Tom Lee’s Massive Ethereum Purchase Draws Market Attention

Veteran investor Tom Lee has reignited excitement in the crypto market after reports surfaced of a massive Ethereum acquisition. According to recent data, his company, BitMine Immersion, purchased over seventy-two thousand ETH worth approximately $281 million within twenty-four hours. The transaction increased BitMine’s holdings to 3.03 million ETH, roughly 2.5% of the total circulating supply. This bold move has prompted speculation about Lee’s long-term outlook for Ethereum’s growth potential.

Ethereum’s Price Stability Amid Market Uncertainty

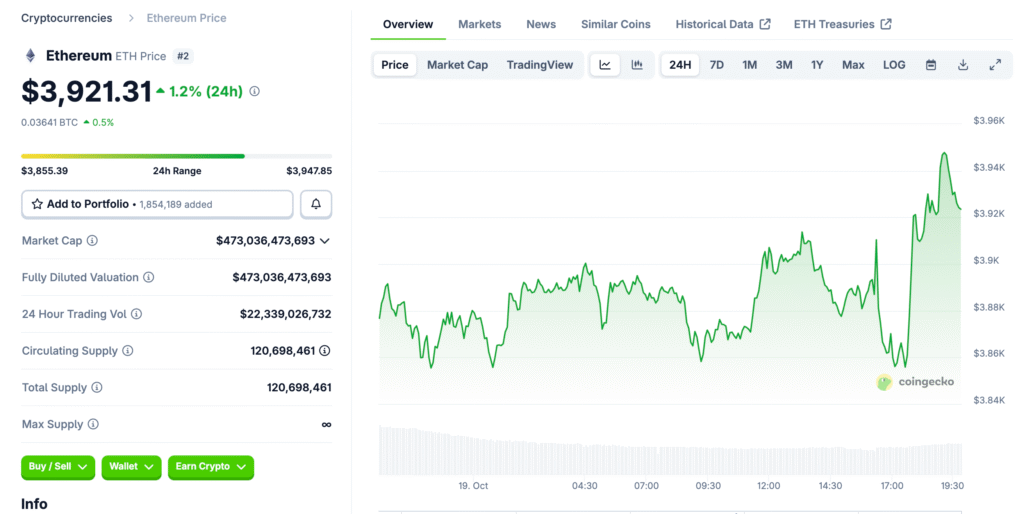

Despite recent volatility, Ethereum’s price remains resilient, hovering between $3,830 and $3,870 according to CoinGecko. The token recovered slightly after last week’s heavy sell-off that saw values briefly dip into the $3,400 range. Analysts believe large investors are using these corrections to accumulate positions in anticipation of the next bullish phase. Lee’s massive purchase reflects renewed confidence that Ethereum’s fundamentals remain strong despite short-term headwinds.

Market Correction Opens New Entry Points For Whales

The recent correction from early October created attractive buying zones for institutional investors. Market watchers note that Ethereum’s liquidity between $3,200 and $3,400 has strengthened, forming a solid support base. This accumulation phase could set the stage for a potential reversal once global sentiment stabilizes. Historically, Ethereum has rebounded strongly after major liquidation events, often outperforming broader crypto indices in recovery cycles.

Recommended Article: Ethereum Targets $5K as Volumes Surge and Market Confidence Grows

Analysts Monitor Liquidity Zones For Next Breakout

Crypto analysts highlight the $4,400 to $4,800 range as the next critical liquidity zone for Ethereum. Heavy sell orders are concentrated in this range, signaling potential resistance in the short term. Analyst Ted explained that ETH’s breakout will depend on whether it can surpass this cluster of sell walls. If Ethereum reclaims these levels, analysts believe a rally toward $5,000 could follow by late Q4 2025.

Technical Indicators Suggest A Potential Double Bottom Pattern

Market analyst Crypto Tony shared his Elliott Wave analysis indicating Ethereum is likely forming a corrective W–X–Y structure. This setup suggests the asset is consolidating before its next upward impulse. He identified the $3,300 to $3,400 range as a possible double-bottom zone, often seen before significant price recoveries. The pattern implies seller exhaustion, hinting at a gradual return of bullish momentum in the coming weeks.

Institutional Accumulation Signals Long-Term Confidence

If reports of BitMine’s purchase prove accurate, it would mark one of the largest single Ethereum acquisitions of 2025. Institutional investors like Lee appear increasingly confident in Ethereum’s position as the leading smart contract platform. The network’s upcoming scalability upgrades and Layer 2 integrations continue to strengthen its long-term outlook. These developments could attract further institutional inflows once the market’s corrective phase concludes.

Ethereum’s Road To $5,000: What Traders Expect

Traders are closely watching Ethereum’s interaction with its key resistance levels around $4,400. A decisive breakout could pave the way toward the $4,800 zone and possibly beyond $5,000 by early 2026. Conversely, failure to hold above $3,600 may trigger renewed selling, pushing prices toward lower support. Analysts agree that upcoming macro events such as trade negotiations and ETF approvals could influence Ethereum’s next major move.

Expert Opinions On Ethereum’s Mid-Term Outlook

While short-term volatility persists, many analysts remain optimistic about Ethereum’s medium- to long-term prospects. They cite ongoing network upgrades, institutional adoption, and developer activity as core growth drivers. Ethereum’s dominance in decentralized finance and NFTs continues to anchor its relevance within the digital economy. If accumulation continues at current levels, ETH could reassert its leadership in the next market cycle.

Final Thoughts: Tom Lee’s Bet Reinforces Ethereum’s Strength

Tom Lee’s $281 million purchase represents a strong endorsement of Ethereum’s resilience and long-term value proposition. While the market remains divided on short-term direction, institutional conviction appears unwavering. The combination of technical recovery signals and major capital inflows paints a constructive outlook for ETH. Whether Ethereum breaks above $5,000 or consolidates further, its foundation as a digital infrastructure leader remains firmly intact.