Chainlink Price Tests Critical Support Amid Bearish Structure

Chainlink (LINK) is navigating a critical technical phase after confirming a Head and Shoulders breakdown on its daily chart. The token has fallen below short-term moving averages, signaling waning bullish momentum. Analysts now view $14–$15 as a vital zone that could determine whether LINK resumes its broader uptrend or extends its current correction. As of Sunday, LINK trades near $16.70, down over 4% in the past 24 hours amid cautious investor sentiment.

Head and Shoulders Breakdown Confirms Trend Reversal

The Head and Shoulders formation—a classic bearish reversal pattern—has been validated, reinforcing the notion that LINK’s prior bullish cycle has cooled. According to Alpha Crypto Signal, the neckline breach alongside increasing sell-side volume confirms a structural shift in market direction. The analyst warns that unless LINK reclaims its 9-day exponential moving average (EMA) at $18.25, bears may continue to dominate short-term price action.

LINK Trades Below Key Moving Averages

Technical indicators highlight sustained weakness as LINK remains below its 50-day simple moving average (SMA) of $21.88. This reinforces the downward pressure and reflects the reluctance of buyers to defend higher price zones. Historically, trading below these levels has preceded prolonged consolidation phases before recovery attempts. Maintaining price stability above the $14 zone will be essential to avoid further downside volatility.

$13–$14 Identified as Potential Rebound Zone

Market observers note that the next significant support area lies between $13 and $14, where multiple technical confluences intersect. This region includes a horizontal demand zone and the lower boundary of LINK’s multi-year ascending channel. Analysts suggest that a bounce from this range could trigger renewed accumulation among long-term investors. However, a decisive breakdown below this zone may open the path toward deeper retracement levels.

Long-Term Accumulation Opportunities at $14

Prominent analyst Ali highlights that Chainlink’s broader structure remains intact despite short-term declines. His chart outlines a long-term ascending channel that has defined LINK’s trajectory since 2023. The ongoing retracement toward the channel’s lower edge may represent an opportunity for strategic accumulation. If support holds firm near $14, a recovery toward $22, $28, and potentially $50 over the medium term remains plausible.

Market Sentiment Shifts Toward Neutral Zone

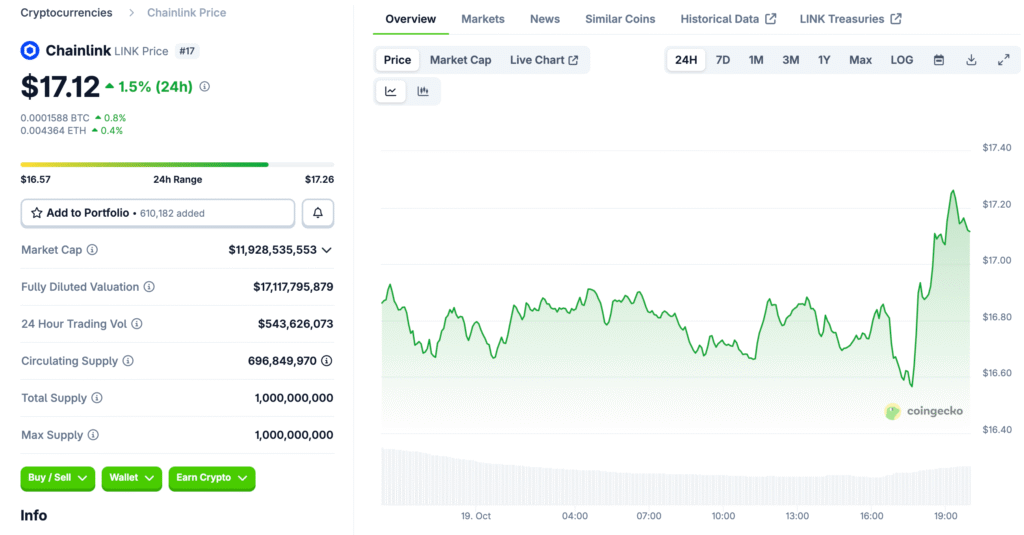

At present, LINK’s 24-hour trading volume sits around $1.32 billion, reflecting moderate activity as traders assess directional clarity. The asset’s market capitalization stands at $11.63 billion, positioning it among the top DeFi-focused cryptocurrencies by value. Price action remains range-bound between $16.60 and $16.80, suggesting temporary consolidation following recent sell-offs. If LINK closes above $17.20, it could signal renewed bullish strength in the coming sessions.

Key Resistance and Downside Risk Levels

From a technical standpoint, Chainlink faces immediate resistance near $18 and $22, with sustained pressure below these levels limiting recovery potential. Failure to defend $16.30 could invite another test of $15.80 or lower. Meanwhile, momentum indicators such as the Relative Strength Index (RSI) show readings near 41—neither oversold nor overbought—hinting at indecision among traders. A neutral RSI typically precedes larger moves as volatility returns.

Analysts Emphasize Patience and Long-Term Perspective

While short-term traders may face uncertainty, long-term LINK supporters maintain optimism about the project’s fundamentals. Chainlink continues to dominate the decentralized oracle market, providing essential data infrastructure for hundreds of DeFi applications. Analysts argue that sustained development activity and growing adoption may eventually restore investor confidence once market conditions stabilize.

Outlook: Consolidation Before a Potential Rebound

Chainlink’s immediate future depends heavily on its ability to maintain support within the $14–$15 corridor. A rebound from this region could set the stage for a gradual recovery toward higher resistance zones, while a breakdown might trigger a deeper correction phase. With the crypto market entering a broader consolidation period, LINK’s resilience near key technical levels will be closely monitored. For now, traders are advised to remain patient as the market seeks equilibrium before its next decisive move.