Stablecoin Infrastructure Transition Gains Momentum

Sui has taken a significant leap forward by introducing its first native stablecoins. The USDi token is fully backed by BlackRock’s BUIDL fund, ensuring institutional credibility. Meanwhile, suiUSDe combines staked ETH with futures exposure to create a synthetic dollar instrument. This dual-token strategy lays the foundation for deeper on-chain liquidity.

The introduction of these stablecoins positions Sui as more than just another settlement layer. It becomes an ecosystem hub for yield generation, arbitrage, and liquidity strategies. By anchoring stablecoin activity directly onto its chain, Sui can drive demand for native assets. Regulatory oversight will be crucial, as derivative-backed models often invite scrutiny.

Suiball Hardware Wallet Enhances Security Standards

Security is essential for mass adoption, and Sui is addressing this head-on. Citadel Wallet’s Suiball offers “clear signing” features to prevent malicious blind transactions. It’s designed specifically for BTCfi assets on Sui’s ecosystem, providing users greater control. Institutional and retail investors alike benefit from enhanced cold-storage integration.

Suiball’s launch aligns with Sui’s roadmap improvements, including scaling upgrades and better UX. The wallet could appeal to institutions seeking safe custody for high-value digital assets. It’s a strategic move that reinforces trust within the ecosystem. Secure infrastructure often precedes major adoption waves across blockchain networks.

Kraken Margin Trading Unlocks Institutional Liquidity

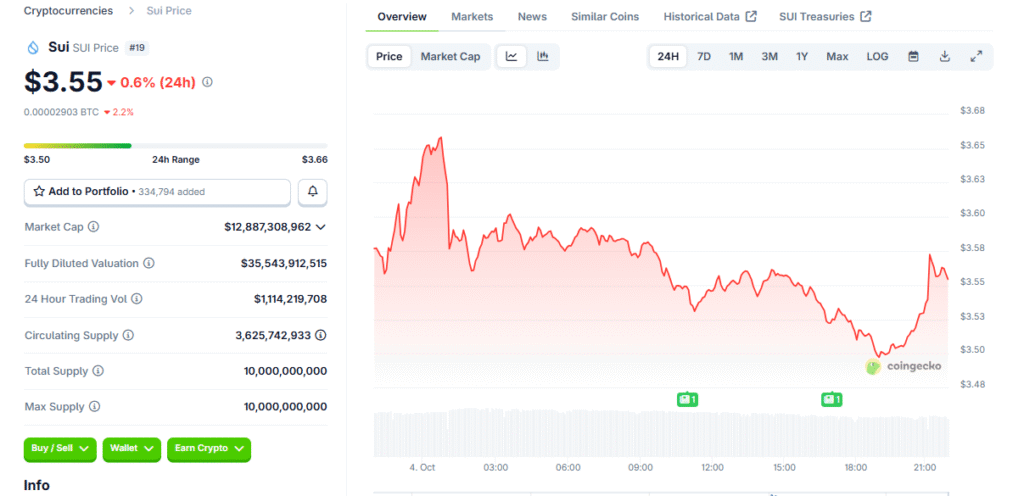

Kraken’s introduction of 10× leverage trading for SUI signals growing institutional interest. This expansion allows traders to amplify positions while increasing overall trading volumes. Institutions can now participate in leveraged strategies previously limited to major crypto assets. The move coincides with Coinbase Derivatives planning SUI futures listings soon.

When futures and margin markets develop simultaneously, liquidity accelerates rapidly. This can boost volatility but also create opportunities for sophisticated participants. Sui’s volume may surge as traders exploit leverage across multiple venues. However, increased liquidations could test the resilience of smaller retail participants.

Recommended Article: SUI Stablecoins Partnership Sparks Major Liquidity Shift

Ecosystem Upgrades Strengthen Developer Engagement

Beyond financial instruments, Sui continues upgrading its technical foundation. Scaling solutions like Remora and Mysticeti enhance throughput, attracting gaming and AI developers. Developer tooling improvements reduce friction for launching dApps within the ecosystem. These upgrades create fertile ground for innovative projects to thrive.

The $10 million Security Expansion Initiative further reinforces ecosystem reliability. By prioritizing audits and exploit prevention, Sui demonstrates a long-term vision. This commitment fosters confidence among developers and investors alike. A robust infrastructure underpins sustainable ecosystem growth.

Speculative Opportunities Rise With MAGACOIN FINANCE

While Sui builds infrastructure, speculative capital often flows toward faster-moving narratives. MAGACOIN FINANCE is positioned as a complementary play with cultural branding and scarcity mechanics. Forecasts suggest potential 48×–56× gains depending on adoption scenarios. Its audits from CertiK and HashEx enhance legitimacy compared to typical presales.

Investors seeking high-beta opportunities view MAGACOIN FINANCE as a leveraged bet on broader ecosystem growth. As Sui’s stablecoins and security layers mature, speculative assets may benefit indirectly. This dynamic mirrors early Layer-1 cycles where adjacent projects experienced explosive rallies. Timing entries and exits will be critical for participants.

Risk Factors And Tactical Considerations

Sui’s bold roadmap brings both opportunity and risk. Stablecoin regulation, hardware adoption challenges, and leveraged trading volatility pose genuine threats. Institutional momentum can accelerate growth but also reverse abruptly. Strategic capital rotation becomes vital under these conditions.

Traders should track issuance velocity, margin data, and cross-chain BTCfi flows closely. Monitoring stablecoin adoption will reveal ecosystem health early. Leveraged strategies demand clear risk management frameworks. Tactical agility separates successful investors from those caught in reversals.

Conclusion: Sui’s Next Phase Begins

Sui’s announcements mark a decisive evolution in its ecosystem narrative. Native stablecoins, a dedicated hardware wallet, and institutional leverage access signal ambitious expansion. These elements intertwine to form a sophisticated financial infrastructure. The project is no longer just about modular dApps but ecosystem-wide transformation.

As this infrastructure develops, speculative narratives like MAGACOIN FINANCE offer parallel opportunities. Traders can balance long-term ecosystem exposure with short-term upside potential. The next phase of Sui’s growth may shape narratives across multiple sectors simultaneously. Execution will determine whether this bold vision translates into lasting impact.