XRP Emerges As Top Performer Amid Market Weakness

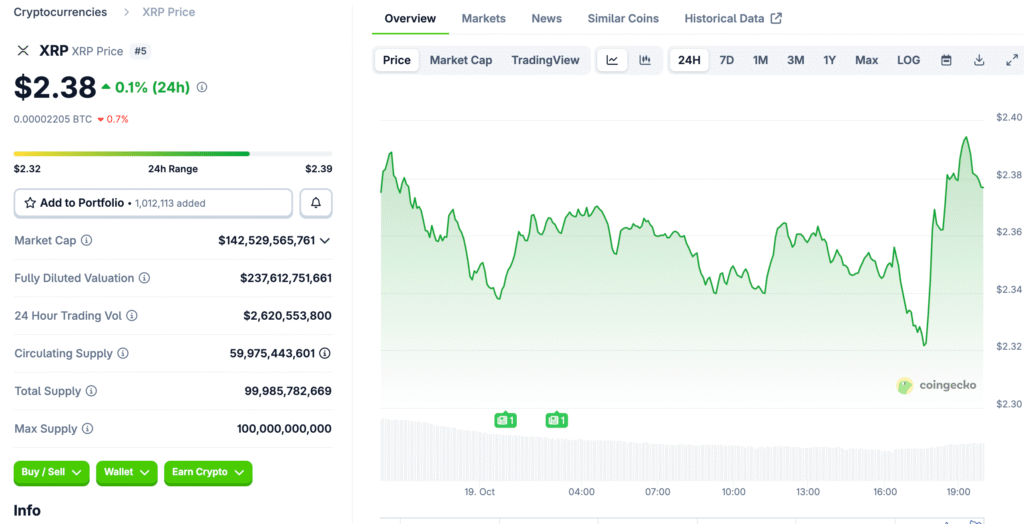

XRP has staged a strong rebound following weeks of downward pressure, outperforming major cryptocurrencies in recent trading sessions. The digital asset climbed over 4% in twenty-four hours to trade near $2.38 after bottoming at $2.25. Analysts attribute this recovery to renewed buying interest among large holders and improving sentiment across the broader crypto market. Despite persistent volatility, XRP’s ability to rebound highlights underlying demand strength.

Whale Accumulation Hits All-Time High

Blockchain analytics firm Santiment reported a surge in wallets holding at least 10,000 XRP, now totaling roughly 317,500 addresses. This milestone represents the highest whale count ever recorded for XRP, suggesting intensified accumulation among mid- to large-scale investors. Historically, such accumulation phases have preceded extended bullish reversals and long-term rallies. The latest data points to renewed confidence in Ripple’s ecosystem and XRP’s future potential.

Accumulation Trends Mirror Previous Bullish Cycles

This accumulation mirrors patterns observed during XRP’s prior recovery phases dating back to late 2024. Each market correction since then has been followed by strong buying pressure from committed holders. These consistent accumulation cycles have strengthened market structure and reduced short-term speculative volatility. Analysts interpret this as a signal that XRP investors remain optimistic about its long-term trajectory despite temporary pullbacks.

Recommended Article: XRP Faces Pressure as Profit-Taking and Risk Aversion Trigger Decline

Open Interest Declines As Speculative Activity Fades

Data from CoinGlass reveals that XRP futures open interest has dropped sharply to $3.49 billion, the lowest since June. This reduction indicates a decrease in leveraged trading and a shift toward more defensive investment positioning. Lower open interest often coincides with market bottoms, where selling exhaustion gives way to accumulation. The decline suggests investors are focusing on holding spot positions rather than pursuing short-term speculation.

Ripple Expands Strategic Investments Through New Treasury

Ripple’s corporate strategy continues to bolster confidence in XRP’s long-term outlook. Reports indicate the company is launching a $1 billion Digital Asset Treasury (DAT) initiative to manage XRP reserves strategically. This treasury will complement Ripple’s recent $3 billion in acquisitions, including Metaco, Hidden Road, and GTreasury. These purchases are aimed at building an integrated financial stack to strengthen Ripple’s enterprise-grade liquidity solutions.

Speculation Builds Around Potential XRP ETF Approval

Anticipation is mounting that the U.S. Securities and Exchange Commission could approve an XRP-based exchange-traded fund (ETF). Several institutional applications for leveraged XRP products have surfaced in recent weeks, reflecting heightened market interest. Such developments could mark a major milestone for Ripple, broadening institutional participation and liquidity. Analysts believe ETF approval could further legitimize XRP’s position within regulated financial markets.

On-Chain And Corporate Signals Reinforce Confidence

The convergence of on-chain accumulation and Ripple’s corporate expansion paints a positive picture for XRP’s future. Whale activity confirms that sophisticated investors are positioning for long-term gains rather than short-term trades. Meanwhile, Ripple’s continued innovation and acquisitions highlight a strategy focused on scaling real-world utility. These combined forces suggest that XRP is entering a phase of structural maturity within the digital asset space.

Market Outlook: XRP Poised For Continued Strength

XRP’s rebound, paired with record whale accumulation and strong corporate fundamentals, signals a healthy recovery trajectory. Analysts expect XRP to maintain upward momentum if it sustains support above $2.30 in the coming sessions. The possibility of an ETF announcement or further institutional engagement could drive new capital inflows. Overall, XRP’s growing base of committed holders reinforces its role as one of crypto’s most resilient assets.