Pi Network Struggles After Prolonged Downtrend

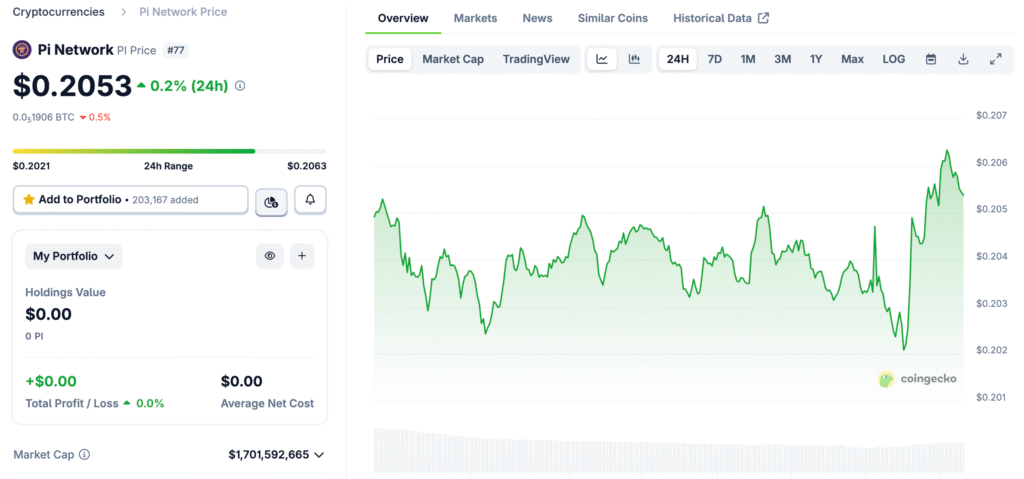

The Pi Network token continues to face steep market challenges following months of decline since its official trading debut. Once peaking near $3, the asset has now dropped more than ninety percent, recently touching an all-time low near $0.172. Despite brief rebounds, market-wide corrections have pressured PI back toward the $0.20 level. The community remains divided on whether the asset can recover or continue its descent.

AI Platforms Offer Diverging Short-Term Forecasts

Artificial intelligence models, including ChatGPT, Grok, and Gemini, have provided varied projections for Pi Network’s near-term performance. While each model recognizes oversold conditions, none foresee a major bullish reversal in the immediate future. The consensus among all three systems is that Pi remains in a fragile consolidation phase. The next week could determine whether the token stabilizes or breaks new lows.

Grok Highlights Critical Support At $0.17 Range

According to Grok’s technical interpretation, Pi Network’s first line of defense lies between $0.17 and $0.18. A breakdown below this level could accelerate losses due to a lack of historical support zones. However, Grok notes that the asset’s relative strength index (RSI) is extremely oversold, potentially enabling a short-term relief bounce. The model suggests that increased buying volume could trigger a temporary upward correction toward resistance.

Recommended Article: Pi Network Price Forecast As Channel Breakout Looms

Gemini Predicts Rebound If Key Resistance Is Reclaimed

Gemini’s analysis points to critical resistance levels between $0.22 and $0.24 that must be reclaimed for recovery to begin. The model argues that crossing these thresholds could restore confidence among traders and stimulate speculative buying. Without sufficient volume, however, PI may continue to drift sideways near the $0.20 zone. Gemini remains cautiously optimistic, projecting modest recovery potential if broader market sentiment improves.

ChatGPT Maintains Predominantly Bearish Short-Term View

ChatGPT’s market model projects a sixty percent probability of continued bearish price movement in the coming week. It warns that failure to maintain $0.20 support could push PI toward new lows between $0.15 and $0.17. The system assigns only a twenty-five percent chance of a sharp rebound and a fifteen percent chance of price stabilization. ChatGPT’s forecast underscores the risks of thin liquidity and reduced speculative participation.

Market Liquidity And Volume Remain Concerning

Across all AI models, low trading volume emerges as a key weakness in Pi Network’s current market structure. Reduced activity suggests limited speculative interest and declining participation from retail traders. This environment increases volatility risk, where even small sell orders can trigger disproportionate price swings. Analysts argue that sustained inflows and stronger exchange listings are essential to restoring market depth.

Technical Indicators Signal Possible Relief Rally

Despite prevailing pessimism, several technical metrics indicate potential for a short-term relief rally. The RSI remains below thirty, historically signaling oversold conditions ripe for temporary reversals. If buying volume increases, Pi could retest the $0.22 to $0.24 range highlighted by Gemini. Traders, however, should remain cautious as structural weakness persists across broader market conditions.

Investor Sentiment Mirrors Broader Market Uncertainty

The ongoing downtrend in Pi Network mirrors sentiment across altcoins facing prolonged consolidation. Many investors remain skeptical due to Pi’s limited exchange availability and uncertain project roadmap. The absence of strong institutional participation further dampens short-term optimism. Still, dedicated community members continue to express long-term confidence in Pi’s ecosystem development.

Outlook: Pi Network Faces Crucial Week Ahead

The next few trading sessions could prove pivotal for Pi Network’s near-term trajectory. Holding above the $0.20 level would preserve the possibility of a gradual rebound toward resistance. However, breaching recent lows could trigger renewed selling and test investor patience. For now, AI-driven forecasts suggest a cautious stance, with mixed probabilities for either recovery or further decline.