Ricardo Salinas Forecasts Bitcoin’s Next Major Rally

Mexican billionaire Ricardo Salinas Pliego has reignited bullish sentiment in the crypto market with his bold prediction that Bitcoin could rise 14 times from its current levels to reach $1.5 million per coin. In a post shared on X on October 16, the Grupo Salinas chairman emphasized Bitcoin’s growing role as a store of wealth and a hedge against inflation. His remarks reflect the increasing conviction among global investors who view Bitcoin as a long-term alternative to fiat currencies.

Bitcoin’s Growing Reputation as a Store of Value

Salinas, once an advocate of gold, now describes Bitcoin as the true successor to hard money. He stated that Bitcoin will not only match gold’s valuation but will continue to outperform it in the long term. The billionaire, who was previously known for his preference for precious metals, said his perspective shifted after realizing the limitations of traditional currency systems. According to Salinas, Bitcoin’s decentralized nature offers a transparent and incorruptible alternative to government-issued money.

From Gold Bug to Bitcoin Maximalist

Recalling his transformation from gold investor to crypto advocate, Salinas explained that he used to believe in gold’s superiority until 2017 when he experienced what he termed the “Bitcoin Enlightenment.” Since then, he has become one of Latin America’s loudest voices promoting Bitcoin adoption. In his words, “The real new money is Bitcoin. Ignore it at your own peril.” He has continued to invest heavily in BTC and regularly urges his followers to do the same, describing it as the ultimate form of financial independence.

Recommended Article: Billionaire Predicts Bitcoin Will Soar 14x To $1.5 Million

Fiat Currency System Under Scrutiny

In a previous interview, Salinas criticized fiat currencies as part of a “global scam” that silently steals value from the public through inflation. He argues that traditional money systems enable governments to print unlimited currency, eroding purchasing power and widening wealth inequality. His stance mirrors that of other Bitcoin proponents who believe that digital scarcity—capped at 21 million BTC—is the foundation of its long-term value preservation. According to Salinas, rejecting government interference in monetary policy is the first step toward financial freedom.

Bitcoin as the Foundation of a New Financial Era

In his co-authored book The Bitcoin Enlightenment, written with Pascal Hügli and Daniel Jungen, Salinas elaborates on Bitcoin’s transformative role in modern economics. He explains that understanding Bitcoin changes how individuals perceive wealth and sovereignty. “Once you see what this new form of money represents, you can’t stop thinking about its potential,” he said. He views Bitcoin not merely as an investment but as a tool for reclaiming autonomy from centralized financial institutions.

The Path to $1.5 Million: Parity With Gold and Beyond

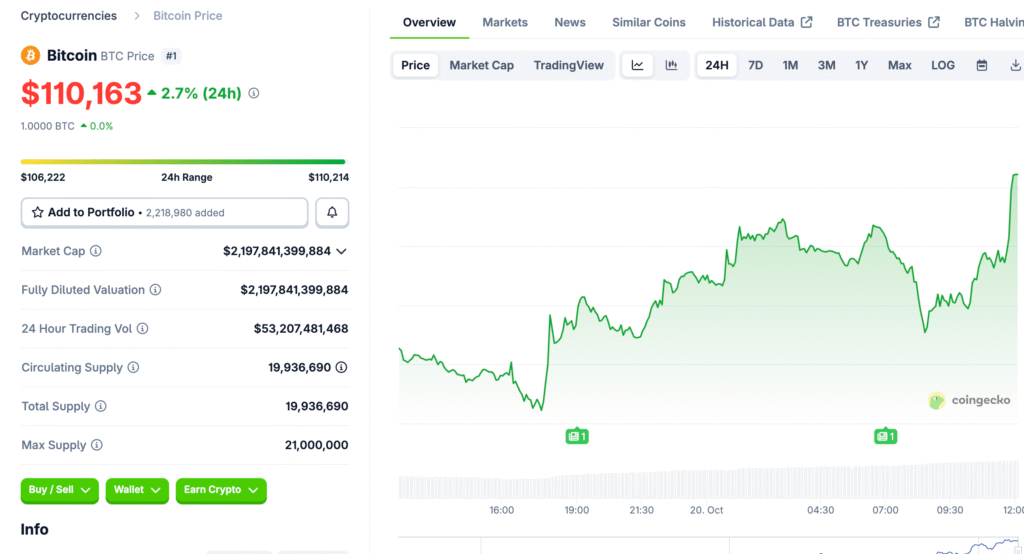

Salinas’s $1.5 million projection for Bitcoin stems from a comparison with gold’s total market capitalization. He believes that if Bitcoin reaches parity with gold’s global valuation, it would represent a 14-fold price increase from current levels. Once this milestone is achieved, he expects Bitcoin to continue outperforming gold due to its ease of transfer, finite supply, and digital utility. Many analysts share this perspective, noting that institutional adoption and ETF inflows could accelerate the journey toward this target.

Bitcoin Adoption Expands Amid Global Uncertainty

The billionaire’s prediction coincides with growing institutional interest in digital assets. Major financial firms have increased their Bitcoin exposure through spot ETFs and long-term holdings. Meanwhile, geopolitical tensions and inflationary pressures have pushed more investors toward decentralized alternatives. In emerging economies, Bitcoin is gaining traction as both a remittance tool and a safeguard against currency collapse, aligning with Salinas’s advocacy for monetary independence.

Salinas’s Advice: Buy, Hold, and Preserve Freedom

Salinas’s investment philosophy remains straightforward: acquire Bitcoin, hold it for the long term, and use it as protection against financial manipulation. “At the end of the day, Bitcoin is freedom,” he wrote. “And freedom is where innovation, responsibility, and prosperity grow.” His message underscores a broader ideological movement that views Bitcoin as a pillar of personal and economic sovereignty. As more investors embrace this narrative, Salinas’s bold forecast may resonate beyond speculation—becoming a vision of the world’s digital financial future.

Conclusion: Bitcoin’s Road to $1.5 Million Reflects a Paradigm Shift

Ricardo Salinas’s prediction of a 14x rally underscores Bitcoin’s growing influence as a global asset. While skeptics question such lofty valuations, historical precedent shows that Bitcoin has repeatedly defied expectations. As distrust in fiat systems deepens and digital adoption accelerates, Bitcoin’s ascent toward $1.5 million could represent more than a price target—it could mark the dawn of a new monetary order built on transparency, scarcity, and freedom.