action and reducing the risk of further cascading liquidations.

Ripple’s Expansion Strategy Supports Market Optimism

XRP’s recovery is also supported by Ripple’s ongoing corporate expansion. Reports indicate that Ripple is preparing to launch a $1 billion Digital Asset Treasury (DAT) entity designed to manage and accumulate XRP reserves. The company’s aggressive acquisition strategy—which includes Metaco, Hidden Road, Rail, and GTreasury—underscores its plan to strengthen XRP’s role in global payment infrastructure and digital liquidity management.

Institutional Demand Rising Ahead of Possible XRP ETF

Speculation continues to mount regarding the potential approval of an XRP exchange-traded fund (ETF). Multiple applications for leveraged XRP ETF products have recently surfaced, signaling heightened institutional interest. Market analysts believe ETF approval could unlock significant new demand, pushing XRP further into mainstream financial markets.

Ripple’s Corporate Moves Reinforce Long-Term Vision

Ripple’s acquisition of GTreasury and other financial platforms represents a strategic push into digital treasury management. By integrating XRP into these ecosystems, Ripple aims to position the token as a key settlement asset for global institutions. This evolution aligns with its mission to modernize cross-border payments through blockchain efficiency, transparency, and scalability.

Technical Indicators Point Toward Stabilization

From a technical perspective, XRP’s daily chart shows early signs of stabilization. The token has reclaimed support above $2.30, while RSI levels are rising from oversold territory. If XRP maintains momentum above $2.40, analysts forecast a potential breakout toward $2.60–$2.80 in the near term. Failure to hold $2.25, however, could trigger a brief pullback before renewed buying pressure reemerges.

Market Sentiment Shifting to Long-Term Confidence

The combination of whale accumulation, declining speculative activity, and Ripple’s strategic growth initiatives suggests a growing shift from short-term trading to long-term positioning. Investors appear more focused on utility and adoption rather than quick profits, a sign of maturation within the XRP ecosystem. This change in sentiment bodes well for sustained market recovery.

Conclusion: Whale Accumulation Strengthens XRP’s Outlook

XRP’s record-breaking whale activity highlights increasing confidence among high-value investors despite broader market turbulence. Ripple’s continued corporate expansion and the potential for an XRP ETF add further bullish catalysts. If current trends persist, XRP could solidify its position as one of the leading assets in the digital payments sector—ushering in the next phase of institutional-driven growth for the token.